Korean startups

Korean unicorns slow growth to focus on profits

Valuable startups, including Viva Republica, are reviving delayed initial public offering plans

By Apr 17, 2024 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korean unicorns, or startups valued at $1 billion or more, are slowing the pace of growth to shore up their bottom lines as they revive long-delayed initial public offering plans.

Domestic unicorn companies performed better in 2023 than the previous year overall, with a large number of them logging their highest-ever revenue.

However, their robust performance was attributed in large part to a sharp reduction in advertising and marketing expenses to survive a funding drought in the venture capital industry.

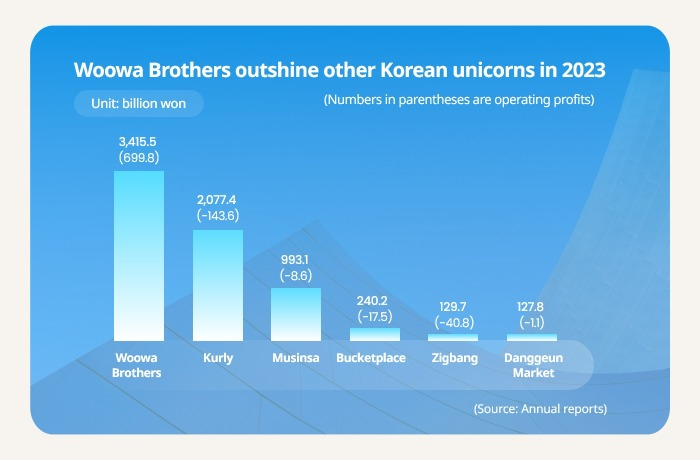

Woowa Brothers Corp., the operator of South Korea’s largest food delivery app Baedal Minjok, posted 3.4 trillion won ($2.5 billion) in sales last year, up 16% from the year prior.

Its operating profit soared 65% on-year to 699.8 billion won, driven by strong growth in fixed-rate fee-based delivery services. It also slashed advertising costs by 34%, compared to 2022.

Kurly, Korea’s dawn delivery pioneer of fresh produce, narrowed operating losses by 40% to 143.6 billion won in 2023 from a year before, while sales edged up 2% to its highest-ever 2.08 trillion won.

It slashed advertising costs by 41% on-year to 31.5 billion won. The 2023 results marked the first time narrowing operating losses since its inception in 2015.

Bucketplace Co., the operator of home interior and decoration platform O!House, posted its highest-ever sales of 240.2 billion won in 2023, up 31% versus 2022.

Its operating losses narrowed by 66% to 17.5 billion won.

Operating losses at Danggeun Market Inc., a neighborhood marketplace app, sharply dwindled to 1.1 billion won from 56.5 billion won in 2022. During the period, its sales skyrocketed 156% to 127.8 billion won.

In 2023, Danggeun recorded its first-ever profit of 17.3 billion won on a parent-only basis in its eight-year history. While substantially reducing advertising costs, its advertising revenue more than doubled to 126.7 billion won in 2023 from the previous year’s 49.5 billion won.

Still, many Korean unicorns have remained deficits due in large part to marketing costs to expand their user base.

Musinsa, the country’s largest fashion platform, swung to a loss of 8.6 billion won in 2023 versus an 11.3 billion won profit in 2022, despite a 40% spike in sales.

The company blamed stock grants awarded to its employees, worth 41.3 billion won, for the shortfalls.

Zigbang, a proptech company, saw its operating losses widening to 40.8 billion won last year from 37.1 billion won a year earlier, despite a 47% growth to 129.7 billion won in sales.

The company attributed the increased shortfalls to the one-off depreciation costs related to its 2022 acquisition of Samsung SDS Co.’s home Internet of Things operations.

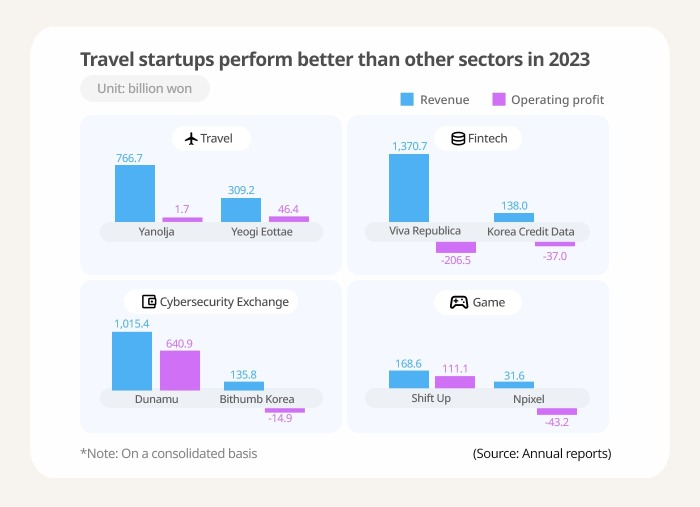

Travel platform Yanolja suffered an 88% plunge to 1.7 billion in operating loss in 2023 versus 2022, weighed by losses from Interpark Triple Corp., the travel service unit it acquired in 2022. By comparison, revenue at Yanolja climbed 27% on-year to 766.7 billion won in 2023.

FINTECH STARTUPS

Fintech unicorns in Korea have been struggling with losses as well. Viva Republica Inc., the operator of the country’s finance super app Toss, logged a 21% rise to 1.37 trillion won in sales from the year prior.

But its operating losses were little changed at 206.5 billion won due to heavy commissions it paid for remittance services to other financial institutions, which accounted for 60% of its expenses in 2023.

Viva Republica’s ambitious overseas expansion has stalled. It shut down Toss South East Asia, its Southeast Asian business headquarters based in Singapore, last year, only a year after its establishment.

CYBERSECURITY EXCHANGES

The slowdown in the cybersecurity market in 2023 was a blow to Korean unicorns in the sector.

Dunamu Inc., the operator of South Korea's top cryptocurrency exchange Upbit, chalked up a 19% drop to 1.0 trillion won in sales in 2023 compared to the year prior, with operating profit down 21% to 640.9 billion won.

Its domestic peer Bithumb turned to the red, racking up 14.9 billion won in operating losses last year, with sales down 58% to 135.8 billion won.

GAMING UNICORNS

Unicorns in the gaming industry saw mixed results.

Shift Up Corp. reported a 155% surge on-year in revenue to 168.6 billion won in 2023 after its new title “Goddess of Victory: Nikke,” a third-person shooter action role-playing game, caught on.

Its operating profit skyrocketed 508% to 111.1 billion won.

Npixel’s operating loss widened to 43.2 billion won in 2023, compared to the previous year’s 1.1 billion loss. Its sales diminished 53% to 31.6 billion won.

The developer of the massively multiplayer online role-playing game (MMORPG) game Gran Saga was hit by delayed new game launches and subdued interest in its existing games.

To sustain their growth, startup industry officials said they need to go abroad. But this has proved more challenging than expected.

Woowa Brothers, Viva Republica and Jobis & Villains, the Korean startup operator of artificial intelligence-powered accounting platform 3.3, have closed their loss-making overseas operations, including in Vietnam and Singapore, raising concerns over their growth momentum.

Write to Ju-Wan Kim at kjwan@hankyung.com

Yeonhee Kim edited this article

More to Read

-

Korean startupsKorean unicorns’ failed global expedition causes growth concern

Korean startupsKorean unicorns’ failed global expedition causes growth concernApr 16, 2024 (Gmt+09:00)

3 Min read -

-

Korean startupsVenture downturn keeps Korean unicorns from acquisitions

Korean startupsVenture downturn keeps Korean unicorns from acquisitionsFeb 16, 2024 (Gmt+09:00)

2 Min read -

Foreign exchangeToss Bank launches commission-free foreign exchange services

Foreign exchangeToss Bank launches commission-free foreign exchange servicesJan 18, 2024 (Gmt+09:00)

1 Min read -

-

-

Tech, Media & TelecomDelivery Hero-backed Baemin to exit Vietnam on low returns

Tech, Media & TelecomDelivery Hero-backed Baemin to exit Vietnam on low returnsNov 27, 2023 (Gmt+09:00)

1 Min read -

Venture capitalKorean startups feel bite of funding drought in H1

Venture capitalKorean startups feel bite of funding drought in H1Jul 07, 2023 (Gmt+09:00)

3 Min read -

-

Korean startupsKorean unicorns jump fivefold in four years with record investment in 2021

Korean startupsKorean unicorns jump fivefold in four years with record investment in 2021Dec 20, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN