Mergers & Acquisitions

SD Biosensor, SJL Partners to acquire Meridian Bioscience for $1.53 bn

In pursuit of global growth, the Korean diagnostic reagent maker hopes to bring its rapid test kits to the US by year-end

By Jul 07, 2022 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SD Biosensor Inc., the world's largest COVID-19 test kit seller, and private equity firm SJL Partners LLC are jointly acquiring Meridian Bioscience Inc., a Nasdaq-listed diagnostic company, for about $1.53 billion.

The three parties have entered into a definitive merger agreement whereby a newly formed affiliate vehicle of the Korean consortium will acquire Meridian in an all-cash transaction, the companies said on Thursday.

The transaction is expected to close in the fourth quarter. Upon completion of the deal, SD Biosensor will control approximately 60% of Meridian Bioscience and SJL will own the remaining 40%.

Meridian will no longer be traded or listed on any public securities exchange upon the close of the deal, the US company said.

The Korean consortium intends to operate Meridian as an independent entity, with its leadership team and headquarters in place.

Under the terms of the agreement, Meridian shareholders will receive $34 per share in cash, which represents a premium of about 32% over Meridian's closing stock price on the day before the consortium's first offer before the market opened on March 18, 2022.

SD BIOSENSOR’S LARGEST M&A DEAL

The purchase of the US diagnostic firm will mark the largest M&A deal for SD Biosensor, which has been aggressively pursuing acquisitions of overseas companies to expand its presence in the global market.

"We are pleased to be a family with Meridian Bioscience as a great partner for accelerating our entry into the US market,” Cho Young-shik, chairman and founder of SD Biosensor, said in a statement.

“I believe that SD Biosensor's R&D capabilities and mass production know-how, Meridian Bioscience's US distribution network and expertise in the regulated US market, and SJL Partners' strong management expertise will enable compelling synergies."

For Seoul-based SJL Partners, the deal comes after it jointly acquired a $3.1 billion Momentive Performance Materials, a US-based specialty silicon maker, with Korea’s KCC Corp. and Wonik QnC Corp. in 2019.

In an earlier local deal, the private equity firm also purchased 200 billion won in convertible bonds issued by Celltrion Healthcare Co.

Established in 2017, SJL Partners specializes in outbound cross-border buyout deals for Korean companies.

The investment company is led by Steve Sukjung Lim, chairman and managing partner, who previously worked as the Korea head of JPMorgan.

PANDEMIC MAKES SD BIO KOREA’S TOP-GROSSING BIO FIRM

Multinational biopharmaceutical companies have dominated the world’s diagnostics market for years.

However, the coronavirus pandemic, which started in early 2020, offered an unexpected boost for smaller Korean test-kit makers, getting their names to the global arena and allowing them to make a decent profit.

One such company is SD Biosensor, which previously posted mediocre sales and profits, but saw its earnings soar following the outbreak of the pandemic.

Its sales revenue, which stood at a mere 72.9 billion won in 2019, skyrocketed to a whopping 2.93 trillion won in 2021. Operating profit posted a 900-fold surge to 1.36 trillion won from 1.5 billion won over the same period.

With last year’s results, SD Biosensor became the highest-grossing company among Korea’s biopharmaceutical companies, earning more than market leader Samsung Biologics Co.

Its revenue and profit growth have accelerated into this year with the spread of the Omicron variant of the coronavirus.

In the first quarter of this year, SD Biosensor racked up record quarterly sales of 1.39 trillion won, buoyed by strong demand for coronavirus test kits.

As the pandemic transformed into a global endemic, the company’s second-quarter sales are expected to fall to around 700 billion won.

Industry watchers attributed SD Biosensor’s significant growth to its aggressive facility investment and price competitiveness.

BIO EFFORTS REDEEMED

SD Biosensor Chairman Cho has been in the diagnostic field since 1984.

With his 10-year experience at GC Pharma Corp., better known as Green Cross Corp., as an R&D researcher, he launched his own diagnostic company, SD, in 1999. The company produced various rapid testing kits for illnesses such as HIV, Dengue and Malaria.

In 2009, SD was acquired by US firm Alere Inc., which later was renamed Abbott Laboratories, via a hostile M&A. But two years later, he took over the test kit division from the US diagnostic company and established a new entity, which has grown into SD Biosensor.

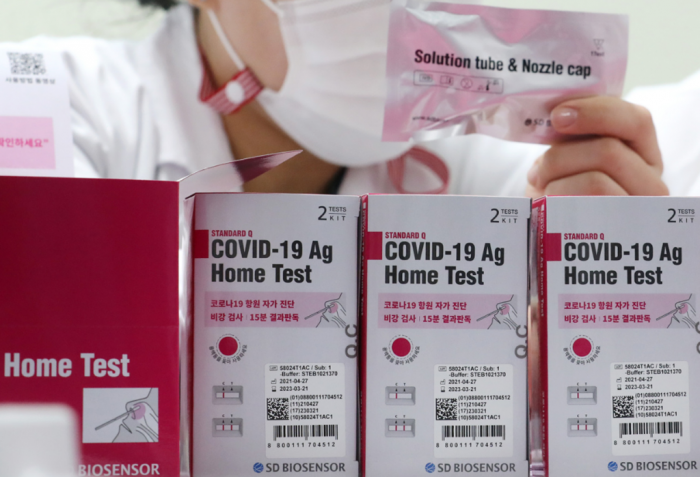

SD Biosensor, one of Korea’s largest diagnostic reagent makers, is also the world’s top manufacturer of COVID-19 test kits.

It started developing the coronavirus test kit in early January of 2020, about half a month before the emergence of Korea’s first infected case.

In February of that year, it obtained approval for its COVID test kit from Korea’s Ministry of Food and Drug Safety. By September, the company won the World Health Organization’s emergency use authorization, the first such permit by the WHO.

Test kits account for more than 90% of the company’s total sales.

RAPID OVERSEAS EXPANSION

In April of this year, the company said it is acquiring a 100% stake in Relab Srl, an Italian medical device distributor, for €46.2 million ($50 million) to enter the European market.

The company has also bought the whole stake in Brazil’s diagnostics kit company Eco Diagnóstica, for 47 billion won, and Bestbion, a German diagnostic products distributor, for 16.1 billion won.

In Korea, it is expanding its molecular diagnostics kit production capacity. The company said in March that it will invest 188 billion won in ramping up its manufacturing facility in Jeungpyeong County, North Chungcheong Province.

With the local facility expansion, the company plans to produce 57 million cartridges for its rapid test kit, Standard M10, annually from next year.

SD Biosensor plans to take its rapid test kit to the US market by the end of this year.

With the Standard M10, a real-time polymerase chain reaction (PCR) test kit, it takes less than half an hour to determine if a person is positive for the COVID-19 virus, according to the company.

On the back of its phenomenal growth during the pandemic, the company listed its shares on the Korea Exchange’s main Kospi bourse in July of last year.

Write to Chae-Yeon Kim and Jae-young Han at Why29@hankyung.com

In-Soo Nam edited this article.

More to Read

-

COVID-19COVID-19 blues? Pandemic makes SD Biosensor Korea’s top-grossing bio firm

COVID-19COVID-19 blues? Pandemic makes SD Biosensor Korea’s top-grossing bio firmJul 01, 2021 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsCOVID test kit maker SD Biosensor buys Italian medical device firm

Mergers & AcquisitionsCOVID test kit maker SD Biosensor buys Italian medical device firmApr 22, 2022 (Gmt+09:00)

1 Min read -

PharmaceuticalsCelltrion, Humasis to ship $300 mn COVID-19 test kits to US

PharmaceuticalsCelltrion, Humasis to ship $300 mn COVID-19 test kits to USFeb 04, 2022 (Gmt+09:00)

3 Min read -

Comment 0

LOG IN