Mergers & Acquisitions

CJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion

CJ, the only global amino acid producer with a plant in the US, stands to benefit from US-China tensions

By Apr 30, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

CJ CheilJedang Corp., South Korea’s largest food and beverage company, said on Wednesday it has scrapped a planned sale of its green bio business, a deal valued at 5 trillion won ($3.5 billion), opting instead to retain and expand it amid growing geopolitical uncertainty and the rising strategic importance of its US production base.

CJ CheilJedang, the flagship unit of Korea’s food-to-entertainment conglomerate CJ Group, said it is terminating the divestment process after months of negotiations with multiple bidders, including top negotiator MBK Partners Ltd.

Analysts said CJ’s reversal underscores the strategic recalibration underway across Asia, where businesses once seen as ripe for private equity-led consolidation are now being repositioned as geopolitical assets.

CJ is the world’s No. 1 player in feed amino acids and nucleotides derived from microbial and plant-based sources – a business that accounts for 90% of its bio business sales.

CJ and its sale manager, Morgan Stanley, said in February that private equity firm MBK Partners and two leading Chinese biotech firms – Guangxin Group and Meihua Group – were in the final stage of the competition, conducting due diligence on CJ’s bio business.

Sources said MBK was ahead of other bidders as the private equity firm submitted a 5 trillion won binding offer to acquire management control of CJ’s bio business in what would have been Korea's largest M&A deal this year.

STRATEGIC SHIFT AMID INTENSIFYING US-CHINA TENSIONS

Industry watchers said the unexpected court-led rehabilitation filing of hypermarket chain Homeplus Co., another MBK portfolio company, also raised concerns among lenders and slowed the deal’s momentum.

Financial institutions grew increasingly hesitant to provide acquisition financing, undermining MBK’s capacity to close the transaction, they said.

As negotiations dragged on, shifting global trade dynamics prompted CJ to reassess the strategic value of its green bio business, people familiar with the matter said.

The Trump administration’s evolving tariff policies, particularly toward Chinese and other Asian goods, have intensified the importance of CJ CheilJedang’s Iowa-based manufacturing facility – the only such plant owned by a major global amino acid producer in the US.

“CJ is uniquely positioned with its global manufacturing footprint, including 11 overseas facilities that allow for flexible production and tariff hedging,” said a person familiar with the matter. “In light of escalating US-China tensions, CJ saw greater long-term value in nurturing the bio unit rather than selling it.”

Last week, CJ also cancelled the sale of a 66% stake in Brazilian soybean crusher CJ Selecta S.A. after more than a year of negotiations with US grain trader Bunge Ltd.

ATTRACTIVE ASSET

CJ’s bio business is an attractive asset, given its strong global presence and stable earnings.

The company's production and sales network spans 11 countries, including the US, China, Indonesia and Brazil. It also boasts a large market share in China, the world’s biggest consumer of feed amino acids.

In 2024, the company’s bio business posted 337.6 billion won in operating profit on sales of 4.21 trillion won, up 20% and 31% from the previous year.

The business’s 2024 earnings before interest, taxes, depreciation and amortization (EBITDA) came to some 700 billion won.

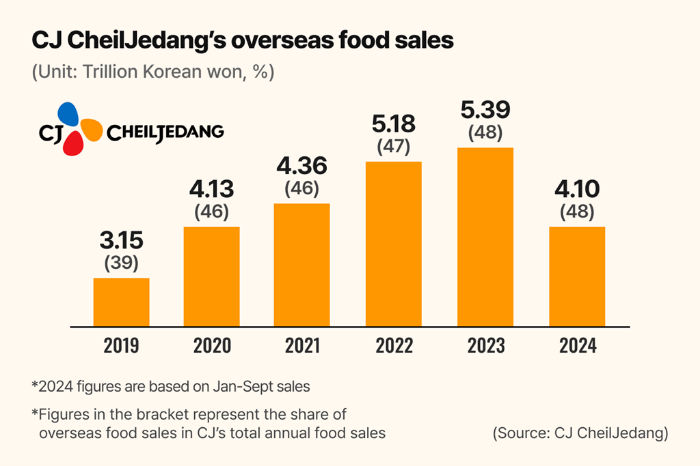

CJ Cheiljedang put its bio business up for sale in line with the parent group’s restructuring efforts to revive sagging sales at its two growth pillars: food and entertainment.

CJ ENM Co. is Korea’s top entertainment company.

Last December, CJ CheilJedang attracted interest from buyout firms, including Blackstone and Carlyle Group, for its bio business.

In 2021, CJ Cheiljedang acquired Batavia Biosciences B.V., a Dutch biotechnology company, for 195.3 million euros to expand its presence in the contract biopharmaceutical production market, known as CDMO.

Write to Jun-Ho Cha at chacha@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Mergers & AcquisitionsCJ CheilJedang scraps sale of Brazilian unit CJ Selecta to Bunge

Mergers & AcquisitionsCJ CheilJedang scraps sale of Brazilian unit CJ Selecta to BungeApr 29, 2025 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsMBK Partners poised to acquire CJ Cheiljedang’s $3.5 billion bio business

Mergers & AcquisitionsMBK Partners poised to acquire CJ Cheiljedang’s $3.5 billion bio businessMar 06, 2025 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsMBK Partners, 2 Chinese firms vie for CJ Cheiljedang’s $4 bn bio business

Mergers & AcquisitionsMBK Partners, 2 Chinese firms vie for CJ Cheiljedang’s $4 bn bio businessFeb 13, 2025 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsBlackstone, Carlyle, MBK vying for CJ CheilJedang’s bio business

Mergers & AcquisitionsBlackstone, Carlyle, MBK vying for CJ CheilJedang’s bio businessDec 02, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsCJ Cheiljedang to acquire Dutch bio firm Batavia for 195 million euros

Mergers & AcquisitionsCJ Cheiljedang to acquire Dutch bio firm Batavia for 195 million eurosNov 08, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN