M&As

Korea approves Korean Air-Asiana merger; hurdles remain

While awaiting tight scrutiny by six other regulators, including the EU, KAL has to find synergy from acquiring the debt-laden rival

By Feb 22, 2022 (Gmt+09:00)

3

Min read

Most Read

S.Korea's LS Materials set to boost earnings ahead of IPO process

Hankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

Samsung Heavy Industries succeeds autonomous vessel navigation

NPS to hike risky asset purchases under simplified allocation system

JapanŌĆÖs request for Naver to shed Line control ŌĆśunprecedented': CEO

The proposed merger of Korean Air Lines Co. and Asiana Airlines Inc. has moved one step closer to completion with approval by South KoreaŌĆÖs antitrust regulator, but hurdles remain as the two full-fledged carriers are required to drastically adjust their profitable routes.

Analysts said the conditional go-ahead on Tuesday by KoreaŌĆÖs Fair Trade Commission (FTC) will pave the way for regulatory approval by the aviation authorities in other countries. Critics, however, say that the combination could be under tighter scrutiny, particularly by the European Commission, which recently blocked the combination of KoreaŌĆÖs two shipbuilders, the worldŌĆÖs two largest, citing monopoly concerns.

While allowing Korean Air to continue its $1.5 billion merger process, the FTC said during a press conference on Tuesday that the combination of the two airlines is feared to hamper competition on a significant number of their flight routes.

The merger could hurt competition on 26 international and 14 domestic routes among the two companiesŌĆÖ 87 overlapping routes, it said.

The FTCŌĆÖs approval comes with strings attached. The regulator asked the two carriers to relinquish a portion of their airport slots and traffic rights, mostly on their heaviest routes such as ones from Seoul to New York, Paris, London, Phuket and Guam. The slots will be reallocated to other Korean airlines, namely low-cost carriers.

Korean Air and Asiana are also banned from raising flight rates, slashing the number of flight seats or reducing services such as free baggage allowance.

The two carriers should not also change their mileage systems in a way that could put their customers at a disadvantage, according to the Korean regulator.

Korean Air and Asiana must abide by the rules for up to 10 years from the day the deal takes effect, it said.

FTC Chairwoman Joh Sung-wook said its approval is expected to help KoreaŌĆÖs low-cost carriers enter the international long-haul flight market, which has been dominated by their two bigger rivals.

AWAITING GO-AHEAD FROM OTHER REGULATORS

"We accept the FTC's decision and will do our best to win the green light from other regulatory authorities," Korean Air said in a statement.

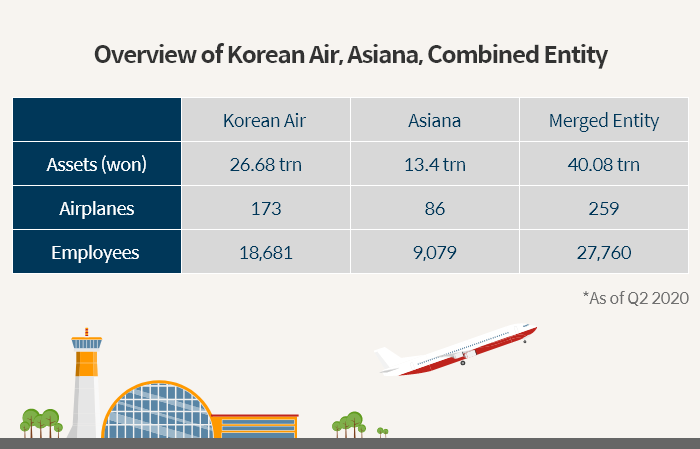

Since January last year, the FTC has been reviewing Korean Air's deal to buy a 63.9% stake in debt-ridden Asiana for 1.8 trillion won ($1.5 billion). Korean AirŌĆÖs parent Hanjin KAL Corp. and its main creditor Korea Development Bank announced in November of 2020 that Korean Air will acquire its crosstown rival to create one of the worldŌĆÖs leading carriers by 2024.

For the deal to be completed, Korean Air must obtain the go-ahead from six other aviation authorities in the US, EU, Japan, China, UK and Australia.

Analysts say the EU may attach harsher conditions to its approval than the other authorities, given its recent track records.

Earlier this year, the European Commission vetoed the combination of the worldŌĆÖs two largest shipbuilders ŌĆō Hyundai Heavy Industries Co. and Daewoo Shipbuilding & Marine Engineering Co. ŌĆō frustrating KoreaŌĆÖs efforts to restructure the country's shipbuilding industry.

Now that KoreaŌĆÖs ruling on the aviation merger is out, the EU is also expected to announce the results of its review of the deal in the coming weeks.

LITTLE SYNERGY

Industry watchers said that the harsh conditions set by KoreaŌĆÖs FTC and similar moves by other authorities could create little synergy for Korean Air from acquiring the debt-laden domestic rival.

ŌĆ£If Korean Air and Asiana have to keep the number of flight seats, it would lead to heavy losses over the next few years,ŌĆØ said an industry official.

The two carriers posted a combined loss of 300 million won from their passenger traffic businesses in 2021 alone.

Korean Air, the countryŌĆÖs flagship carrier, has said it expects to achieve economies of scale and financial synergy from the merged entity, including up to 400 billion won in annual cost cuts, while limiting layoffs, if the aviation industry recovers from the pandemic.

Asiana Chief Executive Jung Sung-kwon said on Tuesday it is not considering any job cuts for its employees even after the merger.

If the takeover is completed, Korean Air, currently the world's 18th-largest carrier by fleet, is expected to become the world's 10th-biggest airline.

Write to Jeong-Min Nam and Ji-Hoon Lee at peux@hankyung.com

In-Soo Nam edited this article.

More to Read

-

-

M&AsKorean Air wary of Asiana deal after EU blocks HHI-DSME merger

M&AsKorean Air wary of Asiana deal after EU blocks HHI-DSME mergerJan 14, 2022 (Gmt+09:00)

2 Min read -

M&AsKorean AirŌĆÖs post-merger plan hits snag after conditional approval

M&AsKorean AirŌĆÖs post-merger plan hits snag after conditional approvalJan 04, 2022 (Gmt+09:00)

2 Min read -

AirlinesKorean Air to fly high on ChinaŌĆÖs cargo conversion ban

AirlinesKorean Air to fly high on ChinaŌĆÖs cargo conversion banDec 16, 2021 (Gmt+09:00)

3 Min read -

Low-cost carriersKorean LCCs rush to stock market for fund on travel recovery hopes

Low-cost carriersKorean LCCs rush to stock market for fund on travel recovery hopesOct 08, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN