Korean stock market

Korean banks stop ELS sales after HSCEI debacle

The country’s financial authorities have warned of a possible ban on the sale of ELS products at banks

By Jan 31, 2024 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korean banks are scurrying to suspend the sale of equity-linked securities (ELS) after the country’s financial regulator said it may consider banning banks from selling ELS amid mounting losses from investments in the Hang Seng China Enterprises Index (HSCEI)-tied high-risk debt instrument.

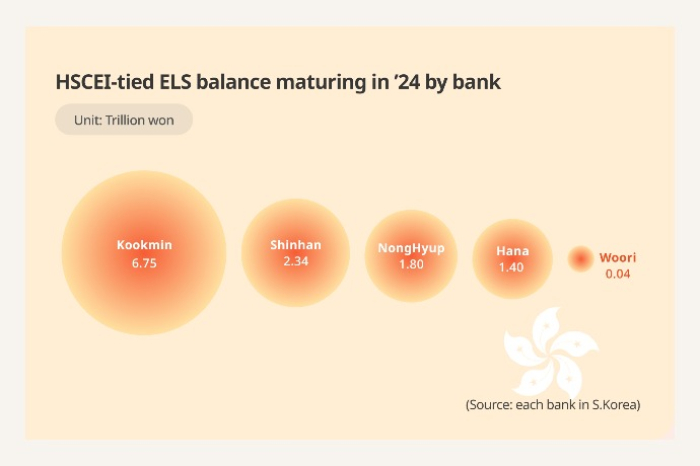

According to sources in the Korean bank industry on Tuesday, Kookmin Bank and Shinhan Bank have decided to stop selling all types of ELS, following suit of NongHyup Bank and Hana Bank, which already suspended their ELS sales in October last year and Monday, respectively.

They said they have made the decision in response to the spiraling volatility in global financial markets and will decide whether to resume ELS sales after reviewing market stability and other factors.

All these commercial banks are currently under scrutiny by the country’s financial market watchdog for possible misselling of HSCEI-linked ELS products, which are likely to cause many Korean retail investors massive losses due to the poor performance of the underlying asset HSCEI.

Since the risk of huge losses from HSCEI-tied ELS was flagged, money also seems to have moved to ELS products linked to the Nikkei index, which has been outperforming its global peers.

The new money move has spooked the market because Nikkei-linked ELS could be the next high-risk derivative that could cause huge losses in case of another market turmoil.

HIGH RISK, BIG LOSSES

Most HSCEI-tied ELS contracts due to mature this year were signed in early 2021 when the index was traded above 12,000 points. The Hong Kong index, which tracks the performance of major Chinese stocks, now hovers around the low 5,000 level amid growing concerns about the Chinese economy.

An ELS is a type of fixed-income derivative that pays out a return based on the performance of certain equities like stock indexes.

Investors are promised returns if the underlying asset price stays above a set level, or knock-in level, until maturity. If the asset prices dip below the predetermined level, investors lose the principal.

As of November last year, the total outstanding balance of the HSCEI-tied ELS products sold by Korean banks and securities firms stood at 19.3 trillion won ($14.5 billion), of which about 80%, or 15.4 trillion won, will mature this year.

In the first half alone, 10.2 trillion won worth of the ELS products will expire, and investors are projected to suffer from more than 6 trillion won worth of principal losses from HSCEI-tied ELS investments following the plunge in the HSCEI below the knock-in level.

POSSIBLE BAN ON BANK’S ELS SALE

In response to the growing concerns over the HSCEI ELS fiasco, one legislator stated during the Korean National Assembly’s plenary session on Monday that banks should stop selling high-risk ELS products.

Financial Services Commission (FSC) Chairman Kim Joo-hyun, who attended the same session, replied, “I personally agree with you to a large extent.”

He added that financial investment products prone to principal loss are all risky and that the FSC will “comprehensively review these from various aspects.”

Lee Bok-hyun, Chairman of the Financial Supervisory Service (FSS), echoed Kim’s concerns, stressing the need to reassess how financial investment products should be categorized, sold and explained to consumers.

“We will use this opportunity to consider whether the sale channels are in line with the principles of consumer protection,” said Lee.

Immediately after Kim and Lee’s comments at the National Assembly, Hana Bank completely halted the sale of all types of ELS, triggering other banks to follow.

The FSS earlier last month began an on-site investigation of Kookmin Bank, the commercial banking unit of KB Financial Group Inc., and Korea Investment & Securities Co. They were the top sellers of the HSCEI-related ELS products.

The FSS will also inspect four other banks – NongHyup, Shinhan, Hana and Standard Chartered Bank Korea — and six more brokerage firms — KB Securities Co., NH Investment & Securities Co., Mirae Asset Securities Co., Samsung Securities Co., Shinhan Securities Co. and Kiwoom Securities Co.

Its preliminary investigations in November and December discovered that some of these banks and brokerage houses had changed their internal standards to encourage the sale of risky derivatives, which can allow banks to reap higher commissions.

Korean investors’ losses from HSCEI-linked ELS investments already reached $235 million (321.1 billion won) as of Jan. 26.

Write to Jae-Won Park at wonderful@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Korean stock marketKorea’s ELS market to stagnate after HSCEI debacle: KOFIA chairman

Korean stock marketKorea’s ELS market to stagnate after HSCEI debacle: KOFIA chairmanJan 23, 2024 (Gmt+09:00)

3 Min read -

Korean stock marketKorean investors doomed to suffer $171 mn losses from HSCEI ELS

Korean stock marketKorean investors doomed to suffer $171 mn losses from HSCEI ELSJan 22, 2024 (Gmt+09:00)

3 Min read -

Korean stock marketS.Korea launches official probe into HSCEI-tied ELS sale

Korean stock marketS.Korea launches official probe into HSCEI-tied ELS saleJan 08, 2024 (Gmt+09:00)

5 Min read -

Korean stock marketKorean ELS investors biting nails over sharp falls in Hong Kong shares

Korean stock marketKorean ELS investors biting nails over sharp falls in Hong Kong sharesNov 24, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN