Earnings

KB Financial posts record-high profit on loan growth

Online lender Kakao Bank reaps its highest-ever profit thanks to double-digit loan growth

By Feb 08, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

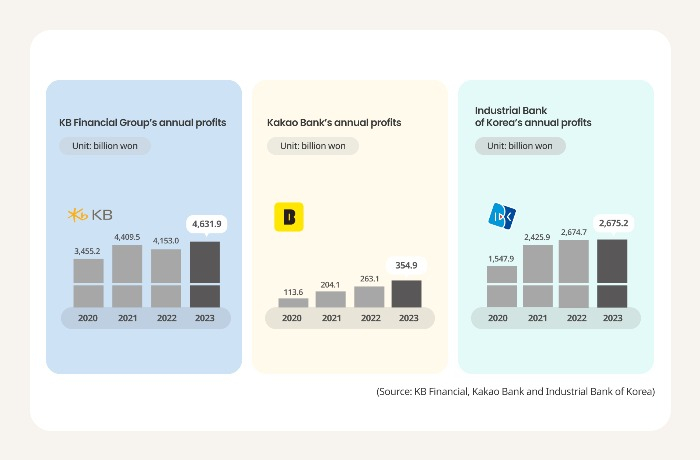

KB Financial Group and Kakao Bank, top players in South Korea’s offline and mobile banking sector, respectively, achieved their highest-ever profits in 2023, with loan growth improving their interest margins.

However, KB Financial’s net interest margin (NIM), the key measure for banks' profitability, decreased from the fourth quarter of last year, a signal that its earnings growth may slow this year.

Domestic banks will likely continue to set aside heavy provisions to cover future loan losses against the possible fallout from the real estate project financing debacle amid the economic slowdown.

KB Financial on Wednesday reported 4.6 trillion won ($3.5 billion) in net profit in 2023, an 11.5% jump from a year earlier. Interest income swelled 5.4% on-year to 12.1 trillion won.

Non-interest income shot up 80.4% to 4.1 trillion won thanks to hefty valuation gains from financial investments, which reached 413.9 billion won. That reversed the negative valuation of 1.2 trillion won in 2022.

FOURTH-QUARTER RESULTS

In contrast to the robust annual earnings, KB Financial performed worse in the final quarter of 2023 than previous quarters. Its net profit tumbled 81% to 261.5 billion won in the October-to-December period, compared with the third quarter when its net profit came in at 1.4 trillion won.

The poor quarterly results were blamed on heavy loan-loss provisions and a cut in the lending rates it charges small business owners in line with the government's efforts to revive the economy.

NIMs at KB Financial and Kookmin Bank edged down by 0.01 percentage point to 2.08% and 1.83%, respectively.

KOOKMIN BANK

Kookmin Bank, KB Financial's flagship unit, logged 8.9% growth to 3.3 trillion won in net profit last year from a year before. A 4% jump in Korean-currency loans contributed the most to the handsome profits.

Earnings at other KB Financial units were mixed. KB Securities Co. and KB Insurance Co. posted a 107.5% and 35.1% surge, respectively, to 389.6 billion won and 752.9 billion won in net profit last year.

In contrast, Kookmin Card Co. and KB Capital Co. saw their net profits decline 7.3% and 14.1% on-year to 351.1 billion won and 186.5 billion won, due to higher fundraising costs.

KB Financial decided to pay 1,530 won per share in fourth-quarter dividend, bringing its annual dividend payment to 3,060 won, up 4% on-year.

Its board of directors also decided to buy back and retire 320 billion worth of KB Financial shares.

KAKAO BANK

Kakao Bank Corp., Korea’s first mobile-only bank, reaped a record-high profit of 354.9 billion won in 2023, up 34.9% on-year.

Founded in 2017, the banking app earned 2.0 trillion won in NIM last year, a 58.3% spike from a year earlier. Its outstanding loan balance ballooned 38.7% on-year to 38.7 trillion won in 2023.

It attracted borrowers with high-interest-loan replacement products, which accounted for about half of its loan balance of 9.2 trillion won as of the end of 2023.

The proportion increased further to 67% of its new loans last month.

INDUSTRIAL BANK OF KOREA

Industrial Bank of Korea earned a record-high net profit of 2.7 trillion won last year, with the loan balance to small- and medium-sized enterprises up 5.9% on-year to 233.8 trillion won.

DGB Financial Group logged a 3.4% decline in net profit to 387.8 billion won from a year earlier. The financial group on Wednesday submitted an application to financial authorities to approve its expansion into other regions of Korea beyond Daegu.

Write to Bo-Hyung Kim and Eui-Jin Jeong at kph21c@hankyung.com

Yeonhee Kim edited this article

More to Read

-

EarningsHana Bank at record profit; office bets hit Hana Securities

EarningsHana Bank at record profit; office bets hit Hana SecuritiesJan 31, 2024 (Gmt+09:00)

1 Min read -

EarningsKB Financial beats profit forecast on higher interest rates

EarningsKB Financial beats profit forecast on higher interest ratesOct 24, 2023 (Gmt+09:00)

2 Min read -

Banking & FinanceKB Financial logs record profit in Q2, above consensus estimates

Banking & FinanceKB Financial logs record profit in Q2, above consensus estimatesJul 25, 2023 (Gmt+09:00)

2 Min read -

EarningsKB, Hana drive major S.Korean overseas banking profits lower

EarningsKB, Hana drive major S.Korean overseas banking profits lowerMar 22, 2023 (Gmt+09:00)

3 Min read -

Banking & FinanceKookmin Card acquires Cambodian leasing firm at $5.2 mn

Banking & FinanceKookmin Card acquires Cambodian leasing firm at $5.2 mnJan 13, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN