Korean chipmakers

Chip designers in high demand despite industry slowdown

With Big Tech such as Apple and Google moving to make chips in-house, chip design houses are playing a greater role

By Feb 17, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

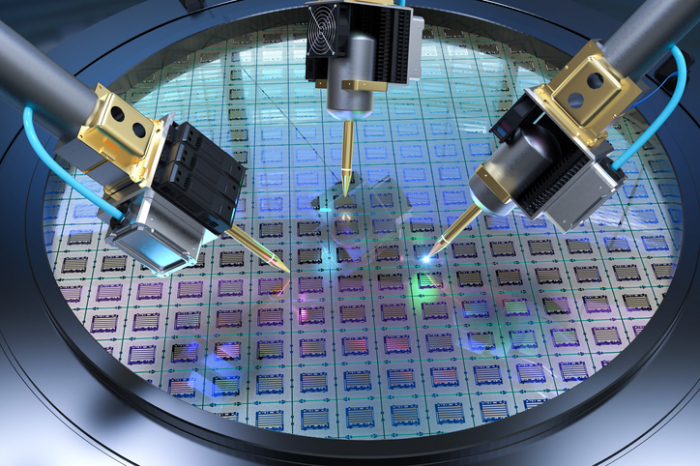

The semiconductor industry is reeling from a chip supply glut amid a broader global economic slowdown. However, as the saying goes, every cloud has a silver lining. In this case, it’s chip designers who are in high demand at a time when some chipmakers are considering an output cut or layoffs.

According to industry sources on Friday, ADTechnology Co., a South Korean chip design company, plans to hire about 100 chip designers by the end of this year.

Other Korean chip design houses such as Gaonchips Co., CoAsia and SEMIFIVE are also planning on hiring at least 50 design experts, respectively, to meet growing demand from their clients, or foundry players. ASICLAND Co., another domestic system-on-a-chip (SoC) design firm, will recruit 100 designers.

If all goes to plan, Korea’s major semiconductor design houses will have 2,000 such employees by year-end, up from the current 1,500.

A semiconductor chip design house acts as a bridge between foundry firms such as Samsung Electronics Co. and Taiwan Semiconductor Manufacturing Company Ltd. (TSMC) and fabless companies like Qualcomm Inc.

Chip designers make integrated circuits designed by fabless companies into marketable products to be manufactured by foundry firms.

“As the development of advanced chips requires complex and demanding processes, chip design houses’ role of coordination between the fabless firms and foundries has become more important than ever,” said Gaonchips Chief Executive Jung Kyu-dong.

About 100 design engineers are usually needed for a project to develop a new 5-nanometer semiconductor, industry officials said.

“Demand for system chips such as AI semiconductors will grow significantly in coming years as you can see the people’s response to ChatGPT,” said Kim Sung-jae, a computer engineering professor and head of a research lab at Seoul National University.

TSMC’S OIP VS SAMSUNG’S SAFE

Taiwan’s TSMC, the world’s top foundry company, has been leading the industry’s move to strengthen ties with chip design houses by establishing an ecosystem called the Open Innovation Platform (OIP).

Within the OIP infrastructure, the company also launched a Value Chain Alliance (VCA) program to serve a broader range of customers. VCA members are independent design service companies working closely with TSMC to help system companies, application-specific integrated circuit (ASIC) companies and emerging startups bring their innovations to production.

Among the eight VCA members is Korea’s ASICLAND.

Samsung Electronics, the world’s largest memory chipmaker and TSMC rival, created an infrastructure dubbed Samsung Advanced Foundry Ecosystem (SAFE) to promote its partnership with design houses in 2018.

Under the SAFE program, Samsung runs the Design Solution Partner (DSP) group. There are nine DSP members, including ADTechnology, SEMIFIVE, CoAsia and Gaonchips.

Industry watchers said Korea’s chip design houses have much room to grow compared with their Taiwanese peers.

Workforce at Korea’s major chip design companies is similar to that of two Taiwanese firms, Global Unichip Corp. (GUC) and Alchip, combined.

GUC’s 2021 sales revenue reached NT$15.1 billion, double that of ADTechnology and CoAsia.

According to market research firm Gartner, the global AI chip market is forecast to grow to $76.8 billion by 2025 from $13.5 billion in 2019.

“With Big Tech such as Apple, Tesla, Google, Amazon and Facebook moving to develop semiconductors in-house, the status of chip design house will rise further,” said Kim Yong-seok, an electronic and electrical engineering professor at Sungkyunkwan University.

Write to Kyoung-Ju Kang at qurasoha@hankyung.com

In-Soo Nam edited this article.

More to Read

-

The KED ViewVietnam’s rise: An ominous sign for Korean chipmakers

The KED ViewVietnam’s rise: An ominous sign for Korean chipmakersFeb 16, 2023 (Gmt+09:00)

3 Min read -

Business & PoliticsKorean CHIPS Act revision hits roadblock as opposition lawmakers balk

Business & PoliticsKorean CHIPS Act revision hits roadblock as opposition lawmakers balkFeb 15, 2023 (Gmt+09:00)

3 Min read -

EarningsSK Hynix to halve investment after posting first quarterly loss in decade

EarningsSK Hynix to halve investment after posting first quarterly loss in decadeFeb 01, 2023 (Gmt+09:00)

4 Min read

Comment 0

LOG IN