Stocks

Meritz leaps to No. 2 financial holding firm in South Korea

Its market value has swelled 17-fold in five years as its shares shot up more than 1,100% over the same period

By Feb 25, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Meritz Financial Group Inc., once a medium-sized financial service firm in South Korea, has become the second-most valuable publicly traded financial holding company, overtaking its bigger cross-town rival Shinhan Financial Group Co. for the first time.

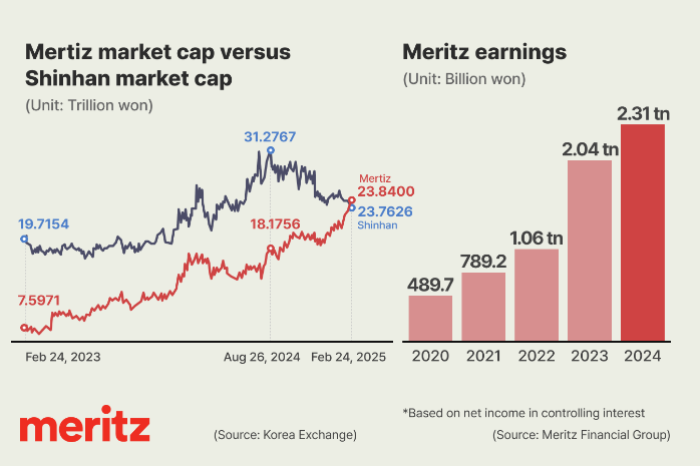

According to the country’s sole stock exchange operator Korea Exchange, Meritz Financial’s market capitalization hit 23.84 trillion won ($16.7 billion) on Monday, toppling the country’s long-time top two financial holding firm Shinhan Financial Group with a market value of 23.76 trillion won for the first time since its inception.

Merirtz Financial’s latest ascent comes just over a year after it beat the country’s third-most valuable financial holding firm Hana Financial Group Inc.

At its current pace, it could pass the country’s incumbent No. 1 financial holding firm KB Financial Group Inc. in market value at any time, said market analysts.

Meritz Financial’s market cap snowballed 17 times from 1.34 trillion won five years ago after its shares zoomed 1,125.49% over the same period.

SHAREHOLDER-FRIENDLY POLICY TO BOLSTER CORPORATE VALUE

The company has become an investors’ darling after it vowed generous returns to shareholders a few years back.

Since then, Meritz Financial has been at the forefront of the campaign to return more than 50% of its net profit to shareholders.

Its shareholder payout ratio reached 53.1% in 2024, up 1.9 percentage points from 2023.

The company’s earnings have also been on a steady rise, with its net profit in controlling interest hitting 2.31 trillion won in 2024, which is nearly 20 times more than a decade ago.

In contrast to other holding firms, Meritz Financial delisted its flagship non-life insurance and securities affiliates – Meritz Fire & Marine Insurance Co. and Meritz Securities Co. – during its corporate governance restructuring in 2023 to make them its wholly owned subsidiaries.

Following the reform, the holdings of its largest shareholder Chairman Cho Jung-ho shrank to 46.94% from 75.81%.

Cho was, however, said to have encouraged the company leadership to make drastic governance structure changes by expressing his keen willingness to relinquish family succession and bear any equity losses from the amendment, sources said.

MANAGEMENT SEPARATION

He is known to have reiterated the importance of shoring up individual minority shareholders’ value, which will benefit major shareholders in the end.

While controlling the largest stake, Cho steps away from corporate management to let hired managers take care of day-to-day business operations, which is considered the best governance structure, said Life Asset Management’s Chairman Lee Chaiwon.

Meritz Financial co-Vice Chairman Kim Yong-beom and Choi Himoon led Meritz Fire & Marine Insurance and Meritz Securities, respectively, as chief executive by 2023.

Kim also doubles as Meritz Financial's CEO, leading bold investments that worked to stabilize the market in Korea.

Under his leadership, Meritz Financial provided 1.5 trillion won in loans to Lotte Engineering & Construction Co., which was reeling under a liquidity shortage in the wake of a debt default by the domestic developer of a Legoland theme park in Korea.

Last year, it also provided 1 trillion won in loans to Korea Zinc Inc. in a battle with the Young Poong Corp.-MBK Partners alliance over its management control.

Despite its stellar performance over the last decade, some analysts doubt whether Meritz Financial could sustain its growth only with its heavy reliance on the local market and its two flagship securities and insurance businesses.

Some are even uncertain about whether the company would maintain its generous shareholder-friendly policy for the mid to long term.

On Tuesday, Meritz Financial shares ended down 1.8% at 122,800 won, snapping the winning streak in the previous three consecutive sessions.

Its market cap worth 23.42 trillion won still passed Shinhan Financial Group, retaining its position as the country’s second-most valuable financial holding firm.

Write to Hyeong-Gyo Seo at seogyo@hankyung.com

Sookyung Seo edited this article.

More to Read

-

EarningsMeritz cheers record profit in 2024, boasts top 3 market cap

EarningsMeritz cheers record profit in 2024, boasts top 3 market capFeb 20, 2025 (Gmt+09:00)

3 Min read -

EarningsMeritz leaves door open for an M&A, to stay shareholder friendly

EarningsMeritz leaves door open for an M&A, to stay shareholder friendlyMay 14, 2024 (Gmt+09:00)

3 Min read -

Banking & FinanceMeritz emerges fast to take on South Korea’s big financial companies

Banking & FinanceMeritz emerges fast to take on South Korea’s big financial companiesMay 02, 2023 (Gmt+09:00)

3 Min read -

EarningsMeritz Securities poised to become Korea’s No. 1 for first time

EarningsMeritz Securities poised to become Korea’s No. 1 for first timeFeb 03, 2023 (Gmt+09:00)

2 Min read -

Corporate bondsLotte to spend $651 mn to save affiliate from Legoland woes

Corporate bondsLotte to spend $651 mn to save affiliate from Legoland woesNov 09, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN