SK Hynix, latest chipmaker to emerge victorious with record Q1 sales

With its NAND business turnaround, it expects 2024 investments to be larger than initially planned

By Apr 25, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SK Hynix Inc., the world’s second-largest memory chipmaker after Samsung Electronics Co., said on Thursday it has swung to a profit in the first quarter with record quarterly sales, emerging as the latest chipmaker to confirm a solid recovery in the memory semiconductor market.

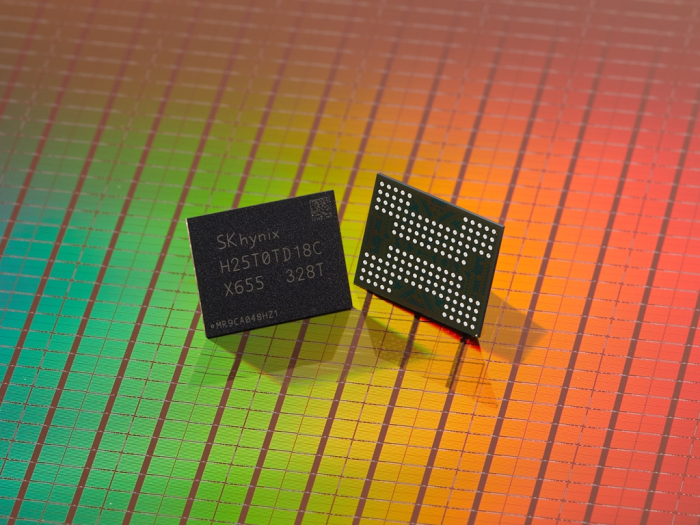

The South Korean chipmaker also said its NAND business achieved a “meaningful” turnaround in the January-March quarter without providing figures.

“We have entered the phase of a clear rebound following a prolonged downturn,” the company said in a statement.

SK Hynix said in a regulatory filing that it posted 2.89 trillion won ($2.1 billion) in first-quarter operating profit, a turnaround from a loss of 3.4 trillion won in the year-earlier period.

SK Hynix's quarterly results

Unit: trillion won

(Graphics by Sunny Park)

Source: SK Hynix

The profit, which came in above market expectations of 2.06 trillion won, marks the company’s second highest since the first quarter of 2018.

The operating profit margin stood at 23%.

Sales more than doubled to 12.43 trillion won – the company’s all-time high for the first quarter.

Net profit was 1.91 trillion won, turning from a loss of 2.58 trillion won a year earlier.

The company attributed its stronger-than-expected results to robust sales of its premium products for artificial intelligence, including high bandwidth memory (HBM) chips and a rebound in NAND flash memory chips.

“An increase in the sales of AI server products backed by our leadership in AI memory technology, including HBM, and continued efforts to prioritize profitability led to a 734% on-quarter jump in operating profit,” it said.

ON STEADY GROWTH PATH

With the sales ratio of eSSD, a premium product, on the rise and the average selling prices rising, SK Hynix’s NAND business has also turned around in the first quarter.

The company said it expects the overall memory market to be on a steady growth path in the coming months as demand for AI memory continues to rise, while the market for conventional DRAM also starts to recover from the second half.

It said DRAM inventories both at suppliers and customers will decrease as an increase in production of premium products such as HBM requires a higher production capacity than conventional DRAM, resulting in a relative reduction in conventional DRAM supply.

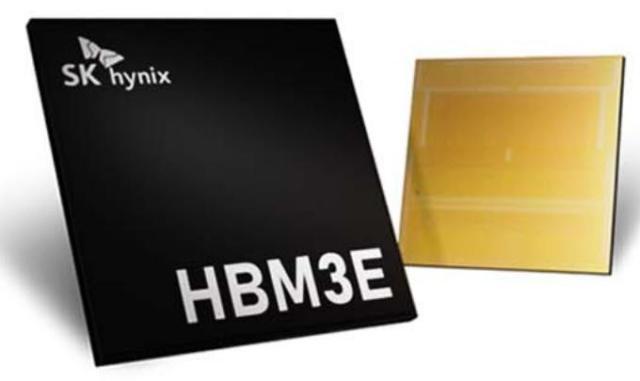

In the DRAM space, the company plans to increase the supply volume of HBM3E, of which mass production started in March – the industry’s first to do so. The chipmaker said it will also introduce 32 Gb DDR5 products based on the 1b-nanometer process, the fifth generation of the 10 nm technology, within this year to strengthen its leadership in the high-capacity server DRAM market.

HBM CHIP IN FOCUS

Among memory chipmakers, SK Hynix is the biggest beneficiary of the explosive increase in AI adoption, as it dominates the production of HBM, critical for generative AI computing and is the top supplier of AI chips to Nvidia Corp., which controls 80% of the AI chip market.

To hold its lead, SK Hynix announced earlier this month a $3.87 billion investment to build an advanced chip packaging plant in Indiana with an HBM chip line and research and development for AI products.

It also announced a collaboration with Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s top contract chipmaker, to develop next-generation AI chips, called HBM4.

On Wednesday, the company said it will spend 20 trillion won to build a new HBM DRAM plant on a site originally designated for a NAND facility in Korea to ride the AI wave.

With sizeable investments planned, SK Hynix said it expects its overall capital expenditure for this year to be larger than initially planned at the beginning of 2024.

“With the industry’s best technology in the AI memory space led by HBM, we have entered a clear recovery phase,” said Chief Financial Officer Kim Woo-hyun. “We will continue to work towards improving our financial results by providing the industry’s best-performing products at the right time and maintaining our profitability-first commitment.”

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSK Hynix to invest $14.6 bn to build HBM plant in S.Korea

Korean chipmakersSK Hynix to invest $14.6 bn to build HBM plant in S.KoreaApr 24, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix, TSMC tie up to stay ahead of Samsung for HBM supremacy

Korean chipmakersSK Hynix, TSMC tie up to stay ahead of Samsung for HBM supremacyApr 19, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung to unveil Mach-1 AI chip to upend SK Hynix’s HBM leadership

Korean chipmakersSamsung to unveil Mach-1 AI chip to upend SK Hynix’s HBM leadershipMar 20, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix to build advanced packaging plant in Indiana for $3.9 bn

Korean chipmakersSK Hynix to build advanced packaging plant in Indiana for $3.9 bnApr 04, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focus

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focusNov 09, 2023 (Gmt+09:00)

4 Min read