Harman’s record profits prop up Samsung's Q3 earnings

It expects overall memory demand to recover in 2024 in line with the AI market boom and customers' reduced inventories

By Oct 31, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Samsung Electronics Co., the world’s largest memory chip maker, on Tuesday reported a triple-digit quarterly increase in third-quarter profit thanks to a stellar performance by Harman, its wholly owned electronics systems maker for automobiles.

The US-based subsidiary posted record-high operating profit for a single quarter in the July-September period.

Its operating profit came in at 0.45 trillion won, or about $333 million, on sales of 3.8 trillion won, buoyed by sales of car audio products from automotive customers, as well as consumer audio products such as portable speakers.

"Harman will seek to post another robust quarter by expanding sales of audio products during end-year seasonality, as well as addressing the continuing demand for automotive products," Samsung said in a statement.

"Harman is expected to secure orders in new areas, including automotive displays and will address demand for high-growth products such as home audio equipment."

The South Korean company acquired Harman for $8 billion in 2016.

EARNINGS OUTLOOK

Looking ahead, it expects the memory chip market will stage a recovery next year, driven by the growing need for high-performance chips that can be applied to generative AI such as chatbots.

“In the fourth quarter, earnings are expected to improve as demand for semiconductors will likely increase with the launch of new products by major customers,” the South Korean company said in the statement.

“In 2024, while macroeconomic uncertainties are likely to persist, memory market conditions are expected to recover ... Overall memory demand is expected to recover gradually thanks to increasing demand for AI and normalizing inventory levels at customers, but various factors can affect the server market.”

THIRD-QUARTER RESULTS

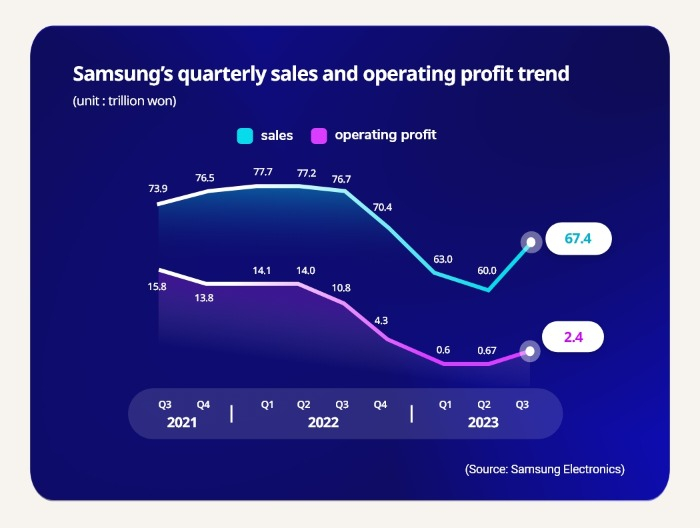

In the third quarter, it reported a 77.57% plunge to 2.4 trillion won ($1.8 billion) in operating profit from a year before.

On a quarterly basis, however, the operating profit soared by a whopping 264% because the digital solutions (DS) division in charge of semiconductor production narrowed losses.

Sales in the July-September quarter decreased 12.21% on-year to 67.4 trillion won on a consolidated basis, but rose 12.33% on-quarter.

MEMORY CHIP LOSSES

The DS division narrowed operating losses to 3.75 trillion won in the third quarter, versus a loss of 4.36 trillion won in the second quarter and a shortfall of 4.6 trillion won in the first quarter.

“In the fourth quarter, the DS division will focus on sales of high value-added products such as high bandwidth memory (HBM),” Samsung said.

It will seek to expand the production capacity and sales of advanced node products of HBM3 and HBM3E, the fourth and fifth generations of that kind.

FOUNDRY BUSINESS

Samsung's foundry business, or contract chipmaking, achieved a quarterly record backlog centering on HPC applications, despite weak third-quarter results, the company said.

Next year, the foundry unit will start mass production of the second generation 3 nanometer Gate-All-Around (GAA) process at its new factory in Taylor, Texas.

“Looking ahead to 2024, the foundry market is expected to return to a state of growth with the recovery in mobile demand and continuing increase in HPC (high-performance computing) demand.”

SYSTEM SEMICONDUCTORS, SMARTPHONES

For systems on chips, primarily used for mobile platforms, Samsung offered an upbeat outlook as well.

“In the fourth quarter, the System LSI Business expects earnings to improve significantly, as supply to mobile customer’s new products is predicted to increase,” it said.

LSI is short for large-scale integration.

The world's largest smartphone maker also expects smartphone market demand to rebound in 2024 in anticipation of a global economic recovery.

It estimated its capital expenditures for the semiconductor division at 47.5 trillion won in 2023, similar to last year’s 47.9 trillion won.

It will spend a total of 2.45 trillion won to pay out dividends of 361 won per share for the third quarter.

(Updated with Harman's third-quarter results and other details)

Write to Jeong-Soo Hwang at hjs@hankyung.com

Yeonhee Kim edited this article.

-

ElectronicsSamsung to sell certified refurbished Galaxy phones in Korea

ElectronicsSamsung to sell certified refurbished Galaxy phones in KoreaOct 29, 2023 (Gmt+09:00)

3 Min read -

Corporate governanceSamsung Group introduces senior outside director system

Corporate governanceSamsung Group introduces senior outside director systemOct 27, 2023 (Gmt+09:00)

2 Min read -

-

Korean chipmakersSamsung showcases HBM3E DRAM, automotive chips

Korean chipmakersSamsung showcases HBM3E DRAM, automotive chipsOct 21, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung eyes next-generation 5 nm eMRAM auto chip by 2027

Korean chipmakersSamsung eyes next-generation 5 nm eMRAM auto chip by 2027Oct 19, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung vows to up memory chip density to 'extreme levels'

Korean chipmakersSamsung vows to up memory chip density to 'extreme levels'Oct 17, 2023 (Gmt+09:00)

3 Min read -

EarningsSamsung Electronics’ narrowed Q3 chip losses fuel more bullish outlook

EarningsSamsung Electronics’ narrowed Q3 chip losses fuel more bullish outlookOct 11, 2023 (Gmt+09:00)

3 Min read