The KED View

Vietnam’s rise: An ominous sign for Korean chipmakers

Korea’s chip industry could be doomed if the political standoff over the Korean CHIPS Act persists, analysts warn

By Feb 16, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Just a few years back, it was Taiwan that was on everyone’s lips in the semiconductor industry.

The small East Asian island country, home to the world’s top foundry player TSMC, has for years been a global base for manufacturing chips found in almost every electronic gadget from smartphones to self-driving cars and AI applications. TSMC’s advanced technology was, and still is, the name of the game in a race for chip supremacy.

Then came Vietnam.

Fabless companies and chip designers, major clients of contract chipmaking, are now flocking to the Southeast Asian country, traditionally known for cheap labor.

Low-wage workers are no longer the main force that attracts chipmakers across the globe to the nation, says an engineering professor at a South Korean university.

“Given the rapid change in chip business cycles, we shouldn’t be just bystanders, ignoring the phenomenon. Vietnam is no longer a country where people look for cheap labor,” he said.

Korea’s major fabless companies have joined their global peers to head to Vietnam to hire local chip experts and skilled workers – at lower costs, of course.

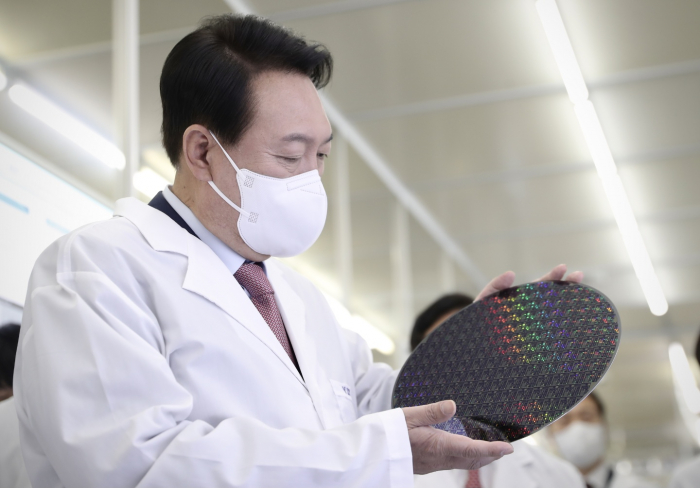

Last December, Samsung Electronics Co., the world’s top memory chipmaker and a TSMC rival, set up an R&D center in Ho Chi Minh City where most of its 3,000 researchers working on artificial intelligence and 5G technologies are Vietnamese.

ADTechnology Co., a Samsung foundry business partner, has locally hired two-fifths of its 500 global design engineers in Vietnam. CoAsia, another Samsung partner, runs chip design centers in Vietnam and Taiwan.

Korea is not alone in an industrywide rush for talent in Vietnam.

US chip design company Synopsys, which runs a semiconductor design center in Ho Chi Minh City, recently decided to double the number of Vietnamese employees on its payroll to 800.

Apple, Intel and Foxconn are already household names in Vietnam’s chip business circle, attracted to the government’s generous tax credits and tariffs, as well as a pool of workers to tap into – those well-trained by foreign chipmakers such as Renesas and Toshiba, which previously found a home in the Southeast Asian country.

BIGGEST SOURCE OF INCOME

Semiconductors also represent one of the biggest sources of income for Korea’s economy – Asia’s fourth-largest.

Nevertheless, Korea’s chip industry has been reeling from a lack of skilled manpower amid criticism that the government has been slow to provide infrastructure and build a professional workforce.

Korea’s government officials earlier said they would cut administrative red tape and ease the restrictive student quota system at colleges to nurture talent.

Industry executives, however, say the government still has lots of catching up to do.

Earlier this week, the main opposition Democratic Party of Korea, which controls the National Assembly, balked at the passage of an amendment to the government-proposed expansion of tax breaks for Korean chipmakers at a parliamentary subcommittee.

Vietnam’s ambitious move to become the next global semiconductor hub is a stark warning that the future of the Korean chip industry could be doomed.

Local chipmakers call for speedy action from politicians and government officials. Time is running out.

Write to Kyoung-Ju Kang at qurasoha@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Business & PoliticsKorean CHIPS Act revision hits roadblock as opposition lawmakers balk

Business & PoliticsKorean CHIPS Act revision hits roadblock as opposition lawmakers balkFeb 15, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung heads to US amid intensifying chip talent war

Korean chipmakersSamsung heads to US amid intensifying chip talent warSep 26, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSouth Korea to cut red tape, raise student quota to grow chip talent

Korean chipmakersSouth Korea to cut red tape, raise student quota to grow chip talentJul 19, 2022 (Gmt+09:00)

4 Min read -

Korean chipmakersKorea may be backpedaling in semiconductor push: Lawmaker

Korean chipmakersKorea may be backpedaling in semiconductor push: LawmakerMay 20, 2022 (Gmt+09:00)

4 Min read

Comment 0

LOG IN