Shareholder activism

Activist fund KCGI to sell Osstem stake to UCK, MBK Partners

KCGI’s decision is aimed at protecting its investors from losses if Osstem is delisted

By Feb 10, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Korea Corporate Governance Improvement Fund (KCGI), one of the country’s most aggressive shareholder activists, plans to sell its stake in Osstem Implant Co. to a consortium of private equity firms seeking management control of the domestic dental implant maker.

Kang Sung-boo, KCGI’s chief executive, said on Friday he will accept the tender offer from two PEFs – MBK Partners and Unison Capital Korea (UCK) – to buy a controlling stake from Osstem founder and Chairman Choi Kyoo Ok and minority shareholders.

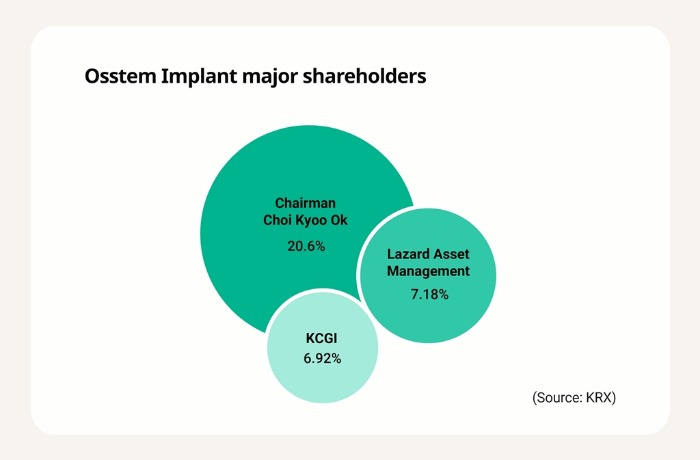

Last month, MBK and UCK agreed to buy 1.4 million shares of Osstem, or about half of Choi’s 20.6% stake, for 274.1 billion won ($223.4 million), or 190,000 won apiece.

The two PEFs also said they are willing to raise the size of their Osstem share purchase to secure stable control of the Kosdaq-listed company through a tender offer to other shareholders, including KCGI.

Analysts said MBK and UCK may attempt to delist Osstem to make it easier for them to pursue a vigorous revamp of the company.

Under Korea’s Commercial Act, a shareholder with a 95% stake or more in a company can delist it without consent from other shareholders.

Osstem Chairman Choi, who is the largest shareholder of the company, has been seeking to sell part of his stake since the company was embroiled in one of the largest-ever embezzlement scandals involving a listed Korean firm last year.

KCGI DECISION AIMED AT PROTECTING RETAIL INVESTORS

Local activist fund KCGI has amassed Osstem’s shares since the second half of 2022. It is now the dental implant maker’s third-largest shareholder with a 6.92% stake.

In efforts to enhance the fraud-ridden company’s corporate governance, KCGI in mid-January sent an open letter to Osstem, calling for CEO Choi’s resignation and board independence.

Industry watchers said KCGI is accepting MBK and UCK’s tender offer to protect retail investors who supported the activist fund’s causes and initiatives.

“If we don’t respond to the tender offer, we may violate our fiduciary duty to the detriment of our investors as they could take on the risk of future share price declines or delisting,” a KCGI official said.

If KCGI sells its Osstem stake at 190,000 won a share, its internal rate of return on the shares would reach close to 150%.

Shares of Osstem Implant closed down 2.7% at 1,752 won on Friday, underperforming the Kosdaq index's 1.6% fall.

In recent years, Korea’s activist shareholders have been exerting their clout over critical corporate decisions, including affiliate spinoffs as well as shareholder returns and dividend payouts.

Write to Ji-Eun Ha at hazzys@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Shareholder activismSouth Korean companies rattled by activist shareholders

Shareholder activismSouth Korean companies rattled by activist shareholdersFeb 06, 2023 (Gmt+09:00)

4 Min read -

Mergers & AcquisitionsMBK, Unison to expand Osstem Implant's target reach beyond China

Mergers & AcquisitionsMBK, Unison to expand Osstem Implant's target reach beyond ChinaFeb 03, 2023 (Gmt+09:00)

4 Min read -

Mergers & AcquisitionsMBK, Unison agree on tender offer for Korea’s Osstem Implant

Mergers & AcquisitionsMBK, Unison agree on tender offer for Korea’s Osstem ImplantJan 25, 2023 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsKorean activist fund KCGI buys Meritz Asset Management

Mergers & AcquisitionsKorean activist fund KCGI buys Meritz Asset ManagementJan 09, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN