E-commerce

StockX in merger talks with Naver’s online reseller Kream

The GMV of the South Korean online reseller has recently exceeded that of the US No. 1 resale marketplace

By Apr 23, 2025 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

StockX, the world’s most popular online resale marketplace, is in talks to merge with Kream, a resale unicorn under South Korea’s tech giant Naver Corp., in a deal that could be a win-win through business diversification and expanded global reach.

According to sources in the investment banking industry on Wednesday, StockX and Kream are in negotiations to discuss their marriage in detail, in which the US resale platform will control the management of the Korean rival, and Naver, in exchange, will take over StockX's stake to become the latter’s second-largest shareholder.

But differences over the enterprise value of each company could prolong the talks, according to sources.

If they land a merger deal, the combined entity is expected to emerge as the unrivaled leader in the global resale market.

Especially, with Kream under its wings, StockX could ease its investors’ concern about its growth slowdown and overfocus on the resale of sneakers.

The Korean reseller could also take another leap as a global player through the consolidation, which is projected to enable it to access StockX’s logistics network and leverage its leading position in the US.

KREAM TOPS STOCKX IN GMV

StockX was reportedly the one reaching out to Kream for the integration talks as the Korean challenger has recently overtaken it in terms of gross merchandise value (GMV) despite its late arrival.

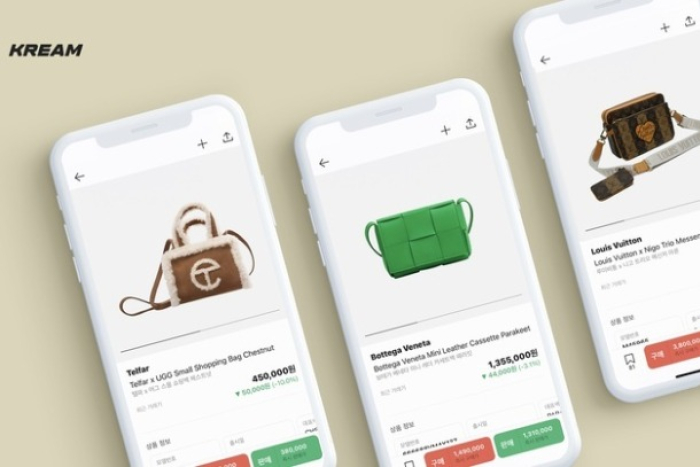

Kream began services in 2021 as a marketplace mediating non-face-to-face transactions of goods between anonymous individuals, like a stock market.

It began with trading limited-edition sneakers and has since expanded to include a wide range of items – from watches and luxury goods to toys, expensive collectibles and trading cards.

It became a Korean unicorn, a privately held company with a valuation exceeding 1 trillion won, translating to $1 billion at a 1:1 exchange rate, in 2022, just one year after its launch.

Founded in 2016, Detroit, Michigan-headquartered StockX operates the global No. 1 resale platform in terms of sales under the same name, StockX.

Its enterprise value jumped to $3.8 billion in 2021, when it prepared to go public with Morgan Stanley and Goldman Sachs as its underwriters. But due to the concern over its sustainable growth, on top of high market volatility, its initial public offering plan fell through.

Since then, the Korean latecomer has rapidly caught up to its bigger global peer and has beaten StockX in GMV and profit growth rate.

Thanks to its fast ascent, Kream’s enterprise value has swelled to nearly be on par with that of its bigger US rival.

BUSINESS DIVERSIFICATION IS THE KEY TO FURTHER GROWTH

StockX’s revenue is still four times bigger than that of Kream, thanks to its high commission fees for matching deals among goods traders on its platform.

But it faces growing challenges from rivals, boding ill for its fee revenue.

Without the high commission revenue, StockX lacks sustainable revenue sources as it heavily relies on shoe trading, its founding business model.

To resume its IPO, it needs to diversify its offerings beyond sneakers, which would be achieved more effectively through a merger with its well-established rival, like Kream, rather than through its advance into a new market.

StockX is said to be pinning high hopes on its marriage with Kream for great synergy after the Korean latecomer has successfully penetrated the online resale market faster than its rivals with a wide range of offerings.

Kream acquired a 43.6% stake in SODA Inc., the operator of Japanese online secondhand shoe marketplace SNKRDUNK, for 97.6 billion won ($68.6 million) in 2023.

It also made additional investments in Sasom Co., the operator of Thailand’s leading limited-edition trading platform, SASOM, in the same year to make inroads into the Southeast Asian market.

ANOTHER LEAP FORWARD

The StockX-Kream consolidation is expected to create synergy in their global business, said analysts.

It could also allow Kream to access StockX’s immense global logistics network and infrastructure, which could help it leap to become a global player.

According to ThredUp, the world's largest online consignment and thrift store platform, the global secondhand market is forecast to grow to $350 billion in 2028.

But Kream’s business largely relies on the Korean market, which is a restraint to its long-term growth.

Kream’s operating loss narrowed to 8.0 billion won in 2024 from a loss of 40.8 billion won in 2023, on sales of 177.6 billion won, up 45.3% over the same period.

Based on the stellar local business performance, its earnings before interest, taxes, depreciation, and amortization (EBITDA) swung to profit for the first time since its foundation.

ROADBLOCKS REMAIN

But the two companies have obstacles to overcome in their merger talks.

The biggest hurdle would be getting consent from Kream’s diverse shareholders for the consolidation.

Kream’s largest shareholder is Snow Corp., Naver’s subsidiary, with 38.82%, while Naver owns 4.87%.

Silicon Valley-based Altos Ventures holds about 31% in the Korean reseller, large enough to exert significant influence over Kream.

The other shareholders are financial investors, including Mirae Asset Capital Co. and Samsung Securities Co.

Write to Jun-Ho Cha, Jong-Kwan Park and Eun-Yi Ko at chacha@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Korean startupsNaver’s resale platform Kream joins Korean unicorns

Korean startupsNaver’s resale platform Kream joins Korean unicornsDec 28, 2023 (Gmt+09:00)

1 Min read -

-

Korean startupsKream poised to become unicorn after closing $157 mn Series C round

Korean startupsKream poised to become unicorn after closing $157 mn Series C roundDec 28, 2022 (Gmt+09:00)

2 Min read -

-

RetailStockX enters Korea's resale market, poses threat to domestic platforms

RetailStockX enters Korea's resale market, poses threat to domestic platformsSep 28, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN