Korean chipmakers

SK Hynix to sell 50% stake in Wuxi foundry unit to Chinese firm

The S.Korean memory giant will sell its 21.3% stake in the unit and issue new shares worth 28.6% to ChinaŌĆÖs state-owned WIDG

By May 09, 2024 (Gmt+09:00)

3

Min read

Most Read

Deutsche Bank's Korea IB head quits after country head resigns

Hanwha buys SŌĆÖpore Dyna-MacŌĆÖs stake for $73.8 mn from Keppel

Macquarie Korea Asset Management confirms two nominees

Meritz leaves door open for an M&A, to stay shareholder friendly

Korea's Taeyoung to sell local hotel to speed up debt workout

SK Hynix Inc. will sell nearly a half stake in its foundry unit in China to a Chinese state-run enterprise for $349.3 million in a bid to expand its presence in the Chinese chip foundry market with great growth potential.

According to regulatory filings and semiconductor industry sources on Wednesday, SK Hynix System IC Co. last week signed an agreement to sell a 21.3% stake in its foundry unit in Wuxi, Jiangsu to China's state-owned Wuxi Industry Development Group Company (WIDG) for $149.3 million by October. ┬Ā

The Chinese company will acquire an additional 28.6% stake later through a new share issuance for $200 million.

SK Hynix System IC, founded in 2017, is the South Korean memory chip giantŌĆÖs wholly-owned contract chipmaking subsidiary, and it currently controls a 100% stake in the foundry fab in Wuxi.

After the stake sale, SK Hynix System IC will hold 50.1% of the foundry fab, and WIDG will control 49.9%.

The foundry stake sale to ChinaŌĆÖs state-run company is expected to help SK Hynix expand its foothold in ChinaŌĆÖs contract chipmaking market, poised to boom in the upcoming years, according to chip industry experts.

CHINA, A PROMISING FOUNDRY MARKET

WIDG is a Chinese state-owned company, controlling 63 entities, including 33 wholly owned and holding enterprises and public institutions, as well as 30 shareholding enterprises, according to its website.

SK Hynix's foundry fab in Wuxi churns out foundational chips, which are 28 nanometers or larger, on 8-inch wafers.

These chips, also called mature or legacy chips, are widely used in automotive power management systems, display driver integrated circuits (DDIs), missiles and Internet of Things devices. ┬Ā

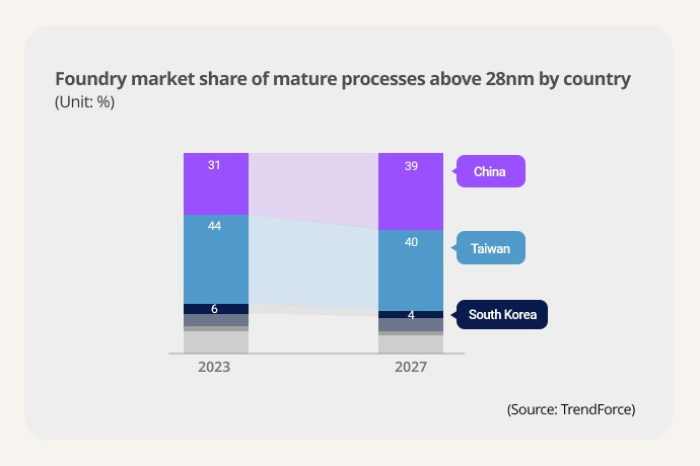

The foundry industry is now in a fierce advanced process chip race for higher profit and market leadership among top players such as Taiwan Semiconductor Manufacturing Company Ltd. (TSMC) and Samsung Electronics Co.

But mature chips still account for about 70% of the entire semiconductor market in terms of sale volume due to their broad applications.

China has recently emerged as a major legacy chip market thanks to surging demand from the countryŌĆÖs electronics companies and electric carmakers.

According to global industry research firm IBS, the global market for 28-nm and above mature chips is forecast to more than triple to $28.1 billion in 2030 from 2020 given explosive demand growth from China.

CHANCE FOR GREATER MARKET SHARE

SK Hynix, a latecomer in the foundry industry, hopes to ride ChinaŌĆÖs legacy chip boom -- given its close ties with the Chinese state firm -- to expand its presence in the Chinese contract chipmaking market.

Combined with the massive market presence of WIDGŌĆÖs subsidiaries and invested companies in the worldŌĆÖs second-largest economy, SK HynixŌĆÖs memory and foundry capabilities are expected to create great synergy, industry observers said.

With its partnership with WIDG through stake sharing, the Korean chipmaker hopes to tap local foundry orders mainly taken by the worldŌĆÖs No. 5 and 6 contract chip makers SMIC and Huahong Group in China.

The Korean chipmakerŌĆÖs foundry fab in Wuxi is also free from US restrictions aiming to limit ChinaŌĆÖs access to advanced AI chips made with US input.

The US government currently bans exports of US-originated advanced chip technologies and equipment ŌĆō mainly dynamic random-access memory chips made with 18-nm or below processes, 128-layer or above NAND flash memories and 14-nm or below logic chips.

But some industry experts warn that SK HynixŌĆÖs foundry unit in Wuxi could take a direct hit if the US tightens its restrictions on the global chip supply chain.

The US Department of Commerce in December announced that it would look into the mature chip supply chain to gather information, suggesting it might already have taken steps to restrict ChinaŌĆÖs legacy chipmaking industry.

Write to Ik-Hwan Kim and Jeong-Soo Hwang at lovepen@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Korean chipmakersSK Hynix to build advanced packaging plant in Indiana for $3.9 bn

Korean chipmakersSK Hynix to build advanced packaging plant in Indiana for $3.9 bnApr 04, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, SK Hynix face collateral damage from Micron chip ban

Korean chipmakersSamsung, SK Hynix face collateral damage from Micron chip banMay 22, 2023 (Gmt+09:00)

4 Min read -

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stunted

Business & PoliticsSamsung, SK Hynix look to China exit plans as growth stuntedMar 22, 2023 (Gmt+09:00)

3 Min read -

DealsSK Hynix push for takeover of Key Foundry to boost foundry production

DealsSK Hynix push for takeover of Key Foundry to boost foundry productionMay 17, 2021 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Hynix mulls foundry expansion, advances capex to ease chip shortage

Korean chipmakersSK Hynix mulls foundry expansion, advances capex to ease chip shortageApr 28, 2021 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix co-vice chairman hints at expanding foundry business

Korean chipmakersSK Hynix co-vice chairman hints at expanding foundry businessApr 22, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN