Mergers & Acquisitions

MBK Partners, 2 Chinese firms vie for CJ Cheiljedang’s $4 bn bio business

CJ and its sale manager Morgan Stanley plan to complete the main bidding process as early as next week

By Feb 13, 2025 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

North Asia-focused private equity firm MBK Partners and two leading Chinese biotechnology firms are vying for management control of CJ Cheiljedang Corp.'s bio business in what would be South Korea's largest M&A deal this year.

According to investment banking industry sources on Thursday, MBK and China’s two biotech firms – Guangxin Group and Meihua Group – are in the final stage of the competition, conducting due diligence on CJ’s bio business.

CJ CheilJedang, Korea’s largest food and beverage company, and its sale manager Morgan Stanley plan to finalize the main bidding process as early as next week, sources said.

China’s Guangxin and Meihua produce food additives such as MSG and nucleotides, as well as feed additives such as lysine and tryptophan, similar to CJ CheilJedang's bio division.

Guangxin Group is a Chinese state-owned enterprise with an annual revenue of 51 trillion ($35 billion).

Meihua Group, another major player in China's green bio sector, posted 3.58 trillion won in revenue in the third quarter of 2024.

ATTRACTIVE ASSET

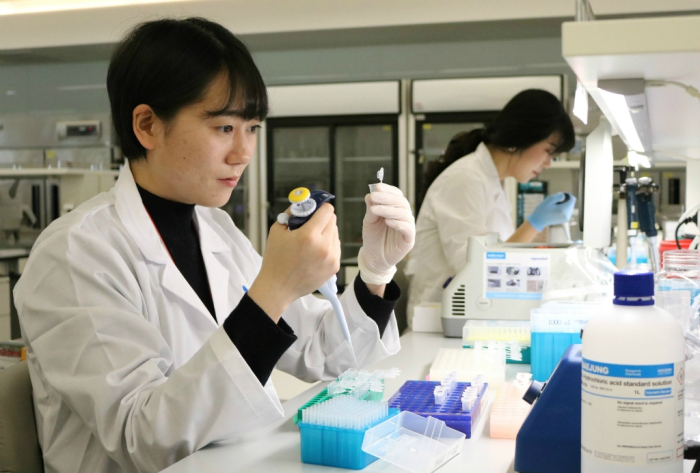

CJ’s bio business is an attractive asset, given its strong global presence and stable earnings.

The company's production and sales network spans 11 countries, including the US, China, Indonesia and Brazil. It also boasts a large market share in China, the world’s biggest consumer of feed amino acids.

CJ is the world’s No. 1 player in amino acids, which account for 90% of its bio business sales. Feed amino acids were the driving force of the company’s ascent in the global food and beverage market.

In 2024, the company’s bio business posted 337.6 billion won in operating profit on sales of 4.21 trillion won, up 20% and 31% from the previous year.

The business’s 2024 earnings before interest, taxes, depreciation and amortization (EBITDA) came to some 700 billion won.

Based on its EBITDA, the value of CJ’s bio business is estimated at 6 trillion won ($4.1 billion), sources said.

GROUPWIDE RESTRUCTURING

CJ Cheiljedang, the flagship unit of Korea’s food-to-entertainment conglomerate CJ Group, has put up its bio business for sale in line with the parent group’s restructuring efforts to revive sagging sales at its two growth pillars: food and entertainment.

CJ ENM Co. is Korea’s top entertainment company.

CJ CheilJedang put its bio business up for sale last December, initially attracting interest from buyout firms, including Blackstone, Carlyle Group and MBK Partners.

In 2021, CJ Cheiljedang acquired Batavia Biosciences B.V., a Dutch biotechnology company, for 195.3 million euros to expand its presence in the contract biopharmaceutical production market, known as CDMO.

Write to Jun-Ho Cha at chacha@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Mergers & AcquisitionsBlackstone, Carlyle, MBK vying for CJ CheilJedang’s bio business

Mergers & AcquisitionsBlackstone, Carlyle, MBK vying for CJ CheilJedang’s bio businessDec 02, 2024 (Gmt+09:00)

2 Min read -

Executive reshufflesKang Shin-ho returns as CJ CheilJedang CEO to revive sagging sales

Executive reshufflesKang Shin-ho returns as CJ CheilJedang CEO to revive sagging salesFeb 16, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsCJ Cheiljedang to acquire Dutch bio firm Batavia for 195 million euros

Mergers & AcquisitionsCJ Cheiljedang to acquire Dutch bio firm Batavia for 195 million eurosNov 08, 2021 (Gmt+09:00)

2 Min read -

Corporate investmentCJ Group Chief unveils $8.5 billion investment plans for growth

Corporate investmentCJ Group Chief unveils $8.5 billion investment plans for growthNov 04, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN