Korean chipmakers

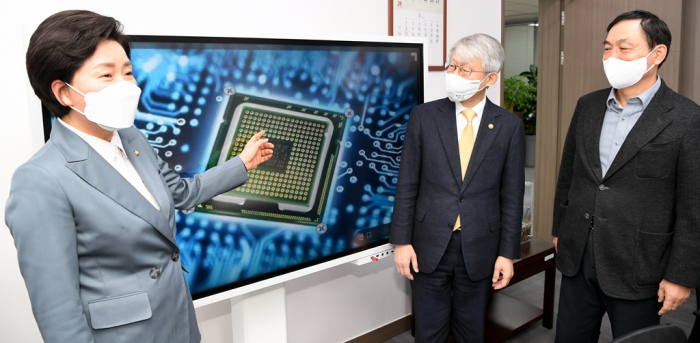

Korea may be backpedaling in semiconductor push: Lawmaker

Korea’s future depends on whether or not it has semiconductor supremacy, says the former Samsung executive

By May 20, 2022 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

A sudden surge in demand for semiconductors post-pandemic, coupled with a prolonged chip shortage, has forced policymakers worldwide to revisit policies for nurturing talent and developing an ecosystem for the chip industry.

South Korea, home to the world’s two largest memory chipmakers, Samsung Electronics Co. and SK Hynix Inc., has also promoted semiconductors as the backbone of its economy, but is slow to provide infrastructure and build a skilled workforce, says a lawmaker.

“Competition in the chip industry is like a sprint. Any company or a country that first develops state-of-the-art technology wins the race and takes all the trophies home,” Yang Hyang-ja, a former Democratic Party of Korea member who is now an independent lawmaker, said in a recent interview with The Korea Economic Daily.

“In the global race for semiconductor talent, it looks like Korea alone is backpedaling when our competitors are all sprinting to the finish line.”

Now is the time for the Korean government to look deep into the sector and heed the call for change to find the root cause of the quandary, in which the local chip industry lies, she said.

“Semiconductors are a lifeline to Korea just the way they are to other countries. To stay ahead of the competition has become a matter of life and death not just for companies but for countries,” the lawmaker said.

CHIP INDUSTRY LEGEND

Yang is better known as a legendary semiconductor executive at Samsung Electronics rather than a lawmaker.

After graduating a high school in Gwangju, South Jeolla Province, she joined Samsung Electronics at the age of 18 as an assistant to the semiconductor memory researchers at the company.

Since then she had worked at Samsung’s chip design division for over three decades and in 2014 she was promoted to the executive for its flash memory development, becoming Samsung’s first female executive without higher education. She completed tertiary education while working at Samsung.

She left Samsung in December 2015 to pursue a political career and in 2016 was elected to the National Assembly as a member of the then-ruling Democratic Party.

According to Yang, the semiconductor industry will see the advent of the age of “Super Moore’s Law” by 2030 in a tweaked reference to Moore’s law, an empirical observation that the number of transistors on a microchip doubles about every two years.

“Who would want an outdated chip inside an advanced product? That’s why Taiwan’s announcement that it will complete the development of 1-nanometer chip technology by 2030 is a serious threat to Korea,” she said.

Over the past decades, chipmakers have tried to cram more transistors onto ever smaller surfaces but have nearly reached the limit of what can be achieved with silicon, the main material for semiconductors.

Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s top foundry chipmaker, and US technology giant IBM have said they have developed technology to make 2 nm or lower chips.

CHIP TALENT

Despite a government vow to foster Korea’s chip industry as a global powerhouse, Samsung has been losing its share of the global foundry market to TSMC amid insufficient government support, industry watchers said.

By contrast, TSMC has been upping the ante by announcing a grandiose plan that it would spend $100 billion over the next three years to build six foundry plants in the US – a move widely seen to hold Samsung, a fast-follower, in check as well as tighten a chip alliance with the Joe Biden administration.

Taiwanese President Tsai Ing-wen said last December her government plans to allow universities to recruit new students majoring in semiconductors twice a year to nurture about 10,000 chip experts annually.

Citing data from the Korea Institute for Advancement of Technology (KIAT), Yang, the Korean lawmaker, said Korea needed about 1,600 new semiconductor professionals as of 2020 but the sector got only 650 fresh graduates from semiconductor-related departments at local universities.

Aggressive government-led investment is also required for local chipmakers to compete with their global rivals, she said.

The Biden administration, jointly with private companies, is committed to investing $300 million in the national semiconductor technology center annually, while the European Union has said it will spend over 3% of its member countries’ GDP on chip research and development.

“The late Samsung leader Lee Kun-hee once said that 'one genius feeds 100,000 people' to stress the importance of a super chip talent. That saying also applies to the era of the Fourth Industrial Revolution,” Yang said.

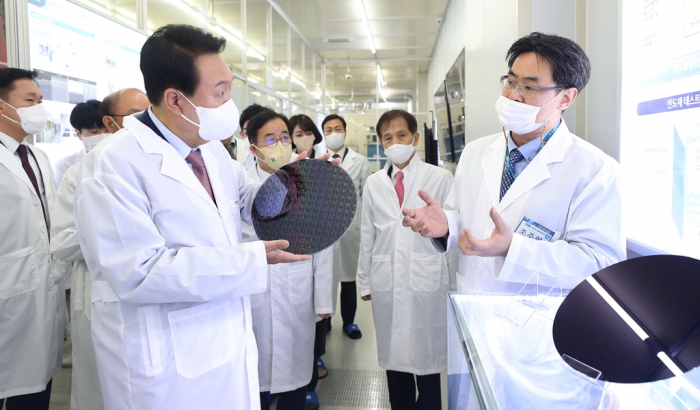

She urged Korea’s new president, Yoon Suk-yeol, to keep his campaign pledge to significantly ease administrative red tape, enhance tax incentives and offer other supportive measures for the local chipmakers.

“Our future depends on whether or not we have semiconductor supremacy. I’m afraid we are not fully aware of that,” she said.

Write to Ji-Eun Jeong at jeong@hankyung.com

In-Soo Nam edited this article.

More to Read

-

ElectronicsLG Display to nurture its own display experts at local graduate schools

ElectronicsLG Display to nurture its own display experts at local graduate schoolsMay 18, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung to make mobile AP chip dedicated to Galaxy smartphones

Korean chipmakersSamsung to make mobile AP chip dedicated to Galaxy smartphonesMay 16, 2022 (Gmt+09:00)

3 Min read -

-

Korean chipmakersSamsung, SK Hynix scramble for talent amid a lack government support

Korean chipmakersSamsung, SK Hynix scramble for talent amid a lack government supportMay 06, 2022 (Gmt+09:00)

6 Min read -

The KED ViewCan Samsung Electronics ever catch up to foundry leader TSMC?

The KED ViewCan Samsung Electronics ever catch up to foundry leader TSMC?May 03, 2022 (Gmt+09:00)

4 Min read

Comment 0

LOG IN