Fried chickens

Korea’s fried chicken brands fly high on food delivery boom

By Dec 30, 2020 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The country’s leading chicken brands, including Kyochon F&B, are tipped to flag their highest-ever sales this year. They have also lured both foreign and retail investors, including the Ontario Teachers' Pension Plan (OTPP), as well as private equity firms.

The Canadian pension OTPP agreed this month to invest 300 billion won ($276 million) in BHC Group, in a rare direct investment in South Korea's fried chicken market still fragmented by mom-and-pop outlets.

Kyochon F&B became the country’s first listed chicken stock after it made a successful trading debut on the country’s main bourse last month. The IPO of the franchise operator, with estimated sales of 430 billion won, pulled in $8.2 billion in deposits from retail investors for the subscription. Its shares were oversubscribed 1,318 times.

Two Seoul-based PE firms – Q Capital Partners and Corstone Asia – jointly acquired smaller chicken franchise Norang Tongdak for 70 billion won this year. Last year, Q Capital invested 120 billion won in BBQ to become its No. 2 shareholder with a 30% stake.

“Fried chickens, a popular delivery food item, benefited substantially from the COVID-19 pandemic this year. They should continue their steady growth for more than five years,” said Euromonitor analyst Kim Young-mi.

In addition to developing various chicken recipes, they unveiled new side menus ranging from chicken burgers and twisted breadsticks to spicy rice cakes to boost sales.

In particular, third-ranked Genesis BBQ took full advantage of the food delivery boom, opening more than 100 delivery-only outlets nationwide this year. Each franchise measures fewer than 30 square meters and costs only 50 million won to open, including rent. They have drawn those in their 20s and 30s who want to start their own business.

“This year, unprecedented investment and innovation were made in our market,” said a fried chicken industry source.

Chicken franchises had reported the highest rate of business closures for the past three years in a row, according to the Fair Trade Commission, despite annual growth of 10% in the domestic fried chicken market over the past five years.

But the global pandemic has changed their fortunes. Their market size has more than doubled to 7.5 trillion won ($6.9 billion) this year, compared to 2016, according to research firm Euromonitor.

The country's food delivery services market has ballooned to 22 trillion won from 12 trillion won in 2015, according to McKinsey.

EYES ON CRAFT BEER

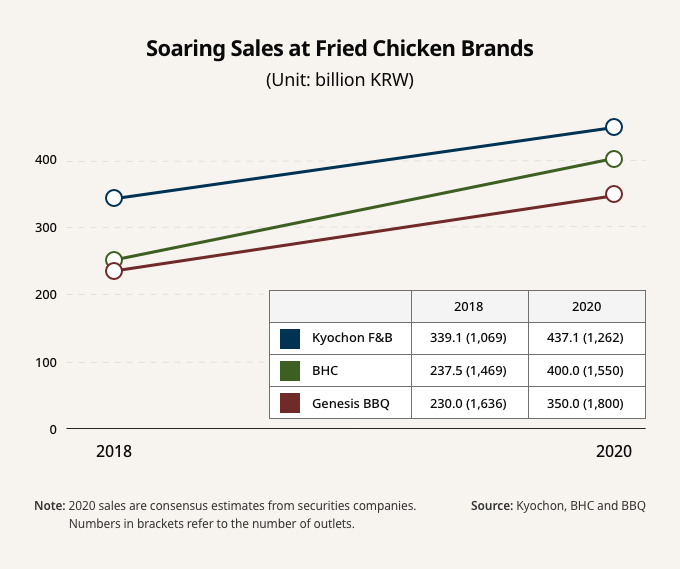

This year, both Kyochon and BHC are expected to report sales in the 400 billion won range for the first time.

Kyochon's sales are likely to have climbed by 15% on the year to 437.1 billion won in 2020, with sales at BHC seen up almost 30% to top 400 billion won. BBQ looks set to log a 43.5% jump to 350 billion won in sales.

To keep the upward momentum going, fried chicken franchises are looking to serve up their own craft beer.

Kyochon is considering acquiring craft brewery Moon Bear Brewing, based in Gangwon Province, to roll out its craft beer in the first half of next year. BBQ is building a craft beer plant for completion by the end of June 2021 as the government has pledged to lower barriers to the beer industry from next year.

Write to Jong-Pil Park at jp@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN