Korean startups

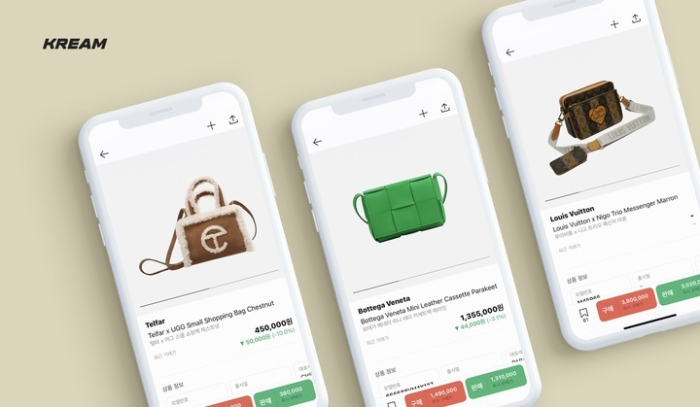

Naver’s resale platform Kream joins Korean unicorns

It is valued at more than $776 million, emerging as the latest Korean unicorn with beauty device firm APR

By Dec 28, 2023 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Kream Corp., the resale platform of South Korean online portal giant Naver Corp., has emerged as the latest Korean unicorn with a valuation exceeding 1 trillion won ($776 million) as it completed bridge round financing.

The resale platform has received a 49.9 billion won investment from Seoul-based Altos Ventures, according to its regulatory filings last week. The fundraising follows its 220 billion won series C round in March of this year.

Its corporate value surpasses 1 trillion won with the new capital injection, as it was valued at 970 billion won at the series C round. In Korea, a unicorn refers to a privately held startup with at least a 1 trillion won valuation.

Kream said it used the proceeds for its subsidiary Soda, a leading resale platform in Japan. The Korean firm has not yet confirmed its initial public offering plan, it added.

The Naver affiliate is a customer-to-customer platform on which to buy and sell products, including limited edition items of global sportswear brands like Nike and Adidas. The company’s peer group includes Korean online fashion platform Musinsa’s spin-off Soldout, and US online marketplace operator StockX.

Kream is one of two companies to join the list Korean unicorns this year. In June, beauty device firm APR surpassed 1 trillion won in corporate value with a pre-IPO investment from CJ Onstyle, entertainment powerhouse CJ ENM Co.'s e-commerce arm.

The number of new Korean unicorns dropped this year due to high interest rates and deteriorating investor sentiment.

In 2022, seven companies joined the unicorn rankings and three of them went public. The other four unicorns newly registered last year are accommodation platform GC Company, crypto exchange Bithumb, home interior app OHouse operator Bucketplace and e-book provider Ridi.

Meanwhile, Altos Ventures has invested a combined 390.6 billion won in Kream via series A, B and C rounds. The venture capital firm injected more than 300 billion won in Korea this year, and the majority of the funds were used for follow-up investments in existing portfolio companies amid market challenges, said Altos Chief Executive Han Kim.

Write to Jeong-Cheol Bae at bjc@hankyung.com

Jihyun Kim edited this article.

More to Read

-

-

Korean startupsKream poised to become unicorn after closing $157 mn Series C round

Korean startupsKream poised to become unicorn after closing $157 mn Series C roundDec 28, 2022 (Gmt+09:00)

2 Min read -

Comment 0

LOG IN