Korean banks go digital in Southeast Asia for non-interest gains

Southeast Asia has great potential with a relatively high proportion of digital-friendly young consumers

By Oct 05, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s top four banks are strengthening their overseas operations, particularly in the digital banking business, to increase their non-interest gains.

Such moves by KB Kookmin, Shinhan, Hana and Woori target the Southeast Asian market, which has a relatively young population and a high smartphone uptake rate, implying a wealth of digital-friendly consumers.

According to industry officials on Thursday, Hana Bank Indonesia’s mobile banking app LINE Bank has attracted 4.48 million users, surpassing the 4 million mark in the slightly more than two years since its launch.

Hana was the first Korean bank to advance into Indonesia by setting up a unit in the country in 1990. LINE Bank is a digital-only bank jointly launched by Hana and the global messenger platform LINE in June 2021.

Initially, LINE Bank offered only deposit and withdrawal services but gradually expanded its business scope to money transfer, non-contact account and mobile loan services to attract young retail customers.

While strengthening its mobile services, Hana’s Indonesian subsidiary has reduced the number of branch offices to 42 last year from 48 in 2021 to cut costs.

As a result, Hana Bank Indonesia’s first-half net profit rose 17% from a year earlier to 19.5 billion won ($14.4 million). Full-year net profit in 2022 rose nearly threefold to 51.56 billion won from the previous year.

Hana Bank Indonesia’s growing profit comes as its parent, Hana Financial Group Inc., aims to generate 40% of its total revenue from overseas markets by 2025.

“Indonesia is a market with high potential to expand our digital finance business,” said a Hana Financial Group official. “The country has a high proportion of young people who use digital platforms, and the Indonesian government is also actively fostering its financial industry.”

VIETNAM, CAMBODIA

Other major Korean banks are also aggressively launching digital services in overseas markets.

Shinhan Bank focuses its resources on Vietnam after launching a mobile banking app, Shinhan Sol Vietnam, in the country last year.

Shinhan is the first Korean financial services company to enter the Vietnamese market with the opening of a branch there in 1992.

KB Kookmin Bank is expanding its mobile banking services in Cambodia.

In mid-August, the bank received final approval from the Cambodian government for the merger of its two local subsidiaries – Prasac Microfinance and KB Cambodia Bank.

Through the merger, Kookmin plans to expand its customer base from retail to more profitable corporate clients.

Woori Bank’s current focus is also in Cambodia.

In February, the bank’s Cambodian unit launched Woori Pay, a simple settlement system mounted on its mobile banking app, to lure young consumers.

In Indonesia, the bank plans to launch a new mobile banking app that contains non-contact credit loan services through its subsidiary Bank Woori Saudara.

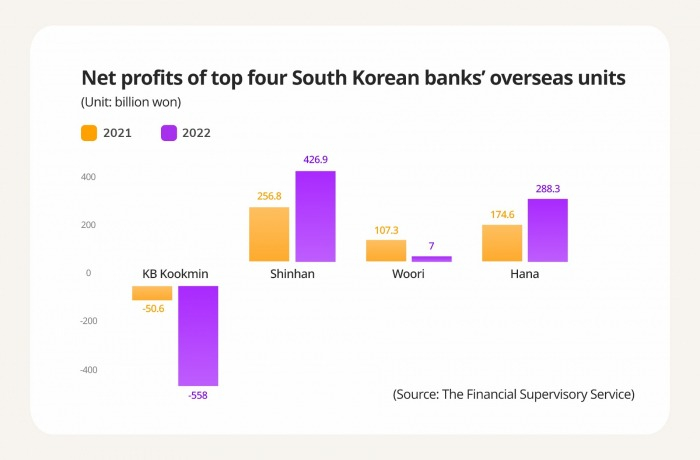

Korea’s four financial groups – KB Financial Group, Shinhan Financial Group, Hana Financial Group and Woori Financial Holdings – posted a combined 2.15 trillion won in net profit from their overseas operations last year, up 47% from the year prior.

Write to So-Hyun Lee at y2eonlee@hankyung.com

In-Soo Nam edited this article.

-

BlockchainHana Bank to enter digital asset custody sector with BitGo

BlockchainHana Bank to enter digital asset custody sector with BitGoSep 05, 2023 (Gmt+09:00)

1 Min read -

Banking & FinanceKorean banks' earnings hit hard by unpaid debts, rate hikes

Banking & FinanceKorean banks' earnings hit hard by unpaid debts, rate hikesAug 28, 2023 (Gmt+09:00)

2 Min read -

Banking & FinanceIndonesia, Vietnam boost Korean banks’ overseas profits

Banking & FinanceIndonesia, Vietnam boost Korean banks’ overseas profitsAug 24, 2023 (Gmt+09:00)

3 Min read -

Banking & FinanceKB Kookmin Bank launches integrated bank in Cambodia

Banking & FinanceKB Kookmin Bank launches integrated bank in CambodiaAug 07, 2023 (Gmt+09:00)

1 Min read -

FintechSamsung, 4 Korean banks to foster financial software engineers

FintechSamsung, 4 Korean banks to foster financial software engineersJun 27, 2023 (Gmt+09:00)

1 Min read -

Banking & FinanceWoori Bank to start legal, accounting advisory for firms entering Vietnam

Banking & FinanceWoori Bank to start legal, accounting advisory for firms entering VietnamJun 26, 2023 (Gmt+09:00)

1 Min read -

Banking & FinanceKorean banks’ profits hamstrung by tighter rules, consumer behavior

Banking & FinanceKorean banks’ profits hamstrung by tighter rules, consumer behaviorApr 18, 2023 (Gmt+09:00)

3 Min read