Banking & Finance

KB Financial to buy back $359 bn in shares after record net profit in 2024

It became South Korea’s first financial holding firm to earn over 5 trillion won in annual net profit

By Feb 06, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

KB Financial Group Inc., South Korea’s largest financial holding group, will spend nearly 1.8 trillion won ($1.2 billion) to boost shareholder returns after reporting more than 5 trillion won in net profit last year on higher interest and fee gains across the board.

The financial group announced on Wednesday that it would buy back and cancel 520 billion won worth of treasury shares in the first quarter of 2025 and use 1.24 trillion won in cash dividends this year.

It announced the shareholder-friendly policy, which was heralded late last year as part of efforts to improve its corporate value, after reporting record-high net profit for 2024.

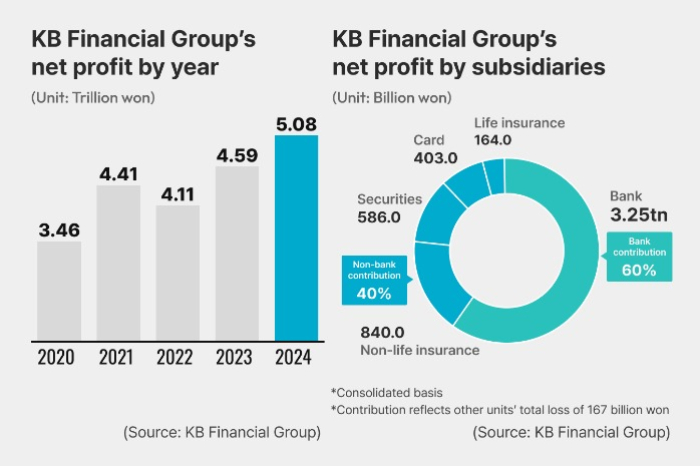

KB Financial posted 5.08 trillion won in net profit on a consolidated basis in 2024, becoming the industry’s first to break the threshold in the country, with a 10.5% on-year gain.

The company attributed the stellar result to handsome interest and non-interest income from mainstay banking and non-banking units.

RECORD PROFIT ON HANDSOME INTEREST AND FEE INCOME

KB Financial's net interest income reached 12.83 trillion won in 2024, up 5.3% from the previous year.

Its net interest margin (NIM) stood at 2.03% versus 2.08% the year prior due to rate cuts.

Its flagship banking unit Kookmin Bank posted 3.25 trillion won in net profit last year, down a mere 0.3% from the previous year despite hefty loan loss reserves to cover massive losses from HSCEI-tied equity-linked securities investments early last year.

Its net interest income added 3.6% on-year to 10.22 trillion won on a rise in household mortgage loans following the central bank’s rate cuts.

NON-BANKING UNITS ACCOUNT FOR 40%

KB Financial’s non-banking units also fared well last year as their combined non-interest income increased 5.2% to 4.20 trillion won. Their net fee and commission income added 4.8% to 3.09 trillion won.

KB Securities Co. reported 586 billion won in net profit for 2024, up a whopping 50.3% from the previous year.

The net profit of KB Insurance Co. and KB Life Insurance Co. jumped 17.7% and 15.1% on-year, respectively, last year. Their total net profit exceeded 1 trillion won.

KB Kookmin Card Co. reaped 403 billion won in net profit, up 14.7% on-year.

The total contribution of non-banking units to KB Financial’s net profit grew to 40% in 2024 from 33% in 2023. The remaining 60% was from Kookmin Bank.

DISAPPOINTING SHARE BUYBACK PLAN

Investors, however, unloaded KB Financial shares in disappointment over its shareholder return plan, which fell shy of their expectations, said analysts.

KB Financial shares ended down 6.7% at 84,900 won on Thursday.

“The company’s CET1 ratio and the share buyback plan were not large enough to meet market expectations,” said Choi Chung-uk, an analyst at Hana Securities Co.

KB Financial’s share buyback volume was determined based on a CET1 ratio of 13.51%.

Last October, the financial group announced it would spend its capital topping 13.50% of the CET1 ratio for share repurchases and retirement this year.

As of the end of the third quarter of last year, its CET1 ratio stood at 13.85%, and the group said it would achieve its CET1 ratio in the mid-13% range.

CET1 is a component of Tier 1 capital mainly comprised of common stock held by a bank or other financial institution. Banks are expected to meet minimum CET1 ratio requirements for their risk-weighted assets (RWAs) as outlined by financial regulators.

The CET1 ratio compares a bank’s capital against its RWAs to determine its ability to withstand financial distress.

Write to Mi-Hyun Jo at mwise@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Banking & FinanceKB Financial to use excess capital for share buybacks, dividends

Banking & FinanceKB Financial to use excess capital for share buybacks, dividendsOct 25, 2024 (Gmt+09:00)

3 Min read -

-

Korean stock marketKorean banks stop ELS sales after HSCEI debacle

Korean stock marketKorean banks stop ELS sales after HSCEI debacleJan 31, 2024 (Gmt+09:00)

4 Min read -

Korean stock marketS.Korea launches official probe into HSCEI-tied ELS sale

Korean stock marketS.Korea launches official probe into HSCEI-tied ELS saleJan 08, 2024 (Gmt+09:00)

5 Min read -

EarningsKB Financial beats profit forecast on higher interest rates

EarningsKB Financial beats profit forecast on higher interest ratesOct 24, 2023 (Gmt+09:00)

2 Min read -

Banking & FinanceKB Financial logs record profit in Q2, above consensus estimates

Banking & FinanceKB Financial logs record profit in Q2, above consensus estimatesJul 25, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN