Samsung in 'do or die' situation'; Lee sounds crisis alarm

Its loss-making system chip and foundry businesses are under tight scrutiny for a potential business overhaul

By Mar 17, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electronics Co. Chairman Lee Jae-yong has warned the company's executives that the South Korean tech giant has lost its characteristic "relentless" Samsung Spirit, calling on them to overcome the current crisis with a "do-or-die" attitude.

“Samsung faces a question of survival,” Lee was quoted as saying through a video message shared during recent executive seminars for the company and its affiliates.

"What matters is not the crisis itself, but our attitude in dealing with it. We must invest in the future even if it means sacrificing immediate profits,” he said in the message.

Lee did not appear in the video himself. It was his first public message since being cleared of decade-long legal risks in February after the Seoul High Court upheld a lower court decision dismissing all criminal charges against him.

It also followed Samsung’s release of weaker-than-expected earnings in last year's fourth quarter.

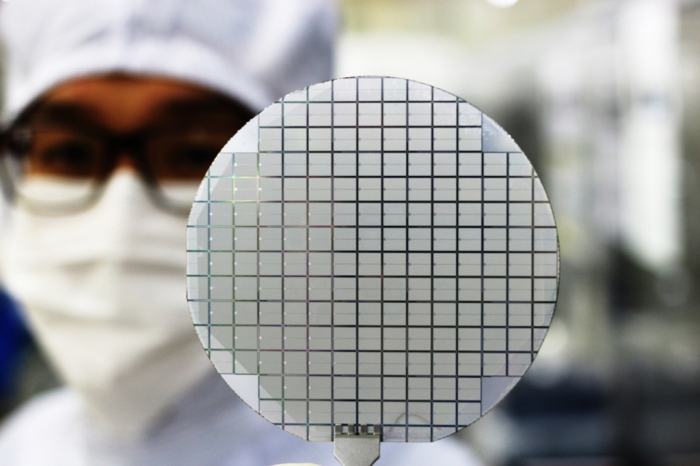

Samsung, the world’s largest memory chipmaker, is not only fighting an uphill battle in the semiconductor sector, but also in the smartphone market.

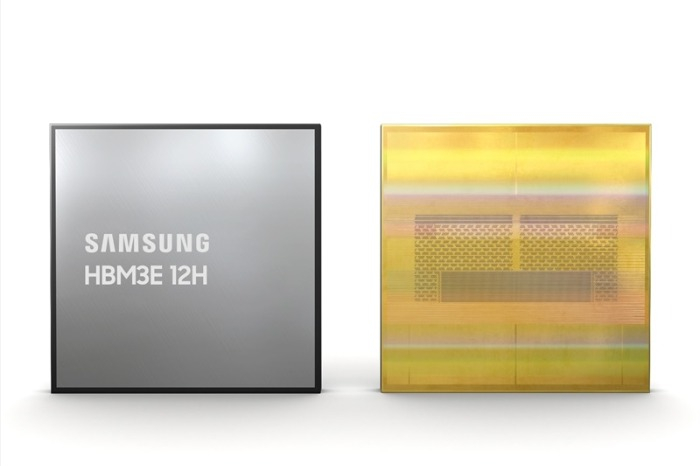

In the foundry segment, it lags far behind Taiwan's TSMC, while in advanced memory chips, particularly high-bandwidth memory (HBM), it trails local rival SK Hynix Inc.

Samsung's foundry division racked up more than 2 trillion won ($1.4 billion) in operating losses in the last quarter of 2024.

Its share price has advanced 8% year-to-date, significantly underperforming SK Hynix's gains of 20.6% over the same period.

Samsung has put its system chip and foundry businesses under tight scrutiny for a possible business overhaul, including an executive reshuffle and employee relocation.

GRIM EARNINGS OUTLOOK

The household name is also losing ground in other key business areas. Its global TV market share dropped to 28.3% last year from 30.1% in 2023. Its share in the global smartphone market contracted to 18.3% versus 19.7%, while its market share in the DRAM sector fell to 41.5% versus 42.2% over the same period, according to Samsung's 2024 annual report.

Samsung Electronics' operating profit is projected to see a 22.54% on-year drop to 5.12 trillion won ($3.5 billion) in the January-March quarter, according to consensus forecasts.

STRONG, ADEPT AND FIERCE

At the seminars, external business experts criticized Samsung for falling into complacency. They warned that Samsung has become too focused on merely outperforming competitors, rather than striving for absolute excellence.

The attendees received crystal plaques inscribed with their names alongside the phrase: "Samsung talent: Strong in crisis, adept at turning the tide and fierce in competition."

“The takeaway was clear: Samsung has grown complacent and we must now become tougher and more determined,” said one seminar attendee.

Write to Jeong-Soo Hwang at hjs@hankyung.com

Yeonhee Kim edited this article.

-

Korean InvestorsSamsung to invest $10 million in US-based C2N Diagnostics

Korean InvestorsSamsung to invest $10 million in US-based C2N DiagnosticsMar 13, 2025 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung’s system chip, foundry business under close scrutiny for overhaul

Korean chipmakersSamsung’s system chip, foundry business under close scrutiny for overhaulMar 06, 2025 (Gmt+09:00)

5 Min read -

Leadership & ManagementSamsung set to rebuild with leader Lee cleared of all charges

Leadership & ManagementSamsung set to rebuild with leader Lee cleared of all chargesFeb 03, 2025 (Gmt+09:00)

3 Min read -

EarningsSamsung to focus on HBM, other high-end chips after weak Q4 earnings

EarningsSamsung to focus on HBM, other high-end chips after weak Q4 earningsJan 31, 2025 (Gmt+09:00)

4 Min read -

EarningsSK Hynix surpasses Samsung with record-high profit in Q4

EarningsSK Hynix surpasses Samsung with record-high profit in Q4Jan 23, 2025 (Gmt+09:00)

2 Min read -

ElectronicsSamsung Electronics' new Galaxy S25 smartphone: 'Perfect AI assistant'

ElectronicsSamsung Electronics' new Galaxy S25 smartphone: 'Perfect AI assistant'Jan 23, 2025 (Gmt+09:00)

3 Min read -

Business & PoliticsSamsung, LG consider moving electronics plants to US from Mexico

Business & PoliticsSamsung, LG consider moving electronics plants to US from MexicoJan 21, 2025 (Gmt+09:00)

4 Min read -

-

RoboticsSamsung joins humanoid robots race with larger stake in Rainbow Robotics

RoboticsSamsung joins humanoid robots race with larger stake in Rainbow RoboticsDec 31, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung foundry ‘relief pitcher’ Han Jin-man vows to improve 2-nm yields

Korean chipmakersSamsung foundry ‘relief pitcher’ Han Jin-man vows to improve 2-nm yieldsDec 09, 2024 (Gmt+09:00)

4 Min read