Mergers & Acquisitions

Asiana Airlines to sell cargo business for merger with Korean Air

The latest decision has removed a major hurdle to the union of Korea’s top two full-service carriers

By Nov 02, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

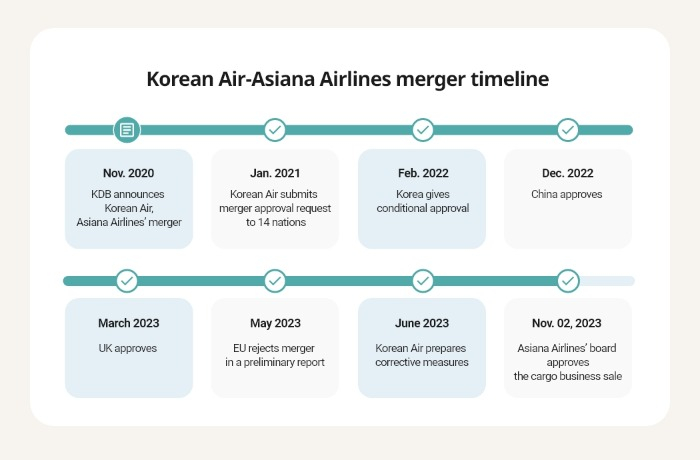

Asiana Airlines Inc. on Thursday decided to carve out its lucrative cargo business, clearing a major hurdle to its merger with bigger rival Korean Air Lines Co. pending approval from three more foreign antitrust bodies.

Asiana said its board of directors approved a proposal to sell its cargo business after three of five directors voted for the sale. One board member rejected it, while another director cast a blank ballot.

The vote to sell Asiana’s cargo business comes after the European Commission (EC), the antitrust body of the European Union, rejected the merger of Korea’s top two full-service carriers in May, citing monopoly concerns following its preliminary review.

The Commission specifically asked Korean Air to come up with a remedy for Korean Air's and Asiana’s nearly 60% combined share of Korea-Europe cargo routes as of 2022.

As part of efforts to ease its concerns, Korean Air has proposed to sell Asian’s cargo business and give up its four lucrative routes between Korea and Europe.

However, the sale of Asiana’s cargo business has required the airline board’s approval.

With Asiana’s approval for the sale of its cargo business, Korea’s No. 1 and No. 2 full-service carriers’ marriage is expected to pick up speed as the EU’s decision is widely anticipated to affect the US' and Japan’s decision on the merger, which has already received the nod from the remaining 11 nations, including Korea.

The US antitrust agency in May also notified Korean Air of its decision to reject the purchase of Asiana if the deal leads to the creation of a dominant player with no formidable rival in South Korea’s aviation industry.

After the board meeting on Thursday, Korean Air submitted the changed merger plan with the sale of Asiana’s cargo business to the European Commission.

It normally takes about 40 days for the European Commission to review a plan.

“As both companies’ board of directors have approved the necessary procedures, the company immediately submitted the amended plan to the EC,” said an official of Korean Air. “We will try to get the EC’s approval as soon as possible so we can speed up the approval process of other antitrust bodies.”

UNCERTAINTY REMAINS

But there seems to be a bumpy road ahead for the merger, which has been delayed for nearly three years since it was announced.

Asiana raked in 3 trillion won ($2.2 billion) in sales from its freight business in 2022, accounting for more than half of its total revenue of 5.6 trillion won. Combined with Korean Air’s 7.7 trillion won in cargo sales, their total annual revenue from the freight business exceeded 10 trillion won.

They together commanded nearly 65% of Korea’s entire air cargo shipment volume last year, according to the Korea Civil Aviation Association.

Despite their stellar freight business performance, none has come forward to show interest in Asiana’s cargo business. Even the country’s top three low-cost carriers (LCC) – Jeju Air Co., Jin Air Co. and T’way Air Co. – have so far shown muted reactions to it.

One reason for the tepid response is the not-so-bright outlook for the air cargo business, which is believed to have peaked during the COVID-19 pandemic.

Some are concerned that the two airlines’ marriage would not be a happy one without lucrative routes and slots given up in key markets like the UK, other European routes, China and North America in return for antitrust bodies’ approval for the merger.

It also remains to be seen whether the EU is happy with Korean Air’s new proposals.

Korean Air agreed to buy beleaguered Asiana for 1.8 trillion won in November 2020, a deal that was expected to create the world’s seventh-largest airline.

It initially planned to complete the acquisition by the end of the first half of 2021 and launch the merged entity in 2022.

(Updated with more background information)

Write to Jae-Fu Kim and Mi-Sun Kang at hu@hankyung.com

Sookyung Seo and Yeonhee Kim edited this article.

More to Read

-

Mergers & AcquisitionsKorean Air may give up Asiana’s cargo business, 4 routes for EU approval

Mergers & AcquisitionsKorean Air may give up Asiana’s cargo business, 4 routes for EU approvalSep 25, 2023 (Gmt+09:00)

5 Min read -

Mergers & AcquisitionsKDB girds up for Korean Air-Asiana deal collapse with Plan B

Mergers & AcquisitionsKDB girds up for Korean Air-Asiana deal collapse with Plan BAug 07, 2023 (Gmt+09:00)

4 Min read -

-

-

AirlinesUK grants de facto approval of Korean Air's Asiana takeover

AirlinesUK grants de facto approval of Korean Air's Asiana takeoverNov 29, 2022 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsKorean Air vows to get nod from all antitrust bodies for Asiana merger

Mergers & AcquisitionsKorean Air vows to get nod from all antitrust bodies for Asiana mergerMay 23, 2022 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsKorea approves Korean Air-Asiana merger; hurdles remain

Mergers & AcquisitionsKorea approves Korean Air-Asiana merger; hurdles remainFeb 22, 2022 (Gmt+09:00)

3 Min read -

AirlinesKorean Air to buy rival Asiana in $1.6 bn deal to emerge as world’s 7th airline

AirlinesKorean Air to buy rival Asiana in $1.6 bn deal to emerge as world’s 7th airlineNov 16, 2020 (Gmt+09:00)

5 Min read

Comment 0

LOG IN