Earnings

Meritz Securities poised to become Korea’s No. 1 for first time

Meritz Securities earned more than 1 trillion won ($816.3 million) in operating profit in 2022, beating the local industry leader Mirae Asset Securities’ result

By Feb 03, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

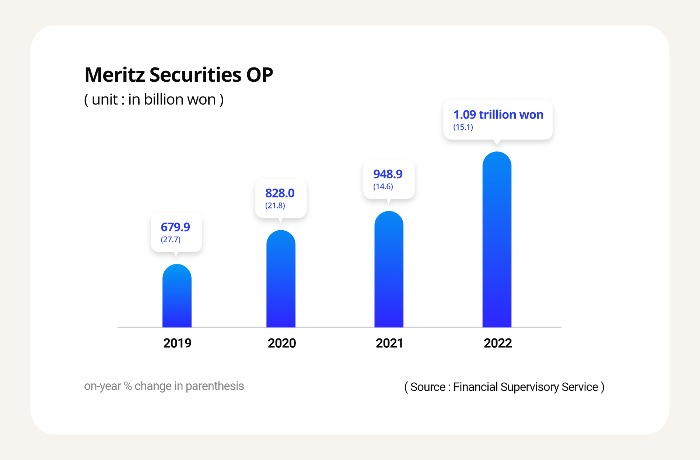

Meritz Securities Co., once a mid-tier securities firm in South Korea, is expected to command the local market as No. 1 after earning more than 1 trillion won ($816.3 million) in operating profit last year for the first time since its inception.

Meritz Securities on Thursday announced in a regulatory filing that its consolidated operating profit for full 2022 reached 1.09 trillion won, up 15.1% from the previous year.

This is the company’s record-high annual operating profit, which is expected to be the local industry’s biggest, above the industry leader Mirae Asset Securities Co.’s 845.9 billion won. The latter is Korea’s largest securities firm in terms of equity capital.

Meritz Securities also reported its largest-ever bottom line of 828.1 billion won last year, 5.8% higher than the previous year.

Its shares on Friday traded down 1.1% from the previous session at 6,520 won in the early morning session.

TRADING, REAL ESTATE PF PROFITS

Meritz Securities beat most of its bigger rivals with operating profit last year.

Mirae Asset Securities’ operating income for 2022 plunged 43.1% year on year, while Samsung Securities Co.’s profit shrank 55.8% to 578.6 billion won. Korea Investment & Securities Co. is also forecast to report a weaker result than Meritz Securities after earning 505 billion won in the first three quarters last year.

Meritz Securities’ upbeat results were largely owed to its pre-emptive efforts to reduce losses in bond trading and make profits from real estate project financing (PF) business.

The company shortened the duration of its bond assets and sold off treasury bonds to reduce losses from bond trading before interest rates went up. Bond prices and interest rates move in opposite directions. Its hedging in bond trading helped it minimize bond losses, according to the company.

Its investment banking (IB) business also fared well, the company said.

It also made huge profits from its unique real-estate PF product that lends funds to construction companies with unsold buildings or units collateralized during the real estate boom in Korea until 2019.

Its heavy exposure to the real estate market, however, may pose a threat to its financial soundness because the worldwide property market has been sluggish due to high borrowing costs from the ongoing global monetary tightening move.

But the company focuses more on stability than profit for now, an unnamed company official said, adding that about 95% of its PF loans are senior debts.

As part of efforts to diversify its business portfolio, the company has been expanding its retail business.

Its sister company Meritz Fire & Marine Insurance Co. also reported robust results last year. Its operating profit amounted to 1.16 trillion won in 2022, up 27.9% from 2021. Net profit jumped 29.4% to 854.8 billion won.

Write to Eui-Myung Park at uimyung@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Mergers & AcquisitionsKorea's Meritz Group likely to sell off its asset management arm

Mergers & AcquisitionsKorea's Meritz Group likely to sell off its asset management armNov 01, 2022 (Gmt+09:00)

1 Min read -

EarningsMeritz Securities posts positive third-quarter earnings surprise

EarningsMeritz Securities posts positive third-quarter earnings surpriseNov 01, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN