Artificial intelligence

LG CNS posts double-digit profit growth ahead of 2023 IPO

The LG Group unit recorded its largest-ever 2nd-quarter results on the back of growing corporate digitalization

By Aug 16, 2022 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea's largest cloud computing service provider LG CNS Co. on Tuesday reported double-digit growth in both profit and revenue in the second quarter as the COVID-19 pandemic accelerated corporate digitalization across industries.

Its operating profit and revenue marked the company's largest-ever results for a second quarter, which would pave the way for an initial public offering planned for next year.

Revenue came in at 1.1 trillion won ($840 million) for the April-June period, a 35% on-year jump and a 30% increase from a quarter earlier. It was the first time for company's quarterly revenue to surpass the 1 trillion won mark.

Second-quarter operating profit spiked 55% to 87.3 billion won from the previous year. It was up 35% compared with the first quarter.

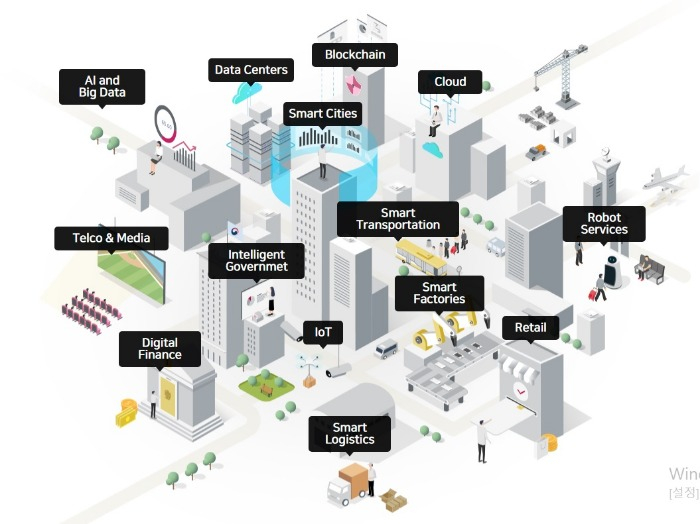

The growing demand for cloud computing, smart factories and smart logistics are credited for its brisk results. Smart factories and logistics refer to AI- and data-driven automated processes.

Cloud service was the key driver of its record-setting results. As a managed service provider, LG CNS transfers customers' IT systems to cloud computing platforms such as Microsoft's Azure.

In smart factory services, LG CNS is adopting AI, big data and digital twin technologies to boost productivity. A digital twin is a virtual representation of a real-world system using simulation and machine learning.

The company has received a string of new major projects in the first half of this year, including one for the online portal Naver Corp.'s third cloud center in Busan.

It also introduced a subscription service for logistics robots.

In May, LG CNS, which is 35% owned by Macquarie Group, sent requests for proposals to brokerage companies to select its IPO underwriters, according to investment banking sources at the time.

The planned IPO would help Macquarie Group's private equity arm to exit from the Korean company for around $2 billion, or nearly triple its investment.

Macquarie bought a 35% stake in the LG Group arm from the group's holding company LG Corp. for 950 billion won in 2020, beating KKR & Co., the other shortlisted bidder.

Write to Sung-Soo Bae at baebae@hankyung.com

Yeonhee Kim edited this article

More to Read

-

Artificial intelligenceLG CNS launches AI robot subscription service for warehouse operators

Artificial intelligenceLG CNS launches AI robot subscription service for warehouse operatorsJun 22, 2022 (Gmt+09:00)

1 Min read -

Research & DevelopmentLG CNS launches virtual factory and lab business

Research & DevelopmentLG CNS launches virtual factory and lab businessJun 09, 2022 (Gmt+09:00)

1 Min read -

-

-

Smart logisticsLG CNS to launch Korea’s first drive-through micro-fulfillment center

Smart logisticsLG CNS to launch Korea’s first drive-through micro-fulfillment centerJul 05, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN