Private equity

Red flags raised even before Homeplus crisis: Sales fall, credit ratings cut

The retailer’s credit ratings have been downgraded six times since MBK acquired it in 2015

By Mar 18, 2025 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Even before South Korea’s second-largest hypermarket chain Homeplus Co. was put under court receivership due to its worsening financial woes, the warning signs were there.

Sales at the retail giant stumbled in the run-up to Homeplus’ filing for court protection on March 4. The downward trajectory, however, began years earlier, with its credit ratings downgraded several times amid an uphill battle to catch up to rivals – signaling its deepening financial woes.

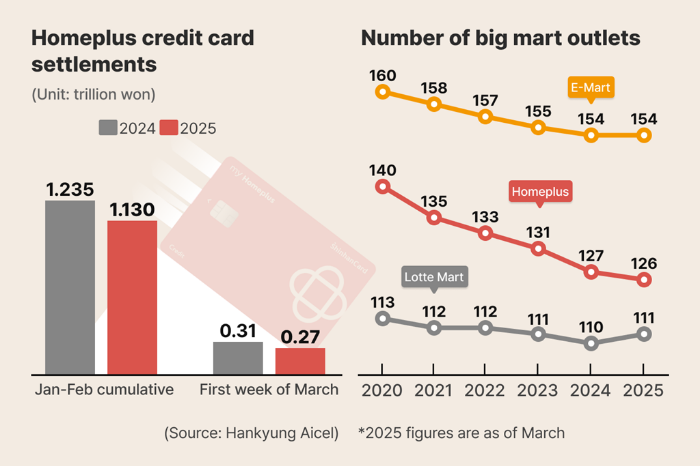

According to Korean alternative data platform KED Aicel, credit card transactions at Homeplus outlets totaled 1.13 trillion won ($781 million) in the first two months of 2025, an 8.5% on-year decline from 1.24 trillion won in the year-earlier period.

Analysts said the sluggish performance contributed to Korea Investors Service Inc., a Moody’s affiliate, downgrading Homeplus' credit rating to A3 minus from A3 on Feb. 28.

Four days later, private equity firm MBK Partners Ltd., which wholly owns Homeplus, filed for corporate rehabilitation of the hypermarket operator with the Seoul Bankruptcy Court.

KED Aicel data showed that Homeplus’ sales further deteriorated in early March.

Credit card settlements between March 2 and March 8 reached 267.6 billion won, down 13.7% from a year earlier.

SALES NOSEDIVE

Sales nosedived immediately after the court receivership filing, with transactions on March 5 and 6 down 28% on-year to 35.6 billion.

The sales decline came even as the company ran its flagship annual discount event Homeple Run.

KED Aicel’s estimates are based on a dataset covering over 20 million credit card users, excluding one-off surges in gift certificate transactions caused by default concerns.

KED Aicel is the alternative data service brand of Hankyung Aicel, renamed from Aicel Technologies Inc. after The Korea Economic Daily acquired the data firm from US-based policy and global intelligence provider FiscalNote Holdings Inc. for $8.50 million last October.

Michael ByungJu Kim, co-founder, partner and chairman of Northeast Asia-focused private equity firm MBK, said on Sunday that he would use his personal wealth to ensure timely payments to small- and medium-sized Homeplus suppliers and merchants.

FINANCIAL DISTRESS ANTICIPATED

Homeplus' financial distress has long been expected.

The retailer’s credit ratings have been downgraded six times since MBK Partners acquired it in 2015.

The company’s ability to cover interest payments has weakened drastically, with its earnings before interest, taxes, depreciation, and amortization (EBITDA)-to-financial expense ratio falling to 0.5 times for the first three quarters of the 2024 fiscal year, or the period from March 2024 to February 2025.

This means Homeplus earned only 50 million won for every 100 million won it owed in interest payments.

According to KED Aicel data, Homeplus' revenue has steadily eroded in recent years.

Credit card transactions at Homeplus hypermarkets stood at 7.38 trillion won in 2024, down 18.1% from 9.01 trillion won in 2019.

After turning south with a 7% on-year drop in 2020, sales declined for three consecutive years until a brief recovery in 2023 and 2024, driven by the expansion of the “Mega Food Market” initiative. The downturn, however, resumed in early 2025.

FAILURE TO ADAPT TO CONSUMER TRENDS

Korean credit agencies have cut Homeplus’ ratings, citing its failure to respond to shifting consumer trends.

When the credit rating of Homeplus was downgraded to A2 from A2 plus in August 2019, Korea Investors Service highlighted the retailer’s poor competitiveness in the fast-growing online grocery market.

At the time, Homeplus sought to strengthen its offline presence with its vow to expand its warehouse-style discount store format, Homeplus Special, to 81 locations. Due to financial constraints, however, it only managed to operate 19 by 2022.

The ratings firm further downgraded Homeplus in 2020 and 2022 for similar reasons, saying Homeplus lagged behind competitors.

Once boasting the top-notch A1 rating in 2014, Homeplus collapsed to A3 minus last month, the lowest investment grade.

Following its court receivership filing, its rating was slashed to D, indicating default.

FORCED TO SELL OUTLETS TO SECURE MONEY

To secure liquidity, Homeplus has been forced to sell its outlets, further undermining its competitiveness.

The number of its outlets has shrunk to 126 as of early 2025 from 140 in late 2020 while rivals Shinsegae Inc.'s E-Mart Inc. outlets and Lotte Shopping Co.'s Lotte Mart stores saw minor reductions of six and two stores, respectively over the same period.

Through outlet sales and sale-and-lease back (S&LB) transactions, Homeplus was able to ease its debt burden.

The retailer’s total borrowings dropped by 2 trillion won over three years, reaching 5.2 trillion won as of February 2023.

Its debt-to-equity ratio improved to 1,409% by November 2024 from 3,212% in February 2023.

Nevertheless, persistent operating losses continued to weigh on its business.

Homeplus swung to a 133.5 billion won net loss in 2021.

In the first three quarters of 2024, the retailer recorded an operating loss of 157.1 billion won, widened by 20.5% from 130.3 billion won in the year-earlier period.

With its business model under severe strain, Homeplus faces a difficult restructuring process under court receivership.

Analysts said its survival hinges on a successful turnaround strategy, which may involve further asset sales, operational streamlining and a potential buyout from new investors.

In 2015, MBK acquired 100% of Homeplus for 7.2 trillion won ($4.9 billion) from British retailer Tesco Plc in what was at the time its biggest acquisition and the largest leveraged buyout (LBO) transaction in Asia.

MBK financed the deal with 2.2 trillion won in equity and the remaining 5 trillion won through acquisition financing.

Write to Tae-Ho Lee at thlee@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Debt financingMBK chairman to leverage own funds to pay Homeplus suppliers

Debt financingMBK chairman to leverage own funds to pay Homeplus suppliersMar 17, 2025 (Gmt+09:00)

3 Min read -

Pension fundsSouth Korea’s pension fund NPS risks massive loss from Homeplus fiasco

Pension fundsSouth Korea’s pension fund NPS risks massive loss from Homeplus fiascoMar 07, 2025 (Gmt+09:00)

3 Min read -

RetailShinsegae to double down on hypermarkets as Homeplus falters

RetailShinsegae to double down on hypermarkets as Homeplus faltersMar 06, 2025 (Gmt+09:00)

3 Min read -

Private equityMBK-owned Homeplus files for corporate revamp with Seoul court

Private equityMBK-owned Homeplus files for corporate revamp with Seoul courtMar 04, 2025 (Gmt+09:00)

4 Min read -

Private equityMBK Partners’ sale of Homeplus Express hits snag over valuation gap

Private equityMBK Partners’ sale of Homeplus Express hits snag over valuation gapAug 30, 2024 (Gmt+09:00)

3 Min read -

Comment 0

LOG IN