Game and entertainment

Nexon invests $874 mn in Hasbro, Japan’s game giants

By Mar 30, 2021 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s Nexon Co. has disclosed investments in the global entertainment sector made last year, totaling $874 million or 58% of the amount authorized by its board last year.

Nexon had shared in June last year its plans to invest a total of $1.5 billion in global entertainment companies that possess strong, globally recognized intellectual properties (IPs).

The company is listed on Japan’s Tokyo Stock Exchange and is a constituent of the Nikkei 225 index.

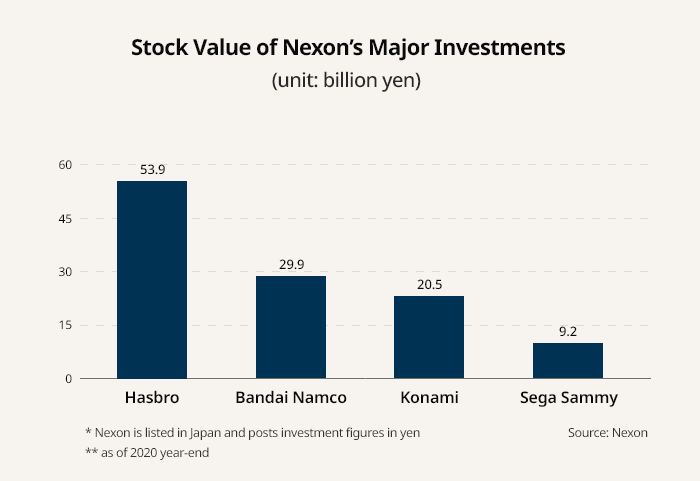

According to the company’s disclosure, Nexon has invested in the US toy giant Hasbro Inc. as well as Japan’s leading game companies Bandai Namco Honldings Inc., Konami Holdings Co. and Sega Sammy Holdings Inc.

Nexon’s stake in each of these four companies is less than 5% and other investments did not meet the company’s threshold for disclosure.

Hasbro is America’s largest toymaker and sells toys of globally popular IPs such as Disney and Marvel characters. Nexon had previously worked together with the US company on its Bubble Fighter IP business.

The Japanese firms are also known for global big hits – Bandai Namco with the Soulcaliber and the Tekken series, Konami with the Metal Gear series and Sega Sammy with the Yakuza series.

“These investments reflect our respect for management teams that create and grow global properties over a period of years and decades. We believe that each has potential to capitalize on the secular shift from linear formats to interactive entertainment,” said Owen Mahoney, president and CEO of Nexon.

INTENTION AND FUTURE PLAN

Nexon said that the investments are “long-term friendly investments with no intention of acquisition or activism,” with a simple intention of strengthening business partnerships.

Others analyze that financial gain is an important motive. The company posted an unrealized gain of $279 million on long-term investments, with more than 30% return on its investment in global entertainment companies over the past six months.

Nexon is also expected to use $626 million or the remaining 42% of its board-authorized funds in 2021, with The Walt Disney Company, Electronic Arts Inc. and Nintendo Co. as potential targets.

“We believe companies with strong, well-managed global IP are often overlooked and undervalued in a market that is narrowly focused on introductions of new IP,” said Nexon CEO.

Write to Joo-Wan Kim at kjwan@hankyung.com

Daniel Cho edited this article.

More to Read

-

Game industryTencent increases appetite for Korean gaming startups

Game industryTencent increases appetite for Korean gaming startupsMar 23, 2021 (Gmt+09:00)

4 Min read -

Game IPsKorean game firms target global market with IP portfolio

Game IPsKorean game firms target global market with IP portfolioFeb 17, 2021 (Gmt+09:00)

2 Min read -

Kakao, NCSoft likely to lead record-breaking earnings in 2021

Kakao, NCSoft likely to lead record-breaking earnings in 2021Jan 03, 2021 (Gmt+09:00)

3 Min read -

K-contentK-content companies set to rule 2021 stock market after breakneck growth

K-contentK-content companies set to rule 2021 stock market after breakneck growthDec 14, 2020 (Gmt+09:00)

3 Min read -

Mobile gamesS.Korean games, entertainment eye China return after 3-year ban

Mobile gamesS.Korean games, entertainment eye China return after 3-year banDec 04, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN