E-commerce

Kurly’s earnings rebound may put IPO back on track

Its major shareholders include Sequoia Capital, Anchor Equity Partners and Aspex Management

By Jan 05, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

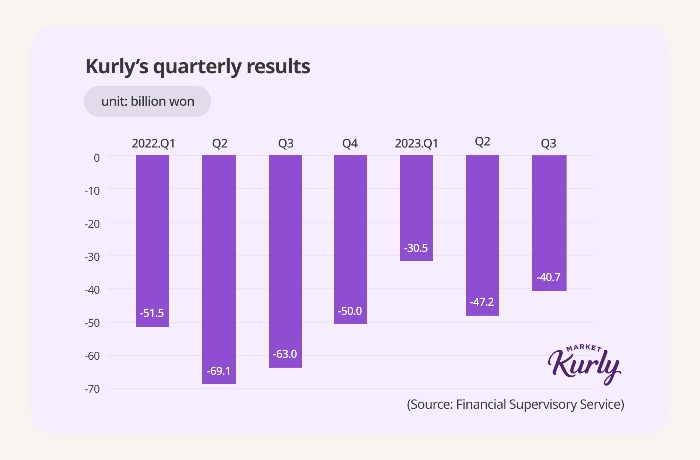

Kurly Inc., South Korea’s dawn delivery pioneer of fresh produce, appears to be getting its delayed initial public offering back on track after it posted its first-ever profit in terms of earnings before interest, tax, depreciation and amortization (EBITDA) last month, according to investment banking sources on Thursday.

Details of the earnings were not disclosed. But the December EBITDA suggests the e-commerce platform has finally ended years of cumulative losses and started generating money from its operations since entering the market in January 2015.

Kurly is aiming to turn a profit in the current quarter.

Sequoia Capital holds an 11.18% stake in Kurly as of the end of September 2023, followed by Anchor Equity Partners and Aspex Management.

In 2022, Kurly got a preliminary nod from the Korea Exchange to go public. However, in January of last year, it postponed its stock market debut after its valuation plunged amid the languid stock market.

In May last year, its enterprise value was estimated at 2.9 trillion won ($2.2 billion), when it raised 120 billion won in pre-IPO funding from Anchor Equity Partners and Aspect Capital.

That compared to its peak value of 4 trillion won in December 2021, at which time it had secured another round of funding from Anchor Equity.

The online grocery platform has been mired in cumulative losses due to heavy investments to build cold-chain logistics centers for fresh produce. Sales growth led to an increase in variable costs related to transportation and packaging.

COST-CUTTING EFFORTS

To slash costs, it has sharply reduced marketing and advertising costs by 40% to 24.1 billion won in the first nine months of last year to September, compared to the same period of 2022. It also cut transportation and packaging costs.

To improve profitability, it enticed customers to buy more items when placing orders for package delivery and started selling cosmetics that require less inventory than fresh food.

Additionally, it raised the proportion of products for which it serves only as a sales platform to receive commissions, while reducing the portion of items it directly purchases from suppliers and stockpiles.

“It increased cumulative sales in the first to third quarters (of 2023) compared to the previous year, while controlling selling, general and administrative expenses, including variable costs such as transportation and packaging costs,” said a retail industry official.

“That means it has achieved economies of scale and to some extent is on track with its business.”

Industry observers draw a parallel between Kurly and its local rival Coupang Inc.

Coupang, the pioneer in South Korea’s same or next-day delivery service market, turned to a quarterly profit in terms of EBITDA in the second quarter of 2022, eight years after it launched the service in 2014.

Then it went on to make its first-ever quarterly profit in the third quarter of 2022. For full-year 2023, Coupang is expected to post an annual profit for the first time.

Kurly is sitting on 140 billion won in cash and cash equivalents as of the end of 2023, an increase of 12 billion won from three months before.

(Correction: The name of one of the three investment companies in the fourth paragraph was corrected to Aspex Master Fund.)

Write to Jong-Kwan Park at pjk@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

-

-

Corporate strategyMarket Kurly drops Market from platform name to expand business scope

Corporate strategyMarket Kurly drops Market from platform name to expand business scopeNov 02, 2022 (Gmt+09:00)

1 Min read -

-

Food & BeverageKurly enters Singapore grocery market, targeting SE Asia

Food & BeverageKurly enters Singapore grocery market, targeting SE AsiaAug 11, 2022 (Gmt+09:00)

1 Min read -

Comment 0

LOG IN