Banking & Finance

Samsung seeks to launch new super mobile banking app with a local bank

Samsung Financial Networks has contacted Kookmin, Hana, Shinhan, Woori and K Bank to bid on the Monimo-based super app

By Mar 25, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Financial Networks, a union of Samsung Group’s four financial affiliates, is seeking to launch a super mobile banking app in partnership with a leading South Korean commercial bank.

Samsung Card Co., the representative of the union, which includes Samsung Life Insurance Co., Samsung Fire & Marine Insurance Co. and Samsung Securities Co., has offered Korea’s five leading banks – KB Kookmin, Shinhan, Hana, Woori and internet-only K Bank – a proposal to jointly launch a super mobile banking app based on Samsung’s mobile app Monimo.

The five local banks will give their business presentations on Tuesday and Samsung will choose a bank out of the five for the partnership as early as Wednesday, people familiar with the matter said on Monday.

“Having a Samsung brand in our banking business is a huge strength to become bigger in the Korean financial market,” said a local bank executive.

For Samsung Group, which doesn’t have a banking affiliate, the joint launch of a super mobile banking app would be an opportunity to enter the mobile banking service sector, sources said.

Despite its financial service units ranging from insurance, card, securities and asset management, Samsung, a leading manufacturer, is banned from directly owning a bank.

However, Samsung is seeking to join hands with commercial banks as the tech conglomerate hopes to enhance its presence in the financial sector given the rapid industry transition toward digital banking, sources said.

MONIMO’S LACKLUSTER PERFORMANCE

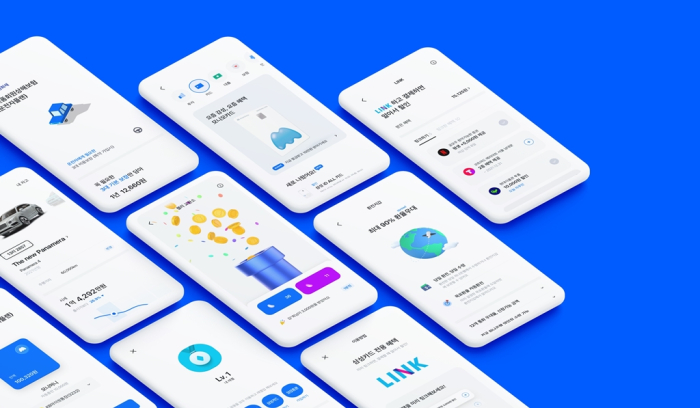

Samsung Financial Networks, led by Samsung Card, unveiled the Monimo mobile app, an integrated financial service app, in April 2022.

Monimo offers various services such as managing different Samsung financial accounts, money transfers, foreign-currency exchanges and search and price comparisons for real estate and cars.

The Samsung app, however, faced an uphill battle to attract users given the similar services of commercial banks and online banks, including fintech platforms Toss Bank and KakaoBank Corp.

Monimo has a user base of a few million people while Toss has some 20 million app users.

BANKS HAVE THEIR SUPER APPS

Major Korean banks have already launched their super banking apps to allow their customers access to various financial services through a single app platform.

Last December, Shinhan Financial Group launched its supper app Shinhan Super SOL, combining key financial services of the existing apps of the group’s five affiliates, including banking, cards and securities.

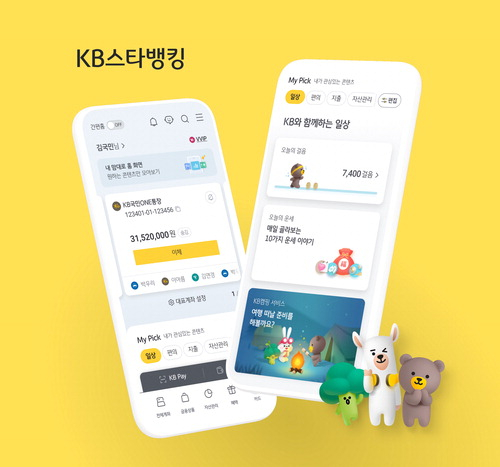

KB Financial Group unveiled the KB Star Banking app in 2021.

Hana Financial Group has launched the Hana One Q app as the group’s super mobile banking app, which integrates services of major affiliates such as securities, cards, capital and insurance.

Woori Financial Group, which operates the Woori WON banking app, plans to launch a new, comprehensive New WON Banking app sometime this year.

Analysts said local banks would still be interested in Samsung’s offer given the top Korean conglomerate’s expansive network and digital technology strengths.

Kookmin Bank’s KB Star Banking app has 12 million monthly average users while Hana Bank has cooperated with digital platform operators such as Naver Corp. and Coupang Inc.

Samsung Financial Networks is also seeking help from startups and fintech companies to advance and upgrade Monimo’s services.

The conglomerate is said to be offering startups joint business opportunities, including potential stake investments by Samsung Venture Investment Co.

Write to Jae-Won Park at wonderful@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Banking & FinanceKorean banks go digital in Southeast Asia for non-interest gains

Banking & FinanceKorean banks go digital in Southeast Asia for non-interest gainsOct 05, 2023 (Gmt+09:00)

2 Min read -

FintechSamsung, 4 Korean banks to foster financial software engineers

FintechSamsung, 4 Korean banks to foster financial software engineersJun 27, 2023 (Gmt+09:00)

1 Min read -

Banking & FinanceKorean online banks’ disruptive business model: Woo low-credit borrowers

Banking & FinanceKorean online banks’ disruptive business model: Woo low-credit borrowersMar 22, 2022 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsKorea’s Toss operator invests $5 mn in US startup fintech platform Republic

Mergers & AcquisitionsKorea’s Toss operator invests $5 mn in US startup fintech platform RepublicNov 24, 2021 (Gmt+09:00)

2 Min read -

Banking & FinanceK Bank valued at $6.9 billion, needs to expand loans: Morgan Stanley

Banking & FinanceK Bank valued at $6.9 billion, needs to expand loans: Morgan StanleyAug 31, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN