Songs and art: Fractional investing bedazzles millennial investors

By May 17, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Meet Mr. A, born in the '80s and a self-proclaimed "analog person" who enjoys collecting CDs and artbooks of his favorite painters. But recently, Mr. A has been spending a lot of time on the internet after discovering he can actually gain partial ownership of his favorite songs while making a profit.

Earlier this year, Mr. A purchased the rights to a song, Aloha, by the popular Korean band, Cool. He invested 100,000 won ($88) to acquire a 0.01% stake in the song. Since making the purchase, Mr. A has made over 50% in profit.

This type of fractional share trading has become a trend among millennial investors -- mostly in their 20s and 30s -- who are investing in intangible goods and luxury items, such as celebrated artwork, limited-edition sneakers and music copyrights.

FRACTIONAL SHARE TRADING: A NEW TAKE ON INVESTING

Fractional investing is popular because it opens up a new investment channel -- people can make investments with a small sum of money and still anticipate favorable returns. It's all the more attractive amid recent skyrocketing real estate and stock prices, which have raised the entry barriers for those without deep pockets.

The majority of fractional traders are between their 20s and 30s, often those who missed out on an opportunity to invest in real estate or promising stocks, as well as aficionados of music and art.

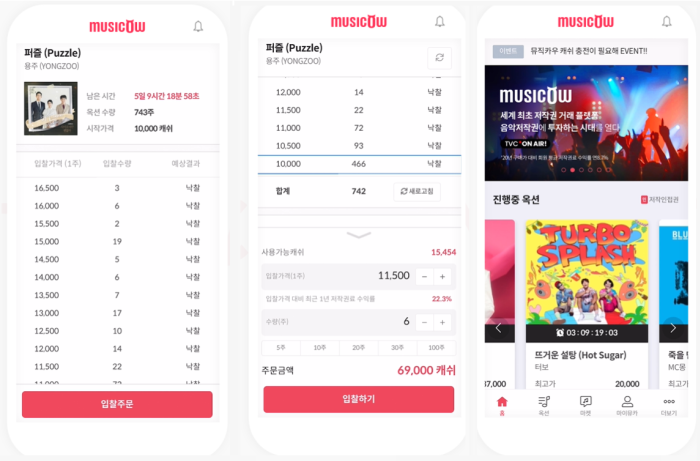

For example, South Korea-based music copyright trading platform MusicCow allows users to purchase ownership of a song via fractional investing and trade their shareholdings.

The platform's number of users in their 20s and 30s has jumped by 250% over the past year, accounting for 70% of its total users.

There are around 800 songs available on the platform, ranging from oldies from the '80s and '90s to the latest hits. Recently, royalties for Rollin', a single by K-pop girl group Brave Girls, soared by 21 times after climbing the music charts.

Also, last July, the author of Writing Our Stories, a single performed by popular Korean vocal group SG Wannabe, sold 33% of the song's ownership on MusicCow by splitting it up into 1,039 shares.A single share accounted for a 0.03% ownership of the song, and the bidding price ranged between 12,000 won and 15,000 won. Currently, the share price stands at 41,800 won ($37) apiece, after spiking to 175,000 won last month when SG Wannabe made an appearance on a popular TV program and performed their hits.

MusicCow users can make a profit via monthly royalties alongside selling their ownership. The annual average return for copyright sales is around 8.7%, almost double the 4% to 5% average return of a high-dividend stock.

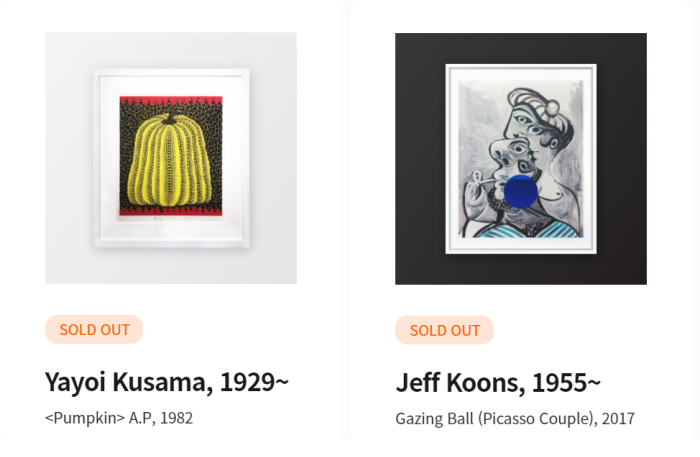

Similarly, millennials make up about 60% to 70% of investors on online artwork trading platforms, Tessa, Sotwo and Art Together, where users bid to co-purchase a popular work of art and split the ownership.

Investors can make a profit by leasing the work, and if it is sold, they will receive gains relative to their shareholdings.

On Tessa, some 13 pieces from renowned artists including Kusama Yayoi and Jeff Koons were traded. For example, Koons' Gazing Ball sold for 140 million won ($123,562), with the ownership split into 140,000 shares among a total of 802 investors.

On Sotwo, investors can purchase limited-edition sneakers in addition to art. According to the company, Sotwo investor's average return stands at around 18.13%.

FRACTIONAL INVESTING CROSSES OVER TO REAL ESTATE

Fractional investing isn't restricted to intangible assets. It also encompasses real estate and over-the-counter shares. On the real estate trading platform Kasa, users can purchase partial ownership of a building via digital asset-backed securities (DABS).

Recently, a building with a market value of10 billion won ($8.8 million) was split into 2 million DABS, with the minimum investment set at 5,000 won and attracting over 5,000 investors.

Meanwhile, fractional investing poses some risk, such as volatility. It's common for royalties to spike when a song becomes popular -- only to plunge once the hype fizzles. Also, investors may not be able to sell their shareholdings if there isn't enough trading volume.

Write to Ui-myung Park at uimyung@hankyung.com

Danbee Lee edited this article.

-

K-pop copyright trading platform Musicow prepares for IPO

K-pop copyright trading platform Musicow prepares for IPOOct 21, 2021 (Gmt+09:00)

1 Min read -

Venture capitalFractional investing platforms for art to Rolex lure VCs

Venture capitalFractional investing platforms for art to Rolex lure VCsNov 17, 2021 (Gmt+09:00)

4 Min read -