Korean startups

Popular app operators in South Korea race to create super apps

Danggeun Market, Remember, and Jobis & Villains are now in the market for providing human resources services on their apps

By Aug 03, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

App operators in South Korea are in stiff competition to create super apps – as clear winners have emerged in different business sectors.

The dominant apps in specific categories are trying to expand into related businesses, taking advantage of the robust branding power.

A super app is a mobile or web application that provides multiple services including payment and financial transaction processing, effectively becoming an all-encompassing and self-contained platform.

ALL-IN-ONE

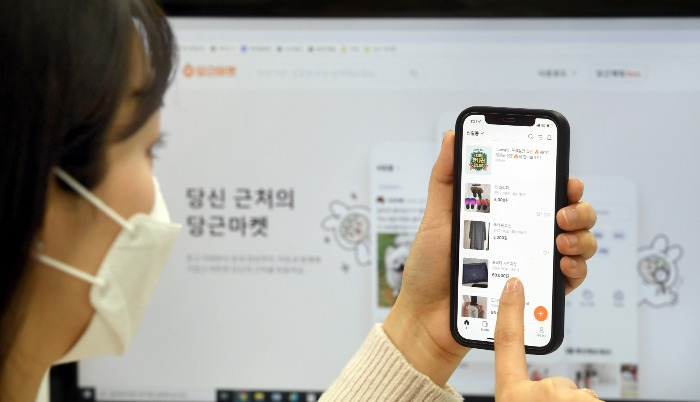

Danggeun Market, the startup behind Karrot, South Korea's largest neighborhood marketplace app, launched a new service called ‘Within 10 minutes of walking distance.”

The service uses the location tracking function to introduce nearby part-time job opportunities to local users.

The plan is to allow for the whole gamut of hiring-related activities on the app, in addition to the original function of business card management.

Including Jobis & Villains, the operator of artificial intelligence-powered accounting platform 3.3, a total of three different platforms are now in the recruiting platform market.

This happened because leading startups are in a push to become super apps at the same time.

Danggeun Market, Remember, and Jobis & Villains are not the only ones vying to grow their apps into super apps.

The country’s top travel and accommodation platform Yanolja Inc. launched a ticketing service last month, in a bid to become a leisure activity super app.

Alarmy, which is the No.1 mobile alarm clock app in South Korea, recently acquired MyRoutine as part of its efforts to become the overarching platform for recording and managing people’s daily habits.

Ride-sharing app So Car, for its part, is also planning to encompass ticketing for trains and reserving parking spots on its app.

M&A OPPORTUNITIES

The startups’ shared goal is to secure future growth engines by centralizing different services in one area and therefore pre-emptively beating the competition.

Viva Republica, the operator of fintech app Toss, is a success case that many founders aspire to emulate.

Let’s compare Toss to its biggest competitor Kakao Corp.

On the other hand, Toss provides the functions in a single super app.

Toss became the leading fintech app in South Korea by the monthly active user count in April, ahead of KakaoBank.

A venture capitalist told The Korea Economic Daily that “Unicorn startups and future unicorns have accumulated ample liquidity in the last couple of years.”

With the economic downturn this year, these startups have embarked on aggressive M&As to take advantage of the smaller startups’ low valuations, the industry insider added.

“The trend shows that the South Korean startup ecosystem has matured enough to become an industry of its own,” Lee Ki-dae, the former chief operating officer (COO) of Startup Alliance Korea said.

Lee elaborated, “Even in the case of conglomerates or overseas startups, mergers and acquisitions across different sectors happen more often when there is a clear leader in a sector.”

Write to Da Eun Choi at max@hankyung.com

Jee Abbey Lee edited this article.

More to Read

-

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google13 HOURS AGO

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN