COVID-19 test kit supplier makes modest market debut

SD Biosensor misses out on Korean IPOs' first-day rallies, closing up 7%

By Jul 16, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

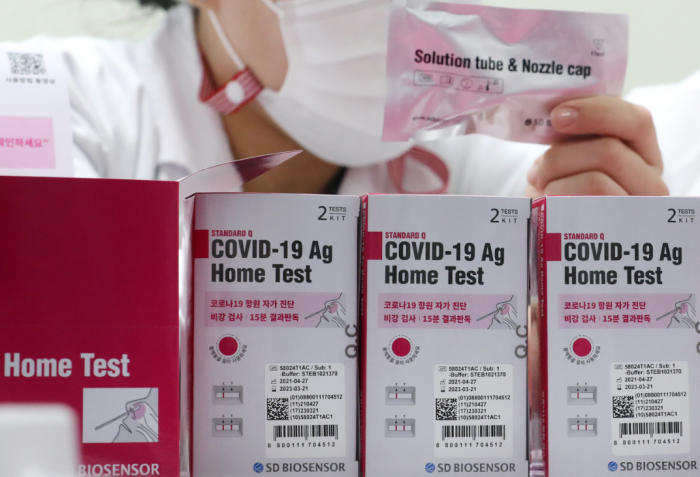

SD Biosensor Inc., the world's largest COVID-19 test kit seller, made a modest debut on the Korea Exchange on Friday, defying market expectations that it would repeat the first-day rallies of recent high-profile IPOs.

The South Korean diagnostic reagent maker opened at 57,000 won ($50), up 9% from its initial public offering price of 52,000 won and then rose as high as 66,700 won. It pared its gains to as low as 56,900 won before closing up 7% at 61,000 won. In comparison, the wider market Kospi edged down 0.28%.

Its first-day performance fell short of investor expectations, given the overheated subscriptions from both institutional and retail investors, with the global pandemic showing little signs of abating.

During the two-day subscription period last week, the stock was 274 times oversubscribed by retail investors, raking in 31.9 trillion won in subscriptions. That marked the fifth-largest amount of retail money for a domestic IPO, surpassing SK Biopharmaceuticals Co.’s record of 31 trillion won in July 2020.

After revising down its IPO price band by about 40% in response to regulators, its IPO was priced at the top of its range of 52,000 won. Then the company increased the volume of shares on offer by 20%, after its shares drew 1,141 times more bids by institutional investors than the sum on offer.

Analysts blamed its modest market debut on the heavy volume of its shares in circulation that amounted to 33.3 million shares, or 32.3% of its outstanding shares.

That is much higher than that of SK Bioscience Co. at 11.63%, which made a strong trading debut in March of this year. It opened at double its IPO price and then reached the upper limit of 30% on its first trading day.

Further, SD Biosensor was weighed down by recent media reports that questioned the accuracy of self-test kits as South Korea's daily new cases of COVID-19 have spiked to new record levels, posting over 1,000 new cases every day for more than a week.

Still, analysts said SD Biosensor has scope to rise further, supported by the global spread of the Delta coronavirus variant.

Its market value reached 6.3 trillion won, far outpacing Seegene Inc., South Korea's No. 2 diagnostic reagent maker, which tumbled 6.54% to 77,200 won on the Kosdaq market.

Write to Sung-mi Shim at smshim@hankyung.com

Yeonhee Kim edited this article.

-

IPOsWorld’s top COVID-19 test kit maker draws $28 bn in IPO subscriptions

IPOsWorld’s top COVID-19 test kit maker draws $28 bn in IPO subscriptionsJul 09, 2021 (Gmt+09:00)

2 Min read -

Coronavirus pandemicCOVID-19 blues? Pandemic makes SD Biosensor Korea’s top-grossing bio firm

Coronavirus pandemicCOVID-19 blues? Pandemic makes SD Biosensor Korea’s top-grossing bio firmJul 01, 2021 (Gmt+09:00)

3 Min read -