Earnings

Coupang posts record quarterly sales, swings to Q3 operating profit

The SoftBank-backed e-commerce firm says its Farftech business is near the break-even point, earlier than planned

By Nov 06, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

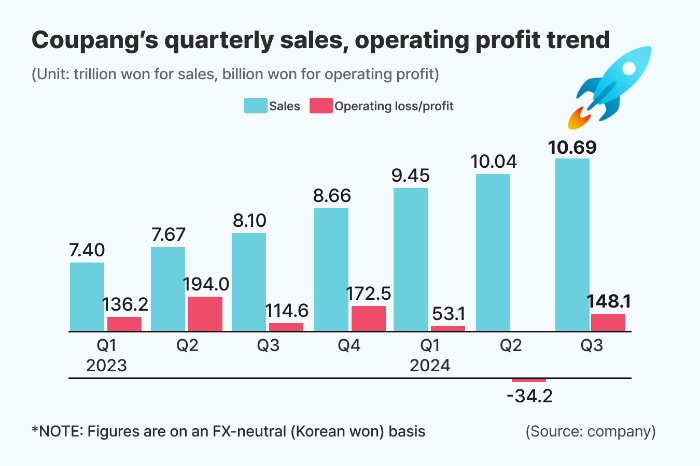

Coupang Inc., South Korea’s answer to global e-commerce giant Amazon.com, posted its highest quarterly sales in the third quarter and swung to operating profit from a loss in the previous quarter.

The e-commerce platform operator, listed on the New York Stock Exchange, said in a regulatory filing to the US Securities and Exchange Commission (SEC) that it posted $7.9 billion in consolidated sales in the quarter ending Sep. 30, up 27% from a year earlier. On a foreign-exchange-neutral basis, sales rose 32%.

Excluding Farfetch Holdings Plc, an online luxury fashion retailer it acquired in January, third-quarter sales reached $7.4 billion, up 20% on a reported basis and a 25% rise on an FX-neutral basis.

Third-quarter operating profit rose 25% year over year to $190 million on a reported basis. From the previous quarter, Coupang made a turnaround.

Its operating profit margin stood at 1.38%, down from 1.41% a year earlier.

Net profit was $64 million on a reported basis, down 30% from a year earlier.

Diluted earnings per share (EPS) was 4 cents, a decline of 1 cent over the year-earlier period.

Coupang's adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) was $343 million, with a margin of 4.4%, up 50 basis points from last year. Excluding Farfetch, adjusted EBITDA was $345 million, with a margin of 4.6%.

EBITDA is a profitability indicator that shows a company's ability to generate cash from its business activities.

SEGMENT HIGHLIGHTS

Coupang said its product commerce active customers reached 22.5 million in the third quarter, up 11% from a year earlier.

Product commerce segment revenue was $6.9 billion, up 16% from a year earlier on a reported basis.

The product commerce segment adjusted EBITDA to $470 million, up $71 million from a year earlier.

Sales in the Developing Offerings segment, including International, Coupang Eats, Coupang Play, Fintech and Farfetch, were $975 million, up 347% from a year earlier on a reported basis.

The Developing Offerings segment's adjusted EBITDA was negative $127 million, an improvement of $34 million on-year. The loss includes a negative $2 million impact from the consolidation of Farfetch.

In January, Coupang acquired British online luxury fashion retailer Farfetch in a $500 million deal that awarded the New York-listed e-commerce firm the leading position in the $400 billion global personal luxury goods market.

FARFETCH NEARS BREAK-EVEN

On the positive side, Coupang said its Farftech business is near the break-even point, earlier than planned.

The business has been a drag on earnings since its acquisition.

Excluding Farfetch, Coupang said its earnings this quarter would have been 6 cents per share.

“We achieved an important milestone in Developing Offerings this quarter, reaching near break-even profitability in Farfetch, earlier than planned. We remain focused on our relentless pursuit of customer wow and operational excellence,” said Chief Financial Officer Gaurav Anand.

"This quarter we continued the strong momentum we’ve seen throughout this year, delivering robust growth in revenues and margins," Anand continued.

"Our newer offerings and categories, like Fulfillment and Logistics by Coupang (FLC) and R.Lux, a new luxury offering, are examples of the massive growth opportunity from selection expansion on Rocket Delivery.”

Write to Jiyoon Yang at yang@hankyung.com

In-Soo Nam edited this article.

More to Read

-

E-commerceCoupang posts 1st quarterly loss in two years; revenue soars

E-commerceCoupang posts 1st quarterly loss in two years; revenue soarsAug 07, 2024 (Gmt+09:00)

1 Min read -

EarningsCoupang to keep investing against Chinese players despite loss

EarningsCoupang to keep investing against Chinese players despite lossMay 08, 2024 (Gmt+09:00)

4 Min read -

-

E-commerceCoupang launches ultra-fast Rocket Delivery service in Taiwan

E-commerceCoupang launches ultra-fast Rocket Delivery service in TaiwanOct 26, 2022 (Gmt+09:00)

2 Min read -

EarningsCoupang posts first positive EBITDA, raises full-year forecast

EarningsCoupang posts first positive EBITDA, raises full-year forecastAug 11, 2022 (Gmt+09:00)

2 Min read -

AutomobilesKia chooses Coupang as first partner for purpose-built vehicle rollout

AutomobilesKia chooses Coupang as first partner for purpose-built vehicle rolloutApr 15, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN