Batteries

LG Energy shrugs off slowing economy as demand grows

LG-GM joint venture is set to begin its first US plant operation in Q3, while LG's LFP cell plant in China will begin operation in 2023

By Jul 27, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s top battery maker LG Energy Solution Ltd. on Wednesday unveiled its ambitious goals for revenue and operating margins as electric vehicle makers such as Tesla Inc., General Motors Co. and Volkswagen bump up production.

At a second-quarter earnings call, LG Energy said it will more than triple its sales and achieve double-digit operating margins over the next five years, driven by a surge in new orders and facility expansion.

“There was no demand slowdown. Our major clients continue to ask us to meet their orders in full,” a company official told the earnings call.

In addition, LG Energy is in talks with other automakers and EV startups, which are trying to place new orders.

For 2021, it lifted its sales target slightly to 20 trillion won ($15 billion) from 19.2 trillion won, shrugging off concerns about higher interest rates and an economic downturn.

The upbeat outlook is in contrast to a slight decline in its second-quarter sales and a plunge in quarterly profit, which the company blamed on the base effect.

By 2027, the company aims to push up its annual sales to 66 trillion won, more than three times its estimated 20 trillion won for 2022.

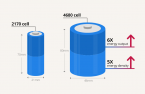

“We will achieve our goals with the launch of our joint venture plants in the US, increased supply of cylindrical batteries and new form factor prototype development,” said the LG Energy official.

NEW PLANTS

Ultium Cells LLC, a joint venture between GM and LG, is set to commence operation of its first EV battery plant in Ohio this quarter. The factory will produce 35-gigawatt hours (GWh) of battery cells a year.

In January, LG Energy and GM announced a plan to build their third US EV battery plant with a $2.6 billion investment. It will be built in Michigan to diversify its manufacturing bases.

Some Korean brokerage firms, including Hanwha Investment & Securities Co. and KB Securities Co., forecast that LG Energy’s annual sales will exceed 100 trillion won by 2030, joining the 100 trillion won sales club.

Samsung Electronics Co. and Hyundai Motor Co. are currently the only Korean companies with annual sales of 100 trillion won or above.

The battery maker is expected to pass on the first-quarter surge in raw material prices for lithium, nickel and cobalt to its customers in the current quarter, as has been done with copper and aluminum.

OPERATING PROFIT MARGINS

The company plans to increase its operating profit margin from 3.9% in the current quarter to double digits by 2027.

To that end, LG will introduce smart factory systems, equivalent to a digitized manufacturing process.

By doing so, it plans to boost productivity, improving production yield by 5 percentage points to the mid- to-high 90% range. It will also reduce the proportion of labor used to roll out products.

LG Energy’s aggregate capacity is expected to increase to 540 GWh of battery supply per year by 2025, the minimum production capacity needed to fulfill 310 trillion won worth of its remaining orders as of end-June.

That compares with 520 GWh in the first quarter of this year.

To meet the growing demand for cylindrical batteries from Europe, LG Energy is considering building a plant there.

Last March, LG Energy and multinational automaker Stellantis N.V. agreed to build a $4.1 billion electric vehicle battery plant in Ontario, Canada.

Regarding LG Energy’s plan to build a billion-dollar battery plant in the US state of Arizona, however, the company said it was in talks with client companies to address a surge in the costs of construction, logistics and labor.

As for lithium ion phosphate (LFP) batteries, used in energy storage systems, LG will produce them in China beginning next year.

LG's second-quarter operating profit tumbled 73% on-year to 195.6 billion won on a consolidated basis. Its year-earlier earnings got a boost from one-off gains such as settlement money from its domestic rival SK On Co. to end their licensing dispute.

Sales dipped 1.2% to 5.1 trillion won over the same period.

Write to Hyung-Gyu Kim at khk@hankyung.com

Edited by Yeonhee Kim

More to Read

-

BatteriesLG Energy, China’s Huayou Cobalt to build battery recycling joint venture

BatteriesLG Energy, China’s Huayou Cobalt to build battery recycling joint ventureJul 26, 2022 (Gmt+09:00)

4 Min read -

BatteriesLG Energy to supply $765 million batteries to Japan’s Isuzu Motors

BatteriesLG Energy to supply $765 million batteries to Japan’s Isuzu MotorsJul 05, 2022 (Gmt+09:00)

3 Min read -

BatteriesLG Energy to invest $451 mn in mass production of Tesla’s 4680 battery cells

BatteriesLG Energy to invest $451 mn in mass production of Tesla’s 4680 battery cellsJun 13, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN