Big Bang deregulation poised to bolster S.Korean ST market

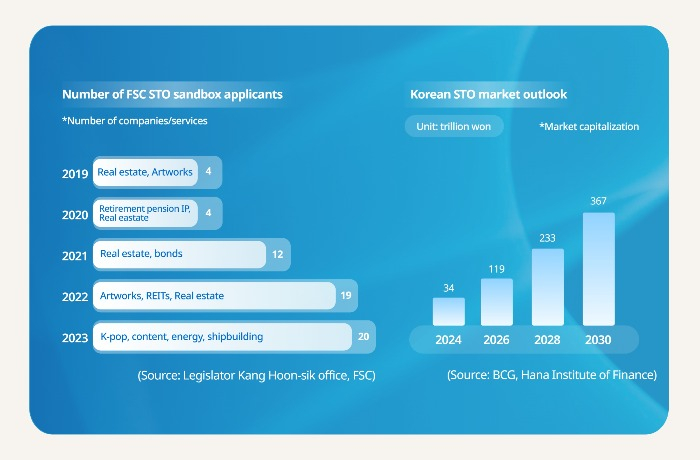

Since the introduction of the STO guidelines in February, applicants for Korea’s fractional investing sandbox program have quadrupled

By Aug 03, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s fractional investment market is gearing up for a grand opening after the government earlier this year unveiled security token offering (STO) guidelines to legalize fractional investing, the latest blockchain-based investment product expected to spark the next revolution in the financial market.

According to Financial Services Commission’s (FSC) data obtained by Kang Hoon-sik, a lawmaker of Korea’s opposition Democratic Party, 20 companies have applied for the STO regulatory sandbox program this year, 34% of 59 firms receiving STO sandbox consulting from Fintech Center Korea under the FSC since 2019.

This is almost four times higher than before the STO guidelines announcement in February, said an official at Fintech Center Korea. All 20 applications have arrived at the center since the guidelines' introduction.

The center expects to receive more applications as the National Assembly is working on bills to amend the country’s Capital Markets Act and the Act on Electronic Registration to enable legitimate security token issuance and distribution.

The STO guidelines enable the issuance of security tokens using blockchain technology, which is expected to play an important role in bolstering fractional investing.

The FSC in early February unveiled a security token issuance and distribution regulatory system improvement plan.

In addition, the Korean financial regulator on Monday announced revisions on the securities registration form to allow fractional investment platform operators to register as financial companies that can trade in non-traditional securities as investment securities by institutionalizing those assets as tradable securities.

With more relaxed rules, the range of underlying assets of fractional investing is expanding from intellectual property (IP) and real estate to music copyrights, artwork and even live cows.

CREATIVE FRACTIONAL INVESTING

Fractional investing is growing in popularity as it allows people to invest in non-traditional assets with a small sum of money and still anticipate favorable returns.

Institutionalized security token trading is expected to further bolster the country’s fractional investing ecosystem a wider swath of participants and assets.

Recently more early-stage startups such as Ever Treasure and HIPE have applied for the STO regulatory sandbox program to join the security token market.

The underlying assets for fractional investing are becoming more diverse and creative, encompassing not only real estate, artwork and IP but also new renewable energy by Hikive, US mortgage-backed securities (MBS) by AFun, film and TV content by Funderful and live cattle by Bancow.

The growing challenge by early-stage startups with unconventional ideas is expected to foster the expansion of Korea's security token ecosystem.

OBSTACLES

But hurdles remain.

According to the Capital Markets Act amendment bill proposed Friday last week, security tokens will be traded under two categories -- non-monetary trust beneficial certificates and investment contract securities.

Fractional investing in real estate securities falls under the former, while artwork and live cattle investing is under the latter.

It is possible to issue and trade trust beneficial certificates in tokens under the STO regulatory sandbox program but investment contract securities are allowed to be issued only until the bill passes next year.

A security token issuer of investment contract securities must trade its tokens via an account management organization, normally a securities firm.

This will ban their issuers, generally fractional investing platform startups, from collecting transaction fees.

A cap on retail investors’ investment amount in the over-the-counter (OTC) market would also make the ST market illiquid.

Some also complained about the strict token approval process for investment contract securities, warning that such strong investor protection vehicles and high standards for operators’ credibility could prevent small startups from offering their innovative services.

But those on the opposite position argued that allowing a security token issuer to trade them is against the fundamentals of the country’s Capital Markets Act.

To protect investors in such a highly volatile fractional investment market, it is important to put strict investor protection measures and a securities issuance approval process in place, said Kim Kab-lae, a research fellow at Korea Capital Market Institute, adding that market liquidity will improve once companies offer attractive token products.

Write to See-Eun Lee at see@hankyung.com

Sookyung Seo edited this article.

-

RegulationsFractional investing to gain traction in Korea with green light from FSC

RegulationsFractional investing to gain traction in Korea with green light from FSCJul 31, 2023 (Gmt+09:00)

3 Min read -

Culture & TrendsKorea's Musicow to lead fractional IP ownership globally

Culture & TrendsKorea's Musicow to lead fractional IP ownership globallyFeb 20, 2023 (Gmt+09:00)

2 Min read -

RegulationsKorea to legalize security token for fractional investment

RegulationsKorea to legalize security token for fractional investmentFeb 06, 2023 (Gmt+09:00)

3 Min read -

Venture capitalKoreans' fractional investing craze spreads to cows

Venture capitalKoreans' fractional investing craze spreads to cowsApr 28, 2022 (Gmt+09:00)

1 Min read -

Korean startupsFractional copyright ownerships are securities: Seoul

Korean startupsFractional copyright ownerships are securities: SeoulApr 20, 2022 (Gmt+09:00)

3 Min read -

Wealth managementSongs and art: Fractional investing bedazzles millennial investors

Wealth managementSongs and art: Fractional investing bedazzles millennial investorsMay 17, 2021 (Gmt+09:00)

3 Min read