Mergers & Acquisitions

SD Biosensor seeks more M&As, to build diagnostic kit plant in US

The Korean company aims to join the world’s top three testing firms alongside Abbott and Roche

By Jul 10, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SD Biosensor Inc., the world's largest COVID-19 test kit seller, is seeking additional merger and acquisition targets in the US following its recent $1.53 billion takeover of Nasdaq-listed Meridian Bioscience Inc.

The South Korean diagnostic reagent maker also said it will build a new test-kit product manufacturing plant in the US, one of the world’s largest biopharmaceutical markets.

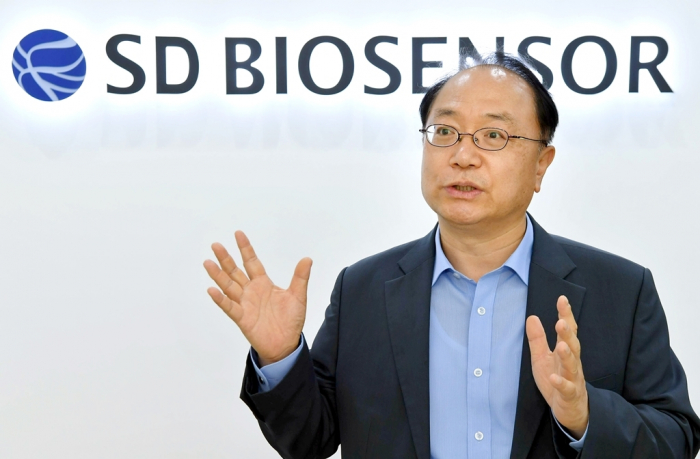

“We’re considering acquiring another diagnostic platform company in the US,” Cho Young-shik, chairman and founder of SD Biosensor, said during a press conference on Friday. “We cannot go into details now, but we are going to expand our POC (point of care) portfolio through more M&As.”

The chairman’s remarks came soon after SD Biosensor and Seoul-based private equity firm SJL Partners LLC on Friday announced that they are jointly acquiring Meridian Bioscience in an all-cash deal to enter the US in-vitro diagnostics (IVD) market.

The transaction, which marks the largest M&A deal for SD Biosensor, is due to be closed by the fourth quarter of this year. Upon completion of the deal, SD Biosensor will control approximately 60% of Meridian Bioscience and SJL will own the rest.

Cincinnati-based Meridian Bioscience will also help the Korean company obtain regulatory approval from the US Food and Drug Administration (FDA) for its product sales in the US.

AIMS FOR NO. 3 SPOT IN GLOBAL POC MARKET

Chairman Cho said the company aims to become one of the world’s top three POC players alongside Abbott Laboratories of the US and Swiss-based multinational healthcare company Roche.

“We’re currently looking for a site for our new test kit manufacturing plant in the US,” he told reporters. “Bringing locally produced products, including Standard M10, to the US market is more efficient.”

With the Standard M10, a real-time polymerase chain reaction (PCR) test kit, it takes less than half an hour to determine if someone is positive for the COVID-19 virus, the company said.

Cho said the company also plans to acquire a couple of test kit distributors in the US to facilitate its advance into the diagnostics market.

SD Biosensor has been aggressively pursuing acquisitions of overseas companies to expand its presence in the global market.

In April of this year, the company acquired a 100% stake in Relab Srl, an Italian medical device distributor, for €46.2 million ($50 million) to enter the European market.

The company has also bought the entire stake in Brazil’s diagnostics kit company Eco Diagnóstica, for 47 billion won, and Bestbion, a German diagnostic products distributor, for 16.1 billion won.

ENOUGH CASH FOR MORE M&As

The company said it has enough cash to buy into more diagnostic and test-kit distributing companies.

It had 1.3 trillion won ($1 billion) in cash and cash equivalents as of end-March. The company’s acquisition of Meridian Bioscience has drained about a third of its cash reserves, according to the company.

SD Biosensor, which went public in July of last year, also plans to use a portion of its earnings on acquisitions.

The Suwon-based company runs factories in India and Brazil in addition to its Korean facility in Jeungpyeong County, North Chungcheong Province.

Established in 1976, Meridian has two business divisions – a diagnostics business that deals with immunodiagnostics, molecular diagnostics, respiratory diagnostics and blood diagnostics; and a life science business that produces raw materials for drugs and diagnostic products.

The US company also operates manufacturing facilities in Canada, Germany and the UK.

Write to Sun-A Lee and Jae-young Han at suna@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Mergers & AcquisitionsSD Biosensor, SJL Partners to acquire Meridian Bioscience for $1.53 bn

Mergers & AcquisitionsSD Biosensor, SJL Partners to acquire Meridian Bioscience for $1.53 bnJul 07, 2022 (Gmt+09:00)

5 Min read -

COVID-19COVID-19 blues? Pandemic makes SD Biosensor Korea’s top-grossing bio firm

COVID-19COVID-19 blues? Pandemic makes SD Biosensor Korea’s top-grossing bio firmJul 01, 2021 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsCOVID test kit maker SD Biosensor buys Italian medical device firm

Mergers & AcquisitionsCOVID test kit maker SD Biosensor buys Italian medical device firmApr 22, 2022 (Gmt+09:00)

1 Min read -

Comment 0

LOG IN