Korean drugmakers control more than half of European biosimilar market

Celltrion, Samsung Bioepis held a combined 53.5% of Europe’s six blockbuster biosimilar categories at the end of September

By Jan 02, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s two leading drugmakers, Celltrion Inc. and Samsung Bioepis Co., have achieved a significant milestone in the European biosimilar market, capturing over 50% market share in the six best-selling blockbuster categories.

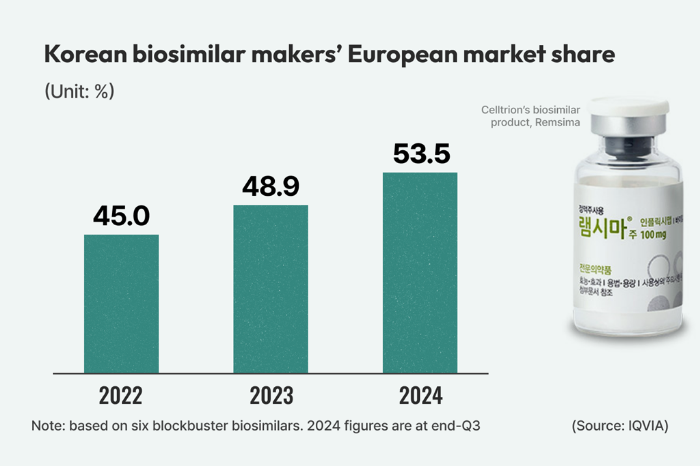

According to global pharmaceutical market research firm IQVIA, the two Korean companies held a combined 53.5% market share in Europe’s six major biosimilar segments: infliximab, rituximab, adalimumab, trastuzumab, bevacizumab and etanercept at the end of the third quarter of 2024.

IQVIA, formerly Quintiles and IMS Health Inc., is a Fortune 500 and S&P 500 multinational company serving the combined industries of health information technology and clinical research.

The Korean duo’s European biosimilar market share steadily grew from 45.0% in 2022 to 48.9% in 2023.

Biosimilars are products that have been demonstrated to be similar in efficacy and safety to the originator’s reference product, with the advantages of cost savings and promoting sustainable access to therapies.

KOREAN FIRMS DOMINATE INFLIXIMAB

IQVIA data showed Korean drugmakers dominated the European market for infliximab, a biosimilar used to treat autoimmune diseases such as rheumatoid arthritis and inflammatory bowel disease, with a combined 59.6% market share.

Including Celltrion’s Remsima SC, a subcutaneous injection-type autoimmune disease treatment, Korean firms’ infliximab market share in the region reached 84.2%.

Referencing Janssen’s Remicade, an anti-inflammatory medication for immune-system diseases, Remsima SC is the world’s first and only infliximab available as a subcutaneous injection to treat conditions such as rheumatoid arthritis, ankylosing spondylitis, ulcerative colitis, Crohn's disease and psoriasis.

Remsima SC showed longer-lasting efficacy on rheumatism patients than its intravenous injection type Remsima IV, according to industry data.

In the etanercept market, Samsung Bioepis controlled 49.2% of the European market at the end of the third quarter, significantly outperforming US-based Pfizer Inc.’s 26.9% and Swiss firm Sandoz Group AG’s 22.2%.

Samsung Bioepis is the only Korean drugmaker selling an etanercept biosimilar in Europe.

ADALIMUMAB, WORLD’S NO. 1 AUTOIMMUNE TREATMENT

In the adalimumab market, the world’s largest autoimmune treatment category with annual sales of 27 trillion won ($18.4 billion), Samsung Bioepis and Celltrion’s combined market share stood at 26.5%, surpassing the 21.9% share of US firm AbbVie’s blockbuster original drug Humira, a treatment for rheumatoid arthritis, Crohn's disease and ulcerative colitis.

Samsung sells its adalimumab biosimilar under the Imraldi brand.

For metastatic colorectal and breast cancer treatment bevacizumab and breast cancer drug trastuzumab, Celltrion led the market, with its share plus that of Samsung Bioepis reaching 40-45%.

Samsung Bioepis claimed the top spot in the emerging biosimilar market for ustekinumab, sold under the brand name Stelara – an autoimmune treatment reaching 14 trillion won in annual sales. Samsung outperformed Icelandic pharmaceutical company Alvotech in that segment.

In Germany and Italy, the Korean company also led the pack in the eculizumab biosimilar market – a high-cost treatment for rare blood disorders, the annual therapy costs of which hover above 400 million won per patient.

‘LAND OF OPPORTUNITY’

Europe, which fosters biosimilar-friendly policies, is a “land of opportunity” for Korean drugmakers, industry officials said.

The global biosimilar market is forecast to grow at an annual rate of 17.3%, reaching 107.7 trillion won by 2030. Europe, larger than the US market, controls half the global biosimilar market.

According to IQVIA, biosimilars accounted for more than 80% of the entire pharmaceuticals market in Europe at the end of the third quarter after remaining in the 70% range for the several preceding quarters.

With similar efficacy to original drugs and available at lower costs, biosimilars are increasingly promoted as preferred alternatives in Europe.

In Korea, the share of biosimilars among pharmaceuticals stands at 35%.

“The Korean government should pay more attention to biosimilars,” said an industry official.

Write to Dae-Kyu Ahn at powerzanic@hankyung.com

In-Soo Nam edited this article.

-

Bio & PharmaSamsung Bioepis to enhance biosimilar presence with Epysqli

Bio & PharmaSamsung Bioepis to enhance biosimilar presence with EpysqliJun 12, 2023 (Gmt+09:00)

3 Min read -

Bio & PharmaCelltrion’s Remsima SC praised in Europe as preferred biosimilar

Bio & PharmaCelltrion’s Remsima SC praised in Europe as preferred biosimilarJun 02, 2023 (Gmt+09:00)

2 Min read -

Bio & PharmaCelltrion gains sales approval for biosimilar Vegzelma in Europe

Bio & PharmaCelltrion gains sales approval for biosimilar Vegzelma in EuropeAug 19, 2022 (Gmt+09:00)

2 Min read -

Bio & PharmaSamsung Bioepis sees greater market for Byooviz eye disease biosimilar

Bio & PharmaSamsung Bioepis sees greater market for Byooviz eye disease biosimilarJul 18, 2022 (Gmt+09:00)

2 Min read -

Bio & PharmaCelltrion to sell biosimilar products via its own channel in Europe

Bio & PharmaCelltrion to sell biosimilar products via its own channel in EuropeMay 11, 2022 (Gmt+09:00)

2 Min read -

PharmaceuticalsSamsung Bioepis to double biosimilars, may resume Nasdaq listing plans

PharmaceuticalsSamsung Bioepis to double biosimilars, may resume Nasdaq listing plansFeb 24, 2022 (Gmt+09:00)

3 Min read -

BiotechCelltrion looks beyond biosimilars to develop its own mRNA drugs

BiotechCelltrion looks beyond biosimilars to develop its own mRNA drugsNov 16, 2021 (Gmt+09:00)

4 Min read