Earnings

Meritz cheers record profit in 2024, boasts top 3 market cap

The South Korean financial holding group’s shares jumped nearly 80% last year

By Feb 20, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Meritz Financial Group Inc. has reported its best-ever net profit for last year thanks to handsome gains from investments by its insurance and securities arms, further boosting its shares already buoyed by nearly 80% in a year.

The South Korean financial holding firm, which has climbed to become the country’s third-largest financial holding firm in terms of market value, forecast its net profit to top 3 trillion won ($2.1 billion) on a consolidated basis within three years, Meritz Financial Group Chief Executive and Vice Chairman Kim Yong-beom said after reporting the company’s stellar earnings on Wednesday.

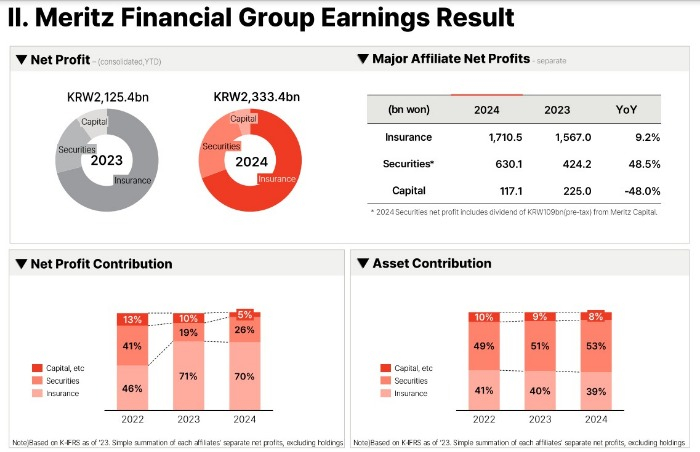

Meritz Financial announced in a regulatory filing that its consolidated net profit hit 2.33 trillion won in 2024, up 9.8% from the prior year.

Its operating profit added 8.7% to 3.19 trillion won in the same period with its total assets swelling 13.1% on-year to 116 trillion won and a return on equity (ROE) of 23.4%, the Korean financial industry’s highest.

On Thursday, Meritz Financial’s shares rose 3% to close at 123,000 won apiece, cementing its position as Korea’s third-largest financial holding stock by market cap.

Once an underdog financial group compared to the country’s longstanding top-dog peers like KB Financial Group Inc., Meritz Financial triumphantly returned to the main Kospi bourse in 2023 as the country’s No. 4 market-cap financial holding stock, immediately elbowing out Woori Financial Group Inc. to the fifth.

About two years later, its market value ballooned to 2.35 trillion won to become the third-largest market cap among the country’s major financial groups, beating Hana Financial Group Inc.

It even threatens to topple the country’s No. 2 financial holding firm Shinhan Financial Group Co. with a market value of 2.39 trillion won as of Thursday.

FLAGSHIP SECURITIES AND INSURANCE FIRMS FLY

Its upbeat earnings were mainly driven by the robust business performance of its fully owned two flagship units – Meritz Securities Co. and Meritz Fire & Marine Insurance Co.

The non-life insurer posted 1.71 trillion won in net profit in 2024, up 9.2% from 2023 and marking the fifth consecutive year of record earnings since 2020.

Its upbeat results are attributed to a strategic focus on profitability while avoiding cutthroat competition against its rivals.

Notably, returns from its investment jumped 25% on-year to 761.6 billion won last year.

Its lucrative brokerage unit Meritz Securities also had a fantastic year last year, with its operating profit recovering above 1 trillion won in two years on a nearly 20% year-over-year gain.

Its operating profit grew to 1.05 trillion won, while its net profit expanded 18.0% to 696 billion won over the same period.

Its strong results are largely owed to the solid performance of its investment banking business and a rise in gains from its fixed-income investment in a low-interest rate environment.

Its digital platform’s assets under management also surged to more than 5 trillion won from the prior’s 1 trillion won after introducing commission-free online-only accounts last November.

Meritz Securities and Meritz Fire & Marine Insurance were merged under their financial holding parent in early 2023.

SHAREHOLDER FRIENDLY POLICY

Meritz Financial kept its promise to return more than 50% of its net profit to shareholders for two years in a row as its shareholder payout ratio reached 53.1% in 2024, up 1.9 percentage points from 2023.

The company implemented the current shareholder return policy in 2023.

Its total shareholder return (TSR) for last year stood at 78.3%, and the three-year annual average TSR came at 34.8%, outperforming its peers.

In 2024, it repurchased company shares worth 1 trillion won and paid out 240 billion won worth of dividends, the company said.

Write to Han-Gyeol Seon at always@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Banking & FinanceMeritz to return 50% of net profit to shareholders

Banking & FinanceMeritz to return 50% of net profit to shareholdersJul 05, 2024 (Gmt+09:00)

1 Min read -

EarningsMeritz leaves door open for an M&A, to stay shareholder friendly

EarningsMeritz leaves door open for an M&A, to stay shareholder friendlyMay 14, 2024 (Gmt+09:00)

3 Min read -

Banking & FinanceMeritz emerges fast to take on South Korea’s big financial companies

Banking & FinanceMeritz emerges fast to take on South Korea’s big financial companiesMay 02, 2023 (Gmt+09:00)

3 Min read -

EarningsMeritz Securities poised to become Korea’s No. 1 for first time

EarningsMeritz Securities poised to become Korea’s No. 1 for first timeFeb 03, 2023 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsKorea's Meritz Group likely to sell off its asset management arm

Mergers & AcquisitionsKorea's Meritz Group likely to sell off its asset management armNov 01, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN