S.Korea’s food delivery apps relish fresh boom in demand

Delivery fees are the top consideration for food delivery app users, one survey found

By Nov 14, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

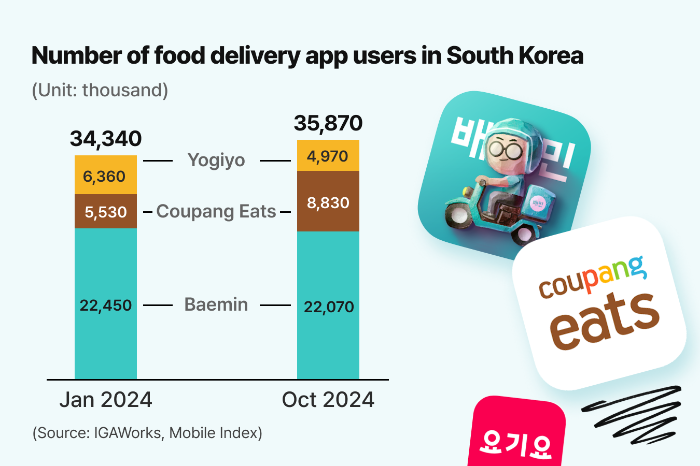

South Korea’s online food delivery market is poised to hit record-high transactions in 2024 as lower fees triggered by Coupang Eats’ free delivery have spurred growth in food delivery app use even after the lifting of COVID-19 lockdowns.

The market, led by Baemin, Coupang Eats and Yogiyo, is forecast to swell to 27 trillion-28 trillion won ($19 billion-20 billion) this year, surpassing its previous record of 26.6 trillion won hit in 2022.

January-September transactions reached 21.4 trillion won, according to Statistics Korea. That is far above the 19.6 trillion won in the same period last year and 20.1 trillion won in the comparable period in 2022.

The rapid growth defied concerns of food delivery demand stagnating or declining after peaking during the COVID-19 pandemic and reaching its growth limits amid soaring food prices.

Coupang Eats’ introduction of free deliveries for its paid members in March this year has fueled a sharp increase in its app users. It has been eating away at the market shares of Baemin, short for Baedalminjok, and Yogiyo.

Baemin and Yogiyo also came up with free deliveries for some services and cut their membership prices, leading to overall growth in the domestic online food ordering market.

Delivery fees were a psychological resistance for online food ordering users.

In a recent survey of 1,000 food delivery app users in the 20-50 age groups conducted by Kang Sanggyun, a professor in the Department of International Logistics at Chung-Ang University, 62% of respondents said delivery fees were their top consideration in whether or not to use the apps.

Food prices (49%) and discount coupons or promotions (34%) came next.

The rise in online food deliveries has also led to sales growth at mom-and-pop stores.

However, most delivery services are not free from the perspective of the app operators and their suppliers. Restaurants are charged 2,900 won per order for using the Baemin and Coupang Eats apps.

Write to Sun A Lee at Suna@hankyung.com

Yeonhee Kim edited this article.

-

EarningsCoupang posts record quarterly sales, swings to Q3 operating profit

EarningsCoupang posts record quarterly sales, swings to Q3 operating profitNov 06, 2024 (Gmt+09:00)

3 Min read -

Korean startupsBaemin founder strikes out for new trophy platform

Korean startupsBaemin founder strikes out for new trophy platformJul 26, 2024 (Gmt+09:00)

2 Min read -

E-commerceCoupang to raise membership fees, 1st hike in over 2 years

E-commerceCoupang to raise membership fees, 1st hike in over 2 yearsApr 12, 2024 (Gmt+09:00)

2 Min read -

Tech, Media & TelecomDelivery Hero-backed Baemin to exit Vietnam on low returns

Tech, Media & TelecomDelivery Hero-backed Baemin to exit Vietnam on low returnsNov 27, 2023 (Gmt+09:00)

1 Min read -

-

RetailS.Korean food delivery app Baemin vows to hike logistics unit's service quality

RetailS.Korean food delivery app Baemin vows to hike logistics unit's service qualityDec 20, 2022 (Gmt+09:00)

1 Min read -

RoboticsKorea’s top delivery app operator Woowa launches food delivery robot

RoboticsKorea’s top delivery app operator Woowa launches food delivery robotNov 29, 2022 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsDelivery Hero sells Yogiyo to GS Retail, Affinity-led group

Mergers & AcquisitionsDelivery Hero sells Yogiyo to GS Retail, Affinity-led groupAug 15, 2021 (Gmt+09:00)

3 Min read -

Korean foodKorea’s fried chicken brands fly high on food delivery boom

Korean foodKorea’s fried chicken brands fly high on food delivery boomDec 30, 2020 (Gmt+09:00)

3 Min read