Vietnam gives traction to Korean banks' global push

Vietnam makes bigger contributions to earnings at KEB Hana Bank and Shinhan Bank

By Jan 19, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea's leading banks began to reap the rewards of their efforts to become regional players in Asia, with their aggressive investments in Vietnam generating handsome returns.

With the largest-ever cross-border investment by a South Korean bank, it became the second-largest shareholder in BIDV.

Since Hana's investment, BIDV has balanced its business portfolio focused on corporate lending and trade finance, utilizing Hana's consumer banking expertise. Now retail banking makes up close to 40% of the Vietnamese lender's operations from 32% when Hana purchased its stake.

BIDV has also more than doubled fee incomes over the past three years. Its net profit is estimated to have jumped more than 40% last year from a year earlier.

Hana Bank booked 110 billion won in profits from its BIDV shares as of end-September, 2021. The figure is bigger than a combined profit of 103.2 billion won it earned from its overseas operations during the same period.

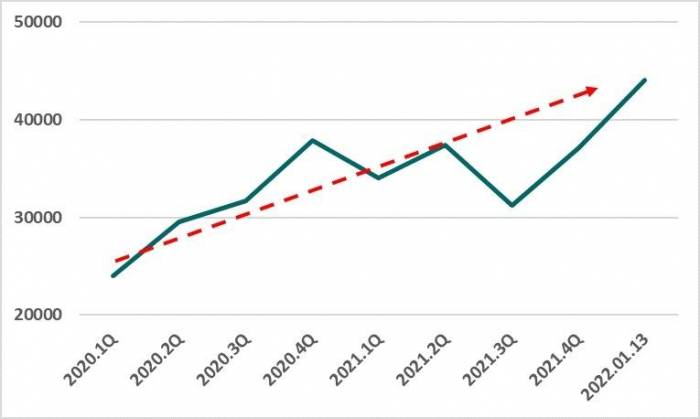

Additionally, the rising share price of BIDV lifted the stake value by 70%. The share price of BIDV has almost doubled to 44,000 dong ($1.94) as of Jan. 13, compared with the Hana's purchase price of 26,747 dong per share.

Last month, the Korean lender bought an additional 155.5 million shares in the Vietnamese lender, using the dividend income from the bank, with an aim to boost investment returns, said a Hana Bank official.

"Our investment in BIDV demonstrated the possibility that overseas expansion via a stake purchase can be successful, even if we do not make a direct investment through an acquisition of a foreign financial services firm or establishing an overseas branch," the official said.

Shinhan Bank, one of South Korea's top four commercial lenders, took a different approach to position itself as the biggest foreign lender in Vietnam by assets.

It penetrated into the market with mobile banking apps tailored to local tastes. Its Vietnamese branch earned a net profit of 88.9 billion won with assets of 7.8 trillion won as of end-September, 2021.

Shinhan's banking app, upgraded twice since its launch in 2018, absorbed digital banking customers in Vietnam. The number of its subscribers has nearly trebled to 648,799 as of the end of 2021, in the country with a 97 million population, signaling room for further growth.

South Korean banks have set their sights abroad in the face of higher levels of regulatory meddling, including a crackdown on household loan growth and stagnant non-interest income. Competition with fintech companies also pushed them to look for new growth markets.

In their first step toward global expansion, they targeted Vietnam, Indonesia and Cambodia which boast of a young population familiar with Korean cultural content.

EYES ON INVESTMENT BANKING

Now they are gearing up for expansion in Australia, Europe and the US not only for consumer banking, but for investment banking services.

"While expanding our operations in Southeast Asia, we will sharpen our competitiveness on investment banking in the US and Europe," said a Woori Bank official.

Woori Bank enjoyed a 65% growth in net profit from overseas operations which came to 131 billion won as of end-September 2021.

But Southeast Asia made a smaller contribution than before as Woori beefed up its operations in the US, Hong Kong and Russia, as well as in Brazil.

Southeast Asia accounted for 62.6% of the profits from Woori's overseas businesses as of end-September of last year, down from the previous year's 83.5%.

Write to Nan-Sae Bin at binthere@hankyung.com

Yeonhee Kim edited this article.

-

Banking & FinanceCitibank Korea to shut down retail business in phases

Banking & FinanceCitibank Korea to shut down retail business in phasesOct 25, 2021 (Gmt+09:00)

2 Min read -

-

Cashless societyVietnam government picks Alliex to lead cashless transition

Cashless societyVietnam government picks Alliex to lead cashless transitionApr 08, 2021 (Gmt+09:00)

3 Min read