Earnings

KB, Hana drive major S.Korean overseas banking profits lower

Shinhan, Woori report surging profits from foreign operations thanks to strong Southeast Asian businesses

By Mar 22, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

KB Kookmin Bank and Hana Bank led weaker earnings of the four largest South Korean lenders’ overseas units last year although their rivals Shinhan Bank and Woori Bank enjoyed higher profits from operations in other countries.

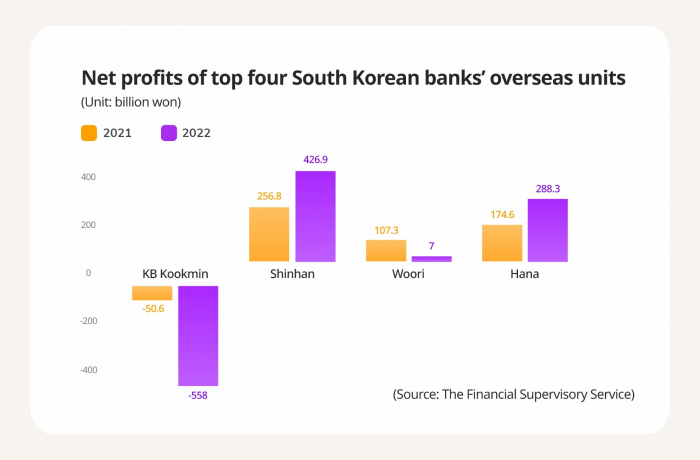

The total net profits of the top four banks’ overseas units tumbled 66.3% to 164.3 billion won in 2022 from the previous year, according to data from the Financial Supervisory Service.

The country’s top bank KB Kookmin logged a net loss of 558 billion won last year from its operations in other countries, more than 10 times the 50.6 billion won posted in 2021.

The banking unit of KB Financial Group reported a net loss of 802 billion won from its Indonesian unit PT Bank KB Bukopin Tbk, reflecting 570 billion won in reserve for bad debts for the lender in Southeast Asia’s largest economy in the fourth quarter of last year.

“We would not report any one-time losses in the future since we set up a larger provision than the bad loans,” said a KB Kookmin official in Seoul. “We are improving Bukopin bank with KB Kookmin’s capabilities and it is expected to turn around in 2025.”

On the other hand, KB Kookmin saw a record net profit of 233.9 billion won from its Cambodian operation Prasac Microfinance Institution Ltd.

KB Kookmin’s smaller rival Hana saw its net profit from overseas units shrink to less than a tenth of the previous year's on a loss from its Chinese operation.

The banking unit of Hana Financial Group reported a net profit of a mere 7 billion won from businesses in other countries last year, down 93.4% from 107.3 billion won in 2021, even as eight out of 10 of its overseas operations logged higher profits.

Its Chinese unit turned to the red with a net loss of 97.2 billion won as the country’s zero-COVID policy locked down key cities such as Shanghai and Changchun.

“We conservatively set up a provision for loan assets there, increasing losses,” said a Hana official in Seoul.

SHINHAN, WOORI SHINE

By contrast, Shinhan and Woori saw higher profits from foreign operations thanks to strong performances in Southeast Asia.

Shinhan earned 426.9 billion won in net profit from 10 overseas units in 2022, up 66.2% on-year. Its Vietnamese operation topped the list of overseas earnings, ranking in a net profit of 197.8 billion won.

The banking unit of Shinhan Financial Group made inroads into Vietnam in 1993, the firstcomer to the country among South Korean lenders, and is now operating 46 branches there, the most among foreign banks.

Net profits of Shinhan’s units in Japan and China rose 9.6% and 228% to 116.7 billion won and 45.7 billion won, respectively.

“Vietnam’s profit was powered by the growth in retail loan assets such as mortgage loans,” said a Shinhan official in Seoul. “SBJ Bank also extended its solid growth by focusing on housing loans and corporate finance,” the official said, referring to its Japanese unit.

Woori’s net profit from 11 overseas units jumped 65.1% to 288.3 billion won on higher earnings from operations in Vietnam, Indonesia and Cambodia.

The unit of Woori Financial Group has been strengthening the corporate finance business for local companies in those Southeast Asian countries and diversifying its service portfolios with bancassurance to expand its market shares there.

Woori aims to develop those three overseas units as a global business hub that generates more than half of its total profits from foreign operations.

Write to So-Hyun Lee at y2eonlee@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Banking & FinanceWoori Bank's Vietnam subsidiary reports record-high performance

Banking & FinanceWoori Bank's Vietnam subsidiary reports record-high performanceJan 27, 2023 (Gmt+09:00)

1 Min read -

Banking & FinanceVietnam gives traction to Korean banks' global push

Banking & FinanceVietnam gives traction to Korean banks' global pushJan 19, 2022 (Gmt+09:00)

3 Min read -

Kookmin gains foothold in Indonesia after bumping up stake in local bank

Kookmin gains foothold in Indonesia after bumping up stake in local bankAug 26, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN