South Korean companies rattled by activist shareholders

It is becoming trickier for firms to defend themselves against shareholder activism, says an industry executive

By Feb 06, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s major companies are under attack by activist shareholders, who are exerting ever-increasing clout over critical corporate decisions, including affiliate spinoffs as well as shareholder returns and dividend payouts.

More often than not, shareholder activism has been encouraged in Korea and abroad to enhance corporate governance and shareholder value. However, activists have become increasingly capricious, often making company chiefs struggle with tall demands, industry watchers said.

According to Insightia, a global voting rights research firm, 47 Korean companies became targets of activist campaigns via shareholder proposals or by other means in 2022.

With that figure, Korea ranked fifth in terms of activist campaigns, following the US (511 such cases), Japan (107), Australia (61) and Canada (53).

Cases of management attacks by activist funds in Korea have been on a steady rise with eight in 2019, rising to 10 in 2020 and 27 in 2021.

“If this trend continues, Korea will rise to third place sooner or later,” said a local financial market analyst.

GEORGESON MULLS KOREAN ENTRY

Activists have often taken issue with group-wide restructuring deals at Korea’s big conglomerates, saying such transactions benefit the controlling family members at the expense of minority shareholders’ interests.

With the growing influence of shareholder activism, Georgeson LLC, a global investor agent that specializes in shareholder engagement, proxy solicitation and corporate governance consulting, is considering entering the Korean market soon, industry sources said on Monday.

One of the world’s largest proxy voting advisory firms, Georgeson is no stranger to the Korean corporate market.

Back in 2018, Georgeson advised US hedge fund Elliott Management on its bid to block the merger between Samsung Corp. and Cheil Industries Inc. and a call on Samsung Electronics Co. to convert into a holding company in 2016.

“Given that Korean companies’ share prices are relatively low amid a stock market slump, companies with a loose control by top shareholders and a weak dividend policy will particularly come under attack by activist shareholders this year,” said a chief executive at a domestic asset management firm.

SM ENTERTAINMENT, KT&G UNDER ATTACK

In the latest sign that shareholder activism is on the rise in Korea, local activist fund Align Partners Capital Management earlier this month has successfully revamped the board of SM Entertainment Co., one of Korea’s largest K-pop agencies.

With just around a 1% stake in SM, Align Partners joined forces with other proxy voters to name its Chief Executive Lee Chang-hwan an SM board member, saying the move was designed to improve its corporate governance.

SM Entertainment founder and Chief Producer Lee Soo-man, the largest shareholder with an 18.46% stake, was excluded from the decision-making process.

Align Partners is also known to have embarked on a campaign to raise dividend payout ratios at Korea’s seven largest financial holding companies to as much as half their net profit.

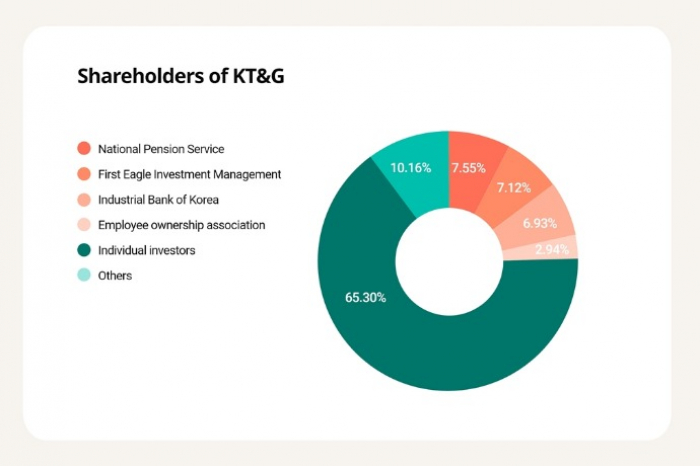

Last year, Singapore-based private equity firm Flashlight Capital Partners Pte. (FCP) urged Korean tobacco maker KT&G Corp. to spin off its ginseng business to boost shareholder value and profitability.

Stepping up its pressure on the tobacco maker this year, FCP in early January nominated Cha Suk Yong, an ex-chief executive and chairman of LG H&H Co. and Hwang Ou Jin, an ex-CEO of Prudential Life Insurance’s Korean unit, as new outside director candidates for KT&G’s eight-member board.

FCP has a 1% stake in the tobacco company.

Analysts said Korean companies find it increasingly difficult to counter attacks by activist funds, joined by local private equity firm executives who are well-versed in the Korean market.

While FCP is led by former Carlyle Group Korean head Lee Sanghyun, Align Partners Chief Executive Lee Chang-hwan was previously the private equity chief at KKR & Co.

Korea Corporate Governance Improvement Fund (KCGI), a local activist fund, has launched a campaign to oust the owners of Osstem Implant Co., a domestic dental implant maker.

Last December, Seoul-based Truston Asset Management Co. blocked Taekwang Industry Co. from participating in a rights offering by Heungkuk Life Insurance.

“In the past, shareholder activists would often hide their identity and the size of their holding until their stake reached the obligatory revelation level of 5% and then make a surprise appearance at the shareholders’ meeting to make their case before company management,” said a local company official.

“But these days, they meet up with company executives in advance and listen to their thoughts before presenting their case at the annual shareholder meeting. It’s getting trickier to defend their attacks.”

Write to Jun-Ho Cha and Ji-Eun Ha at chacha@hankyung.com

In-Soo Nam edited this article.

-

Mergers & AcquisitionsMBK, Unison to expand Osstem Implant's target reach beyond China

Mergers & AcquisitionsMBK, Unison to expand Osstem Implant's target reach beyond ChinaFeb 03, 2023 (Gmt+09:00)

4 Min read -

Shareholder activismKT&G refuses activist funds' call for ginseng biz spinoff

Shareholder activismKT&G refuses activist funds' call for ginseng biz spinoffJan 27, 2023 (Gmt+09:00)

2 Min read -

Shareholder activismK-pop label SM taps activist investor as board member

Shareholder activismK-pop label SM taps activist investor as board memberJan 20, 2023 (Gmt+09:00)

2 Min read -

Shareholder activismAnda pushes for right to copy KT&G shareholder list

Shareholder activismAnda pushes for right to copy KT&G shareholder listJan 10, 2023 (Gmt+09:00)

2 Min read -

Shareholder activismShareholder activism gathers momentum in South Korea

Shareholder activismShareholder activism gathers momentum in South KoreaSep 19, 2022 (Gmt+09:00)

2 Min read -

Shareholder activismDelta Air increases stake in Hanjin KAL to back Chairman Cho

Shareholder activismDelta Air increases stake in Hanjin KAL to back Chairman ChoSep 05, 2022 (Gmt+09:00)

3 Min read -

Shareholder activismUS hedge fund urges SK to focus on share buybacks

Shareholder activismUS hedge fund urges SK to focus on share buybacksApr 08, 2022 (Gmt+09:00)

1 Min read