LG CNS eyes 2023 IPO to pave way for Macquarie's exit

Accelerated digital transformation during the pandemic sent LG CNS' earnings to a record high in 2021

By May 03, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea's LG CNS Co., 35% owned by Macquarie Group, sent requests for proposals to brokerage companies on Monday as it is looking to go public next year, according to investment banking sources.

The country's leading IT service provider will select underwriters later this month to prepare its initial public offering on the Kospi main bourse, which would help Macquarie Group's private equity arm to exit from LG CNS for around $2 billion, or nearly triple its investment.

Macquarie had bought a 35% stake in the LG Group arm from the group's holding company LG Corp. for 950 billion won in 2020, beating KKR & Co., the other shortlisted bidder at the time.

Since its investment, LG CNS' enterprise value is estimated to have more than tripled to 7 trillion won ($5.5 billion) from 2.8 trillion won. That is below the 11.4 trillion won for its bigger rival Samsung SDS Co. as of Tuesday afternoon.

Macquarie's stake purchase was made on the condition that it should cash it out through an IPO of LG CNS or other methods within the next five years.

As the No. 2 shareholder, the Australian bank's stake in the IT company is worth 2.45 trillion won, based on its trading price in over-the-counter markets.

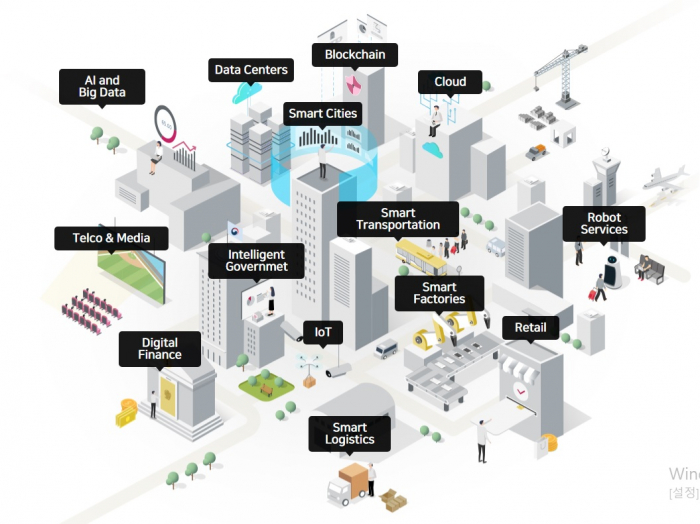

The COVID-19 pandemic has accelerated digital transformation across industries, driving LG CNS' earnings to a record high last year. In particular, the growing demand for cloud computing, online financial services and smart logistics, or data-driven logistics management, are credited for its brisk results.

Moreover, LG CNS has been aggressively investing in the creation of AI voice, customer experience consulting based on its accumulated data and the de-identification of data to prevent personal identity from being revealed.

LG Corp. holds a 49.95% stake in the IT service unit as the top shareholder. LG Group Chairman Koo Kwang-mo owns a 1.12% stake in LG CNS.

Back in 2020, the group reduced its stake in LG CNS to avoid toughened antitrust rules on intra-group business transactions. Under the revised laws, inter-subsidiary or intra-group business transactions are strictly restricted for a company, 50% or more owned by a sister company, of which its founding family controls at least 20%.

LG CNS will likely put its IPO proceeds into new growth fields targeting retail customers to expand beyond business-to-business services.

In September 2021, LG CNS was granted a license to join the government-led MyData project, which allows the collection and analysis of personal data across financial services. Going forward, it plans to combine them with non-financial data obtained from other companies to produce customized services.

Additionally, LG CNS applied for government permission in March of this year to become a domestic operator of a private 5G network to deliver high bandwidth connections and ultra-low latency.

Write to Seok-Cheol Choi and Ye-Jin Jeon at dolsoi@hankyung.com

Yeonhee Kim edited this article.

-

Smart logisticsLG CNS to launch Korea’s first drive-through micro-fulfillment center

Smart logisticsLG CNS to launch Korea’s first drive-through micro-fulfillment centerJul 05, 2021 (Gmt+09:00)

4 Min read -

Macquarie buys $800 mn stake in LG Group’s IT firm

Macquarie buys $800 mn stake in LG Group’s IT firmDec 07, 2019 (Gmt+09:00)

1 Min read -

KKR, Macquarie among bidders for over $800 mn stake in LG CNS

KKR, Macquarie among bidders for over $800 mn stake in LG CNSAug 27, 2019 (Gmt+09:00)

2 Min read