S.Korean games, entertainment eye China return after 3-year ban

By Dec 04, 2020 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea's game and entertainment companies saw their share prices surge on rising expectations of a return to the Chinese market after a Korean mobile game developer received approval from the Chinese government -- the first Korean game to do so in over three years.

On Dec. 2, China’s gaming regulator, the State Administration of Press and Publication, said that it issued a license for Summoners War, a game by Korean mobile game developer Com2uS Corp.

This is the first Korean game to get the nod from the Chinese government since February 2017, after which China issued a ban against Korean content in retaliation over Korea's decision to deploy the US anti-missile defense system (THAAD).

The domestic game industry and investors are in high spirits following the approval, taking it as a sign that China will lift its Korean content ban in the near future.

Com2uS closed at 159,000 won ($146), up 6.19%, on Dec. 3. Share prices also rose for other game companies, including PearlAbyss Corp. (14.11%), Wemade Co. (5.75%), Nexon GT Co. (5.41%), Webzen Inc. (3.62%) and Netmarble Corp. (3.59%).

According to the Korea Creative Content Agency, China became the world's largest game market this year valued at around 47.7 trillion won ($43.9 billion).

“Com2uS' license is symbolic for Korean game and content companies that are heavily reliant on China," said Lee Chang-young, an analyst at Yuanta Securities.

Other companies including Netmarble, PearlAbyss and NCsoft Corp. are also waiting to relaunch services in China.

In anticipation of China's eased ban, major Korean entertainment companies also saw their share prices rise on Thursday, including YG Entertainment Inc. (12.11%), JYP Entertainment Corp. (10.47%), SM Entertainment Co. (4.52%) and Big Hit Entertainment Co. (4.12%) -- all much higher than the country’s benchmark Kospi, which rose 0.76%.

IMPROVED DIPLOMATIC RELATIONS MAY HAVE IMPACT

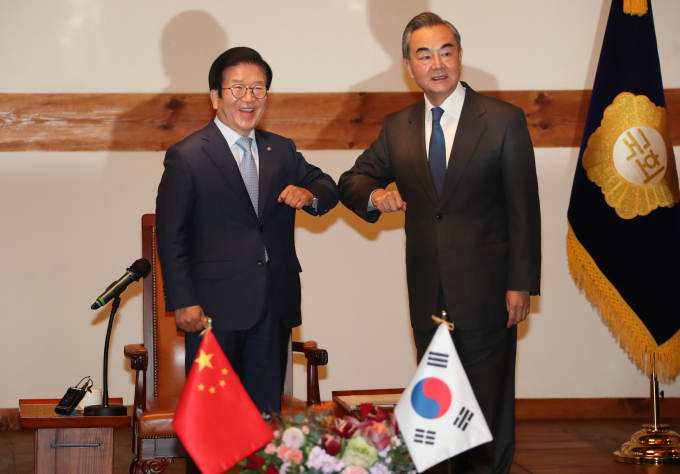

Last month, Chinese State Councilor and Foreign Minister Wang Yi visited Korea, and Xi Jinping, the President of China, is expected to visit once the COVID-19 crisis eases.

Analysts say that improved diplomatic relations may help Korean game companies' share prices to stabilize and return to normal.

Amid anticipation that China’s stance may change, some are still taking a conservative approach as it may be too early to expect a complete removal of China’s ban on Korean content.

“Other major games that could have a greater impact in the Chinese game market have yet to receive licenses from China,” said a game industry source. “It could just be a one-time approval for show and tell,” the source added.

Write to Byeong-hun Yang, Joo-wan Kim, Bum-jin Chun at hun@hankyung.com

Danbee Lee edited this article.

-

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google22 HOURS AGO

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-