Game industry

Tencent increases appetite for Korean gaming startups

By Mar 23, 2021 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Chinese technology giant Tencent Holdings has been gobbling up South Korean gaming startups that have yet to launch their first products, a move seen aimed at securing their intellectual properties (IPs) and developers to cement its No. 1 spot in the global game industry.

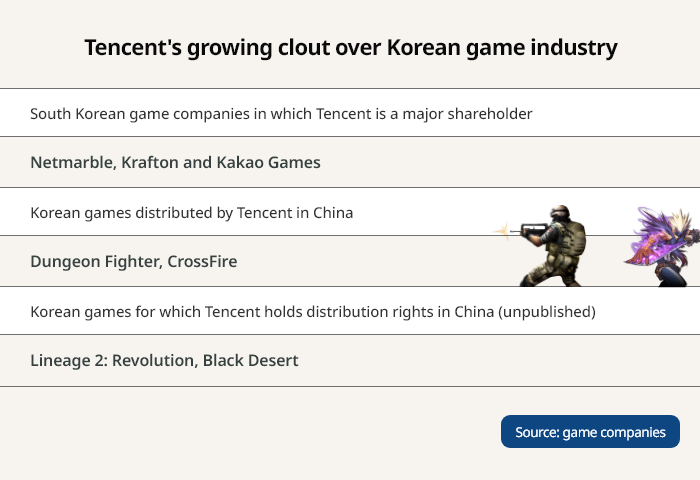

Tencent is already a major shareholder of leading Korean game publishers such as Netmarble Corp., Krafton Inc. and Kakao Games Corp. The Chinese IT giant has also been extending its reach to small and medium-sized Korean game developers, alongside the expanding game market amid the contactless trend.

"In the past, Tencent had invested in Korean game companies with a successful IP portfolio," said a game industry source. "But after facing criticism for its heavy spending to buy a stake in Krafton, it changed strategy to invest in promising startups."

Tencent owns 16.4% of Krafton, the label behind the global blockbuster game PlayerUnknown’s Battlegrounds (PUBG). Krafton is now preparing for an IPO, aiming to raise over 1 trillion won ($887 million).

In 2020, Tencent outspent Alibaba Group Holding on investments in startups, forking out more than $12 billion to buy shares in 163 businesses, according to the Financial Times. Its investments were heavily tilted toward the entertainment and game industries.

In South Korea, Tecent's recent investments include Nyou Inc., which raised 20 billion won in Series C funding last year. Tencent has invested multimillion dollars in Nyou to become its major shareholder, according to the game industry sources on Mar. 22.

Nyou is developing its first massively multiplayer online role-playing game (MMORPG) to unveil in the second half of this year. The game, tentatively named Project N1, is a medieval game in a virtual world setting that changes according to players’ in-game decisions.

| Nyou at a glance | ||

| * Established | 2016 | |

| * Founders | Ex-senior developers of leading Korean game companies NCSoft Corp. and Neople | |

| * Chief Executive | Kim Jung-hwan | |

| * CEO's biography | Led the launch of Lineage 2 in Taiwan at NCSoft | |

| Spearheaded the development of ArcheAge at XLGAMES Inc. | ||

| Served as Korean head of Blizzard Entertainment Inc., known for StarCraft | ||

Additionally, Tencent has invested 50 billion won in Line Games, owned by a subsidiary of South Korea's biggest online platform Naver Corp. Line Games published Dragon Flight and Exos Heroes.

Last month, the Chinese IT giant became the second-largest shareholder of Royal Crow with an investment of 17.7 billion won. The startup is developing its first game.

| Tencent's investments in South Korean game companies |

||

| Company | Investment Amount | Stake |

| Netmarble | N/A | 17.54% (No.3 shareholder) |

| Krafton Inc | N/A | 16.4% (No.2 shareholder) |

| Kakao Games | N/A | N/A |

| Nyou | Multibillion won | N/A |

| Line Games | 50 billion won | N/A |

| Royal Crow | 17.7 billion won | N/A |

| Actfive | N/A | N/A |

| NX3GAMES | N/A | N/A |

| Other Korean companies backed by Tencent |

||

| TV drama production firm JTBC Studios Co | N/A | 7.2% |

| Kakao Bank | N/A | N/A |

South Korea's game industry is growing steadily. Its market value is expected to surpass $16 billion this year, almost one-third the size of the domestic automobile market. The game industry's growth this year is expected to be led by new titles created by cashing in on the intellectual property of popular games.

DISTRIBUTION RIGHTS

Tencent has been earning multibillion dollars annually from the distribution of popular Korean games such as Neople's Dungeon Fighter and Smilegate Entertainment Inc.'s CrossFire in China. Neople is a unit of the country's leading gaming developer NCSoft.

Dungeon Fighter, a multiplayer action role-playing game, ranked as the world's highest-grossing game by sales last month, according to market tracker SuperData. CrossFire came third.

Tencent also holds the distribution rights in China for some unpublished games: Pearl Abyss' Black Desert and Netmarble's Lineage 2: Revolution. South Korea-based Pearl Abyss is 4% owned by Singapore's GIC.

But Krafton saw the mobile version of its popular game Battlegrounds abruptly replaced by Tencent's similar game in 2019. Also, the Chinese company, its second-largest shareholder, took over Krafton's user information for the mobile game co-developed by the two firms.

Krafton raised no complaint about the abrupt suspension of its mobile game in China and instead, received royalties from the Chinese shareholder.

Write to Joo-Wan Kim at kjwan@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Game IPsKorean game firms target global market with IP portfolio

Game IPsKorean game firms target global market with IP portfolioFeb 17, 2021 (Gmt+09:00)

2 Min read -

-

Kakao, NCSoft likely to lead record-breaking earnings in 2021

Kakao, NCSoft likely to lead record-breaking earnings in 2021Jan 03, 2021 (Gmt+09:00)

3 Min read -

K-contentK-content companies set to rule 2021 stock market after breakneck growth

K-contentK-content companies set to rule 2021 stock market after breakneck growthDec 14, 2020 (Gmt+09:00)

3 Min read -

Mobile gamesS.Korean games, entertainment eye China return after 3-year ban

Mobile gamesS.Korean games, entertainment eye China return after 3-year banDec 04, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN