Banking & Finance

Samsung’s Monimo set to disrupt Korea’s financial app market

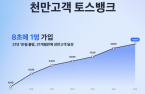

It took a little over two years for the latecomer to recruit 10 million members, about a year faster than market leader Toss

By Aug 14, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Mirae Asset to be named Korea Post’s core real estate fund operator

KT&G eyes overseas M&A after rejecting activist fund's offer

Meritz backs half of ex-manager’s $210 mn hedge fund

StockX in merger talks with Naver’s online reseller Kream

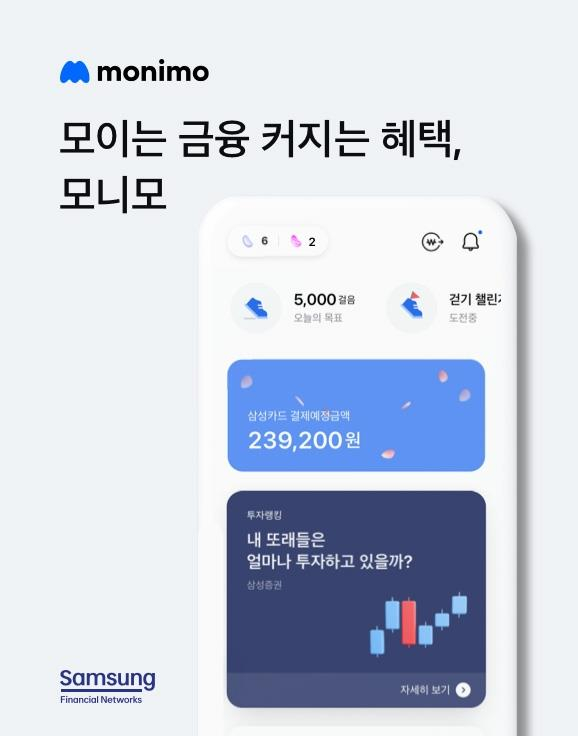

Samsung Group, South Korea’s most powerful business group, is poised to crack the country’s financial app market — now crowded with local fintech companies and traditional banks — thanks to the ascent of Monimo, a mobile financial platform launched by a union of its financial affiliates.

Samsung Financial Networks on Tuesday announced that Monimo had garnered more than 10 million members as of this month, two years and four months after the app’s launch.

By comparison, it took three years and nine months for the country’s leading fintech platform Toss to break the 10 million member threshold.

Monimo is an integrated financial services app offering services such as the management of various Samsung financial service accounts, money transfers, foreign-currency exchange and search-and-price comparisons for homes and cars.

It was launched in April 2022 by Samsung Financial Networks, which is composed of Samsung’s four financial affiliates: Samsung Card Co., Samsung Life Insurance Co., Samsung Fire & Marine Insurance Co. and Samsung Securities Co.

Compared to the somewhat muted response to it right after its launch, its latest performance is a promising sign of Monimo’s growth into a super financial app.

A super app is a mobile or web application that enables its users to do various jobs in one place, ranging from social networking to banking, e-commerce, messaging and more.

Fintechs and financial holding companies are eager to seize this market due to its vast growth potential.

The Korean super financial app market is already being vied for by the country’s major financial platforms operated by Naver Corp., Kakao Corp. and Toss Bank.

The country’s commercial banks are also seeking to unlock opportunities in the market with their own mobile banking apps.

BANKING SERVICES

To win the market, Monimo has asked Korean commercial banks to partner with it to enhance its service.

In March, Samsung Card, Samsung Financial Networks’ representative, proposed to the country’s five leading banks — KB Koomin, Shinhan, Hana, Woori and internet-only K Bank — to team up to launch a super financial app based on Samsung’s Monimo.

Samsung's finance app has sought the banks' collaboration because the Korean business empire is banned from directly owning a bank.

Of the five big commercial banks, KB Koomin Bank has joined hands with Monimo to develop a checking account that pays interest.

With this new feature, Monimo is expected to be competitive enough to upend the Korean super financial app market, analysts said.

Its monthly active users (MAU) hit 5.24 million this month, topping the MAU of other local mobile payment platforms such as Naver Pay by Naver with 2.33 million and Shinhan Super SOL by Shinhan Financial Group with 2.93 million.

Monimo’s MAU grew by about 2 million in a year, narrowly trailing the country’s popular digital wallet app Kakao Pay by Kakao Corp. with 5.47 million.

In June, Samsung Financial Networks applied to the Financial Services Commission (FSC) to become an innovative financial service under the country’s financial regulatory sandbox scheme in order to offer a bank account service on Monimo.

ADDITION OF A MOBILE PAYMENT SERVICE

Given that it takes three to four months to gain FSC approval for the designation, Monimo is expected to offer the new bank account service in the fourth quarter of this year.

To woo users, Samsung and KB Kookmin are expected to offer the banking industry’s highest interest rate for Monimo users’ deposits.

To accelerate its penetration into the Korean super finance app market, Monimo also launched its own mobile payment service called Monimo Pay, which supports both online and offline payment.

Monimo did not offer its own in-app purchase service so its users had to rely on Samsung Card’s mobile app for in-app purchases.

Write to Hyeong-Gyo Seo and Mi-Hyun Jo at seogyo@hankyung.com

Sookyung Seo edited this article.

More to Read

-

-

Banking & FinanceSamsung seeks to launch new super mobile banking app with a local bank

Banking & FinanceSamsung seeks to launch new super mobile banking app with a local bankMar 25, 2024 (Gmt+09:00)

3 Min read -

Korean startupsPopular app operators in South Korea race to create super apps

Korean startupsPopular app operators in South Korea race to create super appsAug 03, 2022 (Gmt+09:00)

3 Min read -

Comment 0

LOG IN