Retail

Naver's Kream buys stake in Malaysian resale platform

Kream is raising new funding in a Series C round

By Jul 19, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Kream, the resale platform of South Korea’s online portal Naver Corp., has agreed to buy a stake in Malaysia’s biggest sneaker resale community Shake Hands for $1.7 million, Kream said on Monday, a move aimed at extending its clout across Asia.

The purchase of a 22.47% stake in Shake Hands followed the string of Kream’s stake acquisitions of online used-goods market operators in Singapore, Australia, Thailand and Japan in the past year.

Shake Hands is the parent company of SneakerLAH, where sneaker enthusiasts share information and trade goods.

Through the acquisitions, Naver expects to build an Asia-wide, borderless resale platform to allow users to directly trade used items such as limited-edition sneakers, clothes and watches.

Earlier this year, Kream acquired a 2.71% stake in Singapore-based Quista Technology Pte. for $3 million. Quista is the largest online marketplace operator for used home appliances and other secondhand goods in both Singapore and Australia.

| Kream's investments in online resale platforms in other Asian countries | |||

| Company name | Country | Size of Kream's stake | Purchase price |

| Shake Hands | Malaysia | 22.47% | $1.7 million |

| Sasom | Thailand | 20.1% | 28.1 million Thai baht |

| Quista Technology | Singapore | 2.71% | $3 million |

| Soda | Japan | 14.89% | 3.5 billion yen |

| Source: Companies' regulatory filings | |||

In particular, its 3.5-billion-yen purchase of a 14.89% stake in Japan-based Soda Inc. last year is expected to help Kream gain a foothold in other parts of Asia since Soda’s operations span China, Singapore, Hong Kong and Indonesia.

To fund such strategic investments, Kream has borrowed a total of 87 billion won ($66 million) from its parent company Snow Corp., a software developer.

At home, Kream also has been solidifying its lead in the resale market through a series of acquisitions of smaller e-commerce players. One of the acquisitions included the 8-billion-won purchase of a popular online resale community, Nike Mania, in 2021.

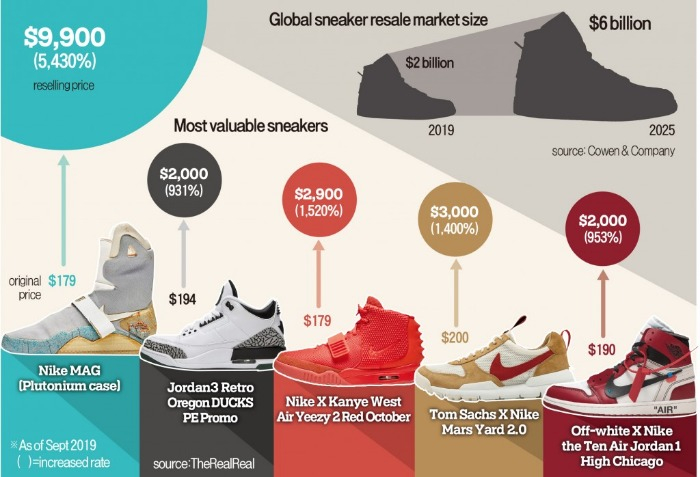

Since its inception in March 2020, Kream has been a major beneficiary of the retail scene's rapid growth. Its first-quarter transactions are estimated at 370 billion won in value, according to industry sources, or more than 90% of the projected 400 billion won for all of 2021.

Currently, Kream is raising new funding in a Series C round.

Write to Han-Gyeol Seon at always@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Behind the ScenesSouth Koreans turned off by luxury fashion houses’ price hikes

Behind the ScenesSouth Koreans turned off by luxury fashion houses’ price hikesMay 11, 2022 (Gmt+09:00)

4 Min read -

Korean startupsResale platform Bunjang to raise funds at over $300 mn valuation

Korean startupsResale platform Bunjang to raise funds at over $300 mn valuationNov 22, 2021 (Gmt+09:00)

2 Min read -

RetailStockX enters Korea's resale market, poses threat to domestic platforms

RetailStockX enters Korea's resale market, poses threat to domestic platformsSep 28, 2021 (Gmt+09:00)

2 Min read -

Comment 0

LOG IN