Earnings

Coupang posts profit for 2 straight years in 2024 on new growth drivers

A recovery in Farfetch revenue and the solid performance of its business in Taiwan helped shore up overall growth

By Feb 26, 2025 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Coupang Inc., South Korea’s answer to global e-commerce giant Amazon.com, ended last year with profit for the second straight year thanks to the revival of its luxury fashion platform Farfetch and a successful landing in Taiwan, offsetting a slowdown in its mainstay delivery business.

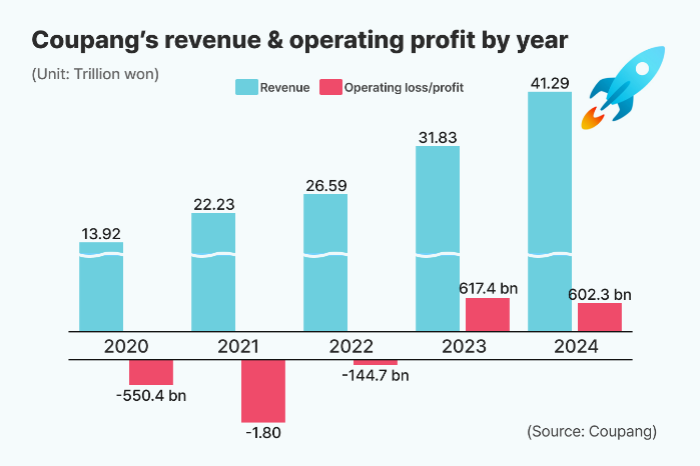

The New York Stock Exchange-listed Coupang announced in a filing to the US Securities and Exchange Commission (SEC) on Tuesday that its consolidated operating profit for 2024 hit $436 million, extending its profit streak for the second consecutive year after its first-ever profit in 2023, albeit marking a 2.4% on-year fall.

Its total revenues jumped 24% to $30.3 billion over the same period. On a foreign-exchange-neutral basis, sales rose 29%.

The company attributed the solid results to a turnaround in once money-losing Farfetch Holdings Plc, an online luxury fashion retailer it acquired last January, as well as robust growth in its international business.

“We believe the playbook we pioneered in Korea can be applied in other markets with equal success,” Bom Kim, founder and chief executive of Coupang, said during an earnings conference call on Tuesday. “Our first international market, Taiwan, is a great example.”

In the final quarter of last year ended in December, Coupang posted $312 million in consolidated operating profit, more than doubling from a year ago. Sales were up 21% to $7.9 billion over the same period.

GLOBAL PUSH PAYS OFF

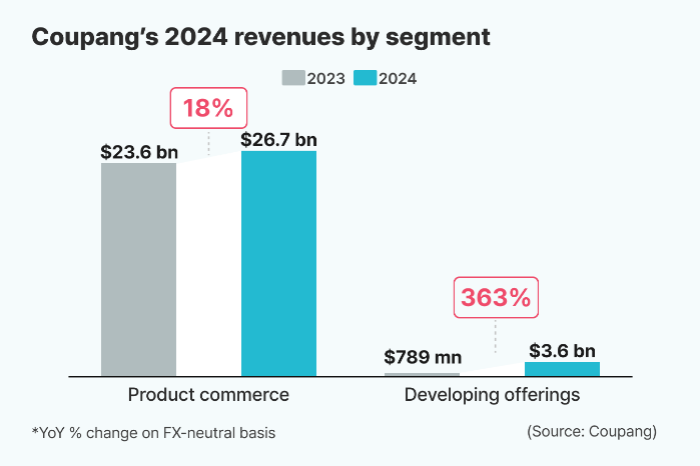

Coupang's mainstay product commerce segment, which mainly deals with its core e-commerce business, reported $26.7 billion in net revenue, up 18% on a foreign exchange-neutral basis, which came below the company's overall sales growth rate of 29%.

The company’s developing offerings segment, which covers international business, Farfetch, Coupang Eats and Coupang Play, played a bigger role in propping up Coupang’s overall sales after earning $3.6 billion in 2024, more than quadrupling from the prior year.

The Korean e-commerce giant advanced into Taiwan in late 2022 with its fast delivery service Rocket Delivery.

Coupang’s sales from its Taiwan business jumped 23% on-quarter in the fourth quarter, contributing to the company’s overall sales.

“The vast majority of that growth (in Taiwan) was organic, a testament to the differentiated customer experience that we're building,” said Kim.

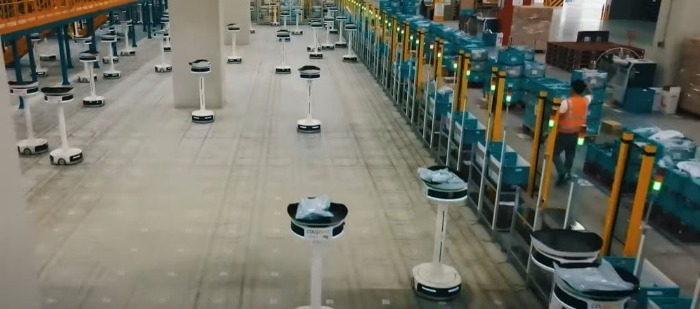

The company has invested about 500 billion won ($348.9 million) in its Taiwan business to build an automated fulfillment center backed by machine learning and AI.

Coupang plans to expand its overseas business this year starting with Taiwan.

As part of the global push, the Korean e-commerce major recently launched its WOW membership program in Taiwan, where the retail market is estimated at about 200 trillion won.

RECOVERY OF FARFETCH

In the final quarter of last year, its money-losing luxury fashion platform Farfetch also swung to a profit, finally taking off.

Farfetch’s adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) stood at $30 million in the fourth quarter while reporting $1.7 billion in annual sales.

“Farfetch was a sector leader with roughly $4 billion in annual transaction volume and a global brand in luxury fashion,” said Kim. “Farfetch continues to attract 49 million monthly visitors in over 190 countries around the world.”

When Coupang acquired Farfetch a year ago, the luxury fashion platform was losing hundreds of millions of dollars annually. But its losses have shrunk “dramatically to a breakeven run rate today,” said Kim.

AI INVESTMENT

Coupang plans to make aggressive investments in AI this year to take advantage of automation in the e-commerce business.

“Just as our past innovations have unlocked new levels of performance, the next wave from robotics in our network to AI and the trillions of predictions we make daily, promises to drive even higher levels of growth and margin expansion in the quarters and years to come,” said Kim.

The Korean e-commerce giant saved 16% in line haul costs after implementing robotics and automation technologies in its fulfillment and logistics network.

“Even with these advances, we've only just begun to tap automation's full potential,” said Kim, hinting that Coupang is open to aggressive investment in AI this year.

“The percentage of our total infrastructure that is highly automated is still just in the low teens. That's a huge runway for further improvement.”

Coupang forecasts about 20% annual sales growth in 2025.

Write to Hyun-jin Ra and Jae-Kwang Ahn at raraland@hankyung.com

Sookyung Seo edited this article.

More to Read

-

E-commerceCoupang, Naver in dead heat for South Korea’s e-commerce market lead

E-commerceCoupang, Naver in dead heat for South Korea’s e-commerce market leadJan 21, 2025 (Gmt+09:00)

4 Min read -

EarningsCoupang posts record quarterly sales, swings to Q3 operating profit

EarningsCoupang posts record quarterly sales, swings to Q3 operating profitNov 06, 2024 (Gmt+09:00)

3 Min read -

E-commerceCoupang to raise membership fees, 1st hike in over 2 years

E-commerceCoupang to raise membership fees, 1st hike in over 2 yearsApr 12, 2024 (Gmt+09:00)

2 Min read -

-

-

LogisticsCoupang to host business briefing on Taiwan market entry

LogisticsCoupang to host business briefing on Taiwan market entrySep 15, 2023 (Gmt+09:00)

1 Min read -

RoboticsKorea’s e-commerce giant Coupang to invest in logistics automation

RoboticsKorea’s e-commerce giant Coupang to invest in logistics automationNov 29, 2022 (Gmt+09:00)

1 Min read -

Comment 0

LOG IN