Coupang on track to post first-ever annual profit in 2023

The S.Korean e-commerce giant reported operating profit for the third straight quarter this year, marking a 3Q 13% on-year gain

By Nov 08, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean e-commerce giant Coupang Inc. on Tuesday reported $87 million in operating profit in the third quarter, its third consecutive quarterly profit for this year, on record sales driven by stellar across-the-board performance.

According to a regulatory filing by the New York Stock Exchange (NYSE)-listed company, Coupang posted $87 million in operating profit for the July-September period, up 13% from the same period last year.

Coupang has reported a profit for three quarters in a row this year, with a cumulative operating profit of $341.9 million this year. It's raised expectations that the company would post an annual profit this year for the first time since its founding in 2010.

Since posting its first quarterly operating profit in the third quarter of 2022, it has reported a quarterly profit for five consecutive quarters.

Total net revenue jumped 21% on-year to a record-high $6.2 billion in the same quarter, while net income grew 1% to $91.3 million.

The SoftBank-backed company attributed its solid earnings to the upbeat performance of its Product Commerce and Developing Offerings segments.

“Our revenue and active customer growth accelerated for a third consecutive quarter. Our Developing Offerings also generated more than 40% revenue growth this year,” said Bom Kim, Coupang founder and CEO, in a press release Tuesday.

DEVELOPING OFFERINGS

Developing Offerings, which manages Coupang Eats, Coupang Pay and the international business, reported revenue of $218 million, up 41%.

In particular, the growth of its same-day delivery service Rocket Delivery in Taiwan has been even stronger than that in Korea, Coupang noted.

The Coupang app is poised to be the most-downloaded app in Taiwan this year.

Kim said the company is confident about its bet on Taiwan, the first overseas market that the Korean e-retailer has ventured into.

Coupang Eats, a latecomer to the Korean food delivery app sector, also achieved rapid growth this year.

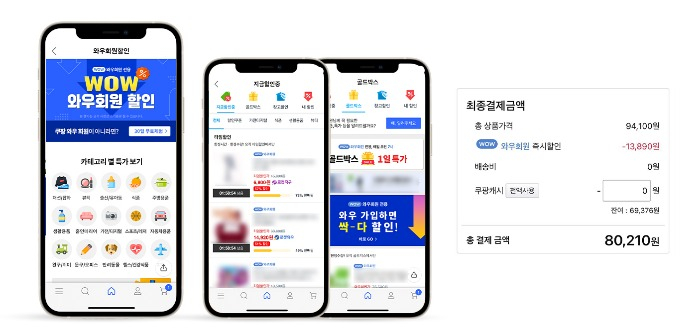

Since introducing 5% to 10% discounts on food delivery for its WOW members in April, Coupang Eats’ gross merchandise value (GMV) has doubled in Korea.

If the GMV grows at its current pace, Coupang Eats is expected to control more than 20% of Korea's fiercely competitive food delivery market by the end of this year. Its industry rivals include Delivery Hero’s Baedal Minjok (Baemin) and Yogiyo.

CEO Kim foresees huge potential growth for Coupang’s food delivery service in the domestic market, given that only 20% of WOW members currently use the app.

WOW is Coupang’s subscription fee-based program. The company currently has about 11 million subscribers.

RAPID GROWTH OF ACTIVE CUSTOMERS

Its core Product Commerce business, which oversees Rocket Delivery, Rocket Fresh and others, earned $5.9 billion in the third quarter, up 21% from the same period a year ago.

Its Active Customers — those who have ordered at least once directly from Coupang’s app or website in Korea during the relevant period — topped 20 million in the third quarter for the first time, a 14% jump from a year ago.

It marked the fastest on-year growth rate since the outbreak of the COVID-19 pandemic.

Total net revenue per Active Customer increased from $284 to $303 over the same period, thanks to the WOW program’s expanded perks and more products deliverable by Rocket Delivery, the company explained.

“Our unrelenting focus on the customer experience and operational excellence drove our record results this quarter,” said Kim.

Coupang's NYSE-listed share price, however, slid about 7% in late US trading after the its third-quarter earnings were released.

The company was incorporated in the US but generates most of its revenue in Korea.

When it debuted on the New York Stock Exchange in March 2021, its cumulative losses stood at $4.1 billion.

Write to Dong-Hui Park at donghuip@hankyung.com

Sookyung Seo edited this article.

-

-

-

LogisticsCoupang to host business briefing on Taiwan market entry

LogisticsCoupang to host business briefing on Taiwan market entrySep 15, 2023 (Gmt+09:00)

1 Min read -

EarningsCoupang’s Q2 profit soars to a record, driven by e-commerce

EarningsCoupang’s Q2 profit soars to a record, driven by e-commerceAug 09, 2023 (Gmt+09:00)

1 Min read -

E-commerceCoupang taps former Trump aide for political relations

E-commerceCoupang taps former Trump aide for political relationsJul 04, 2023 (Gmt+09:00)

1 Min read -