Korea, Hyundai Motor request 3-year reprieve on US EV tax credit law

Hyundai EVs, exported to the US, should get tax credits until the Georgia plant goes up and running in 2025, Seoul says

By Nov 04, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The South Korean government and the country’s top automaker Hyundai Motor Co. have requested the US government give Korean carmakers a three-year grace period before applying the eco-friendly tax credit law to their electric vehicles sold in the US.

In a letter sent to the US Department of the Treasury on Friday, Korea’s Ministry of Trade, Industry and Energy said the Inflation Reduction Act (IRA) will hurt non-US electric carmakers, including those from Korea, and that the act may be in conflict with other trade regimes such as the World Trade Organization (WTO) and the bilateral free trade agreement between the US and Korea.

The ministry said any Korean carmaker, in a clear reference to Hyundai Motor, which plans to make investments to build a manufacturing plant in the US, should be given EV tax credits until the factory is up and running.

Hyundai Motor Group, which owns Korea’s two largest automakers, Hyundai Motor and its affiliate Kia Corp., has also submitted a letter to the Treasury Department, requesting similar requests.

The ministry asked the US to ease the rules and expand the scope of cars assembled in the US to include vehicles partially manufactured in the country.

For example, if semi-assembled auto parts are imported from Korea and fully assembled into cars in the US, such vehicles should be eligible for EV tax breaks, it said.

The Seoul government also asked the Treasury Department to loosely apply the meaning of free trade partners when the US government demand at least 40% of battery minerals be included in EVs from 2023.

Also, eco-friendly cars purchased for rental or lease should be considered commercial vehicles eligible for tax incentives, it said.

HYUNDAI’S GEORGIA EV PLANT NOT READY UNTIL H1, 2025

Last month, Hyundai broke ground on a $5.54 billion electric plant in the US state of Georgia to take advantage of the Biden administration’s aggressive zero-emissions policy, including generous subsidies and tax breaks for EVs made in the country or its free trade partners.

Construction of the plant with an annual output capacity of 300,000 EVs will begin early next year. Commercial production is expected in the first half of 2025.

The IRA, signed into law by the US president in August, requires a certain percentage of critical minerals used in EV batteries to come from the US or its free trade partners.

From next year, EV makers must use batteries with materials sourced primarily in North America for their cars to be eligible for the tax credit of up to $7,500 per unit.

Qualifying EVs must contain at least 40% of their battery minerals and 50% of their battery components from those countries. The proportion will rise to 80% for minerals by 2027 and 100% for parts by 2029.

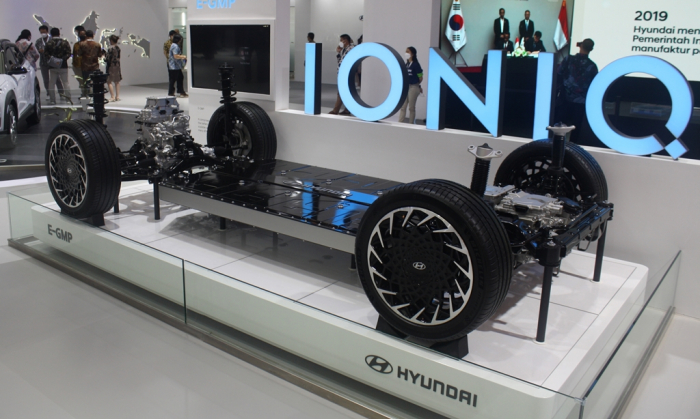

The act, aiming to diminish China’s power in the global EV market, is expected to impact Korea’s finished car makers. Currently, Hyundai Motor Group’s main EVs, such as the IONIQ 5 and the EV6, are all manufactured in Korea and exported to the US.

Write to So-Hyeon Kim at alpha@hankyung.com

In-Soo Nam edited this article.

-

AutomobilesHyundai, Kia post record hybrid vehicle sales in US in October

AutomobilesHyundai, Kia post record hybrid vehicle sales in US in OctoberNov 02, 2022 (Gmt+09:00)

2 Min read -

Electric vehiclesHyundai Motor to boost US presence with $5.5 bn new Georgia EV plant

Electric vehiclesHyundai Motor to boost US presence with $5.5 bn new Georgia EV plantOct 26, 2022 (Gmt+09:00)

3 Min read -

Business & PoliticsUS DOE officials in Seoul to meet with Hyundai Motor, battery makers

Business & PoliticsUS DOE officials in Seoul to meet with Hyundai Motor, battery makersOct 13, 2022 (Gmt+09:00)

3 Min read -

BatteriesFord CEO heads to Korea to discuss EV tax credit with LG Energy, SK On

BatteriesFord CEO heads to Korea to discuss EV tax credit with LG Energy, SK OnSep 16, 2022 (Gmt+09:00)

3 Min read -

Business & PoliticsWashington, Seoul to hold formal talks on US EV tax credit act

Business & PoliticsWashington, Seoul to hold formal talks on US EV tax credit actAug 31, 2022 (Gmt+09:00)

2 Min read -

AutomobilesHyundai’s Chung rolls up sleeves to counter US EV tax credit act

AutomobilesHyundai’s Chung rolls up sleeves to counter US EV tax credit actAug 25, 2022 (Gmt+09:00)

3 Min read