Mergers & Acquisitions

MBK, Unison agree on tender offer for Korea’s Osstem Implant

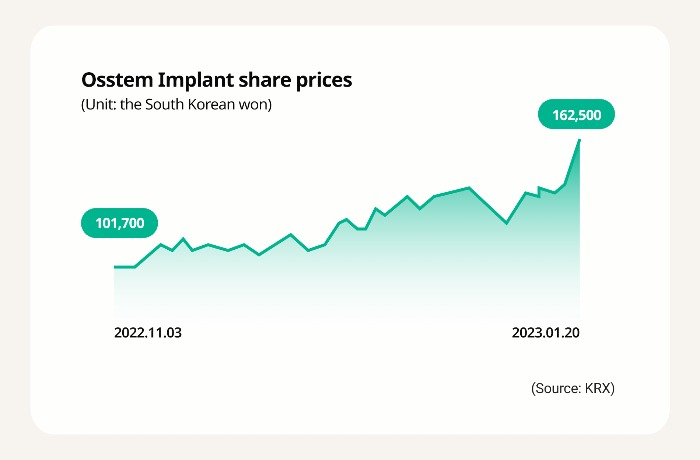

The PE firm plans to buy Osstem’s shares at a 16.9% premium to their Jan. 20 closing price through a tender offer

By Jan 25, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

MBK Partners, a leading Asian private equity firm, and Unison Capital Korea agreed on a tender offer to acquire management rights of Osstem Implant Co., the world’s fourth-largest dental implant maker, for up to 2.1 trillion won ($1.7 billion).

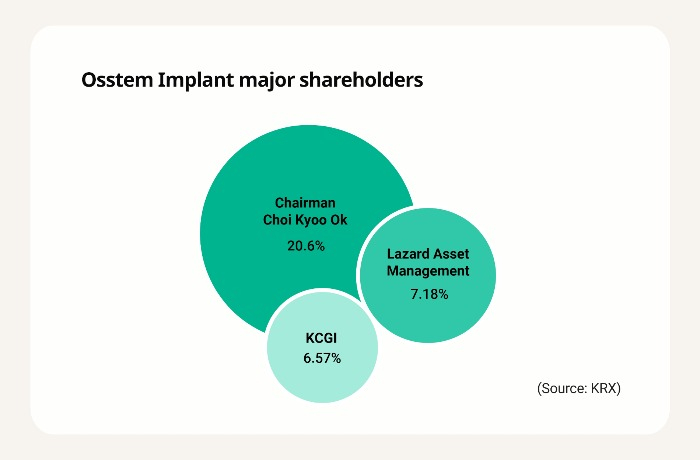

Osstem said on Wednesday its founder and Chairman Choi Kyoo Ok, the company’s top shareholder, signed a deal with those PE firms to sell 1.4 million shares, about half of his 20.6% stake, at 274.1 billion won, or 190,000 won apiece. That was 16.9% higher than the closing price of 162,500 won on Jan. 20. South Korean stock markets were closed on Monday and Tuesday for the Lunar New Year holidays.

MBK and Unison are set to buy more – from at least 2.4 million shares to up to 11.2 million, or from 15.4% of the South Korean company’s potential total stake to 71.5% – at 190,000 won through the tender offer, according to a filing to a local financial regulator. Such an aggressive step indicated the PE firms do not rule out a delisting after the takeover, said investment banking industry sources.

Osstem’s shares jumped as much as 15.7% to 188,000 won on Wednesday morning after the announcement.

The PE firms raised 2.1 trillion won for the takeover bid including a loan of 1.7 trillion won. NH Investment & Securities Co., the manager of the tender offer, was known to have provided the money, according to investment banking industry sources.

SYNERGY WITH MEDIT

Last month, MBK inked a deal to buy Medit Corp., the world’s third-largest 3D dental scanner maker, for 2.45 trillion won from Unison.

MBK and Unison are reportedly seeking to acquire Osstem for synergy with Medit. Osstem is the top implant maker in China and South Korea with market shares of 33% and 45%, respectively, in those countries, while accounting for 8% in the global industry.

Osstem and Medit’s global market shares are expected to quickly rise due to the cooperation, industry sources said.

“The synergy between Osstem and Medit is predicted to boost the global market shares of both companies,” said one of the sources. “The PE firms are likely to sell them to multinationals or list on the US Nasdaq ultimately after ramping up their corporate values through the combination of the two companies.”

FRAUD CASE

Osstem Chairman Choi has been seeking to sell his management rights since the company was hit by the largest-ever embezzlement scandal for a South Korean listed firm. He had been in talks with other domestic PE firms and China’s companies for the sale but failed to reach an agreement.

Korea Corporate Governance Improvement Fund (KCGI), Osstem’s No. 3 shareholder with a 6.57% take, also asked the company to improve its corporate governance. The local activist fund sent a shareholder letter including measures for the company’s governance and corporate value to its management.

KCGI hailed MBK and Unison’s decision to acquire Osstem, calling for cooperation to improve the company’s governance.

Choi is poised to secure 370 billion won in cash through the deal and sale of stakes in Osstem’s affiliates. He plans to repay 110 billion won in stock-backed loans to Meritz Securities Co.

The founder is reportedly set to play a role in the company as the second-largest shareholder after the sale.

Write to Chae-Yeon Kim and Ji-Eun Ha at why29@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Mergers & AcquisitionsMBK signs $2 bn deal to acquire 3D dental scanner firm Medit

Mergers & AcquisitionsMBK signs $2 bn deal to acquire 3D dental scanner firm MeditDec 29, 2022 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsBarbarians at the gate: fraud-hit Osstem wooed by bankers

Mergers & AcquisitionsBarbarians at the gate: fraud-hit Osstem wooed by bankersJan 26, 2022 (Gmt+09:00)

5 Min read -

Fraud scandalsLazard seeks to sell off fraud-hit Osstem Implant

Fraud scandalsLazard seeks to sell off fraud-hit Osstem ImplantJan 25, 2022 (Gmt+09:00)

2 Min read -

Fraud scandalsKorean dental implant maker hit by $160 mn embezzlement

Fraud scandalsKorean dental implant maker hit by $160 mn embezzlementJan 03, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN